Cryptocurrency world, Binance‘s token BNB, is painting a challenging picture for the exchange giant amidst the recent crypto rally. The token’s lagging performance in the market, following the conviction of its former CEO and a hefty $4.3 billion fine for Binance, underlines the obstacles faced by the struggling crypto platform. So, what can be expected in the near future?

Altcoin BNB Faces an Uphill Battle

While the cryptocurrency market witnessed a strong 12% surge last week, reaching $180 billion, BNB traded at $231 with a modest 1.7% increase. This lackluster performance highlighted the complex landscape for Binance, especially as BNB is generally considered an indicator of sensitivity to the stock market.

Legal troubles surrounding Binance, culminating in a guilty verdict for money laundering and sanctions violations on November 21, cast a shadow over BNB. Unlike its counterparts, BNB remained in the red since the beginning of the year, emphasizing the unique challenges faced by Binance in the current regulatory climate.

Erosion of Binance’s Dominance

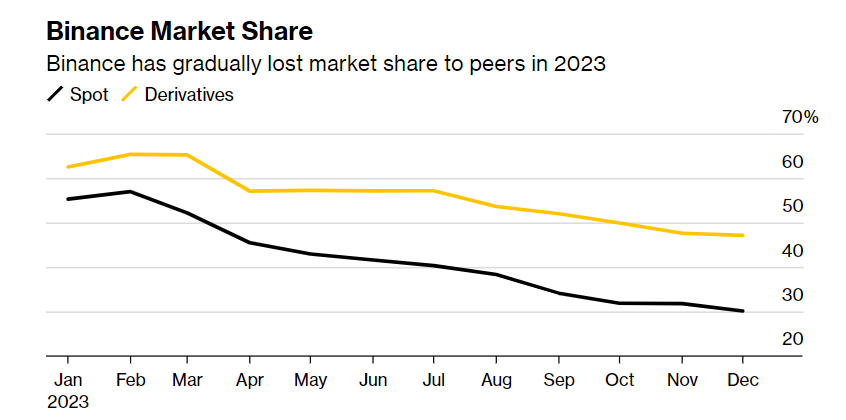

While Binance continues to maintain its position as a significant player in the crypto trading arena, its dominance is waning. The exchange’s share in spot trading volumes dropped from 55% to 32% in November, reflecting a changing landscape. Industry experts anticipate a shift in the hierarchy of centralized exchanges, with competitors like OKX, Bybit, Coinbase, and Bitget poised to take the lead.

The admission of guilt by Binance’s founder Changpeng Zhao and his simultaneous resignation from the CEO position have raised questions about the company’s future. Newly appointed CEO Richard Teng is faced with the daunting task of halting the decline in market share and steering the company through legal challenges.

BNB’s Journey

BNB experienced an 8% decline following the guilty verdict for former CEO CZ and the historic $4 billion fine. Clara Medalie, Director of Research at Kaiko, noted that BNB’s current poor performance is directly linked to Binance’s legal troubles.

Despite recent setbacks, BNB has exhibited resilience over the past three years, delivering a 700% increase in performance. This year’s recovery in digital asset prices provided some support for Binance. However, legal challenges remain the biggest obstacle to BNB’s growth.

Future Uncertainties and Operational Continuity

As BNB grapples with immediate issues, industry observers continue to be cautious. The legal resolution undoubtedly impacted BNB’s price, but Binance continues to operate, offering a glimmer of hope amid uncertainties.

Richard Teng‘s assumption of leadership, the selection of a formal headquarters, and the appointment of a board of directors, as well as enhanced financial transparency, are crucial decisions to be made. In a market where sentiments quickly change, BNB’s journey unfolds in the midst of a complex regulatory environment, serving as an example of flexibility and adaptability for the broader crypto industry.