Today, Ki Young Ju shared an important table regarding 13F filings. These filings allow us to see companies investing in crypto through the ETF channel. Over 1,000 companies with assets of more than $200 million have accumulated BTC, reminiscent of the days when Tesla’s purchases thrilled the markets.

Massive Bitcoin Investments

Ki Young Ju, CEO of CryptoQuant, discussed 13F filings in today’s market assessment. BTC is at $67,550 and has turned from its peak, but it has been revealed that 1,179 different companies are currently investing in BTC through the ETF channel. The filings enable us to see which assets companies with over $200 million in assets have added to their balance sheets.

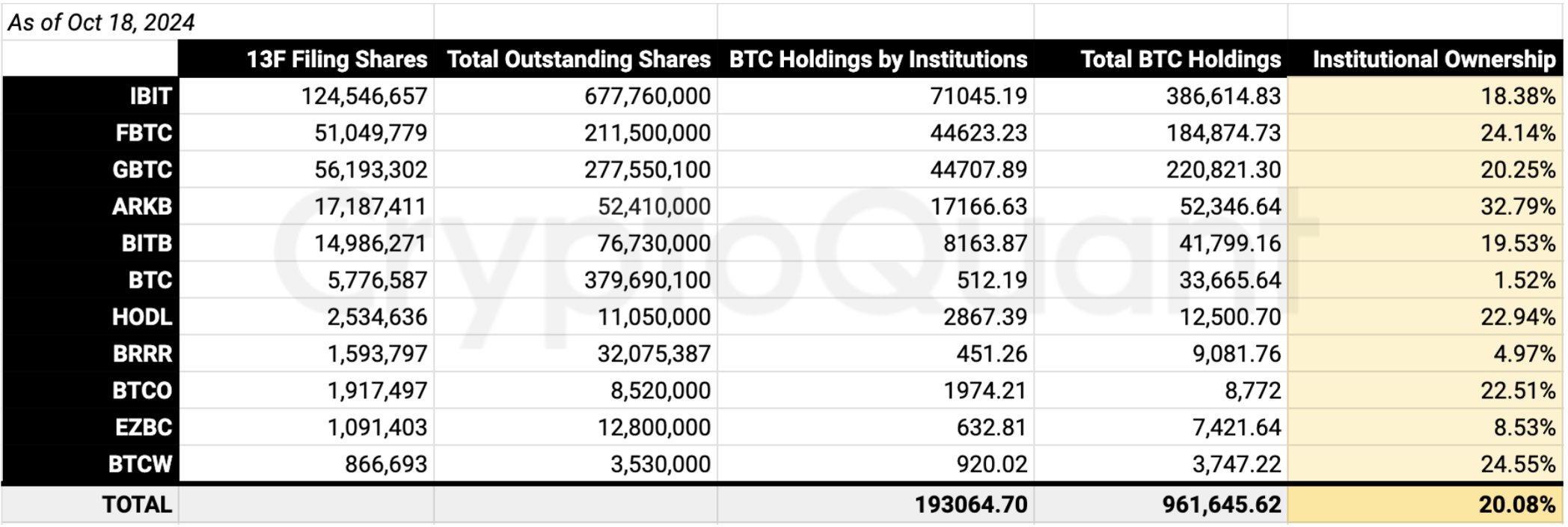

The table below displays the investment companies with the highest BTC investments. Some of these companies hold ETFs on behalf of their clients, while others, like Tesla, keep BTC in their reserves.

Ki Young wrote; “The institutional presence of U.S. Bitcoin  $91,081 Spot ETFs is around 20%, with asset managers holding 193,000 BTC (according to Form 13F filings).”

$91,081 Spot ETFs is around 20%, with asset managers holding 193,000 BTC (according to Form 13F filings).”

“Thanks to Spot ETFs, 1,179 institutions have joined the list of Bitcoin investors this year.”

Will Bitcoin Rise?

Daan Crypto Trades pointed out options in today’s evaluation. The analyst believes we are currently amidst an opportunity, linking the high volatility here to capitulation.

“An interesting chart shows volatility on options. This high volatility usually occurs during capitulation movements. All these increases have been met with local/cyclical lows. Capitulation = Opportunity. For example, Luna, FTX, Yen Carry trade, etc.”

Thus, the current environment signals a buying opportunity for BTC and indirectly for altcoins. BTC is at $67,500 and is making higher lows, instilling optimism that shadows the failure of the last resistance test.