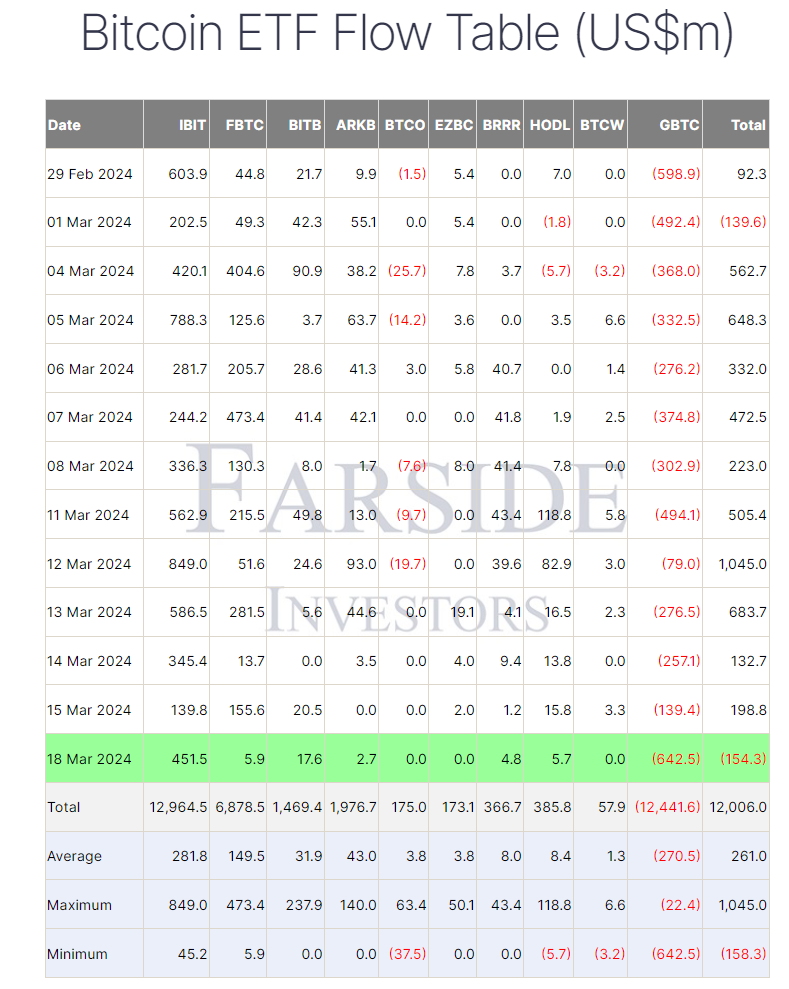

Cryptocurrency exchange developments regarding the ETF process continue to emerge. Accordingly, on March 18th, the crypto asset manager Grayscale experienced an outflow of over $640 million from its spot Bitcoin ETF, marking the fund’s largest outflow day since its conversion to a spot ETF fund on January 11th. Grayscale recorded a total outflow of $642.5 million on March 18th.

ETF Funds and Bitcoin Performance

Farside Investors data indicates that Fidelity’s Bitcoin ETF, the second-largest fund, saw inflows drop to just $5.9 million, marking its lowest day on record. Both funds together led to a net outflow of $154.3 million for spot Bitcoin ETFs.

CoinGecko data shows that the Bitcoin price is trading at $65,875, a 10.5% decrease from its all-time high of $73,797 reached on March 14th. Many market commentators point to the slowdown in Bitcoin ETF flows, the upcoming halving event, and the March 20th US Federal Reserve FOMC meeting as reasons for Bitcoin’s recent pressured price movement. However, other analysts shared an optimistic outlook for Bitcoin ETF flows.

Key Details on the ETF Process

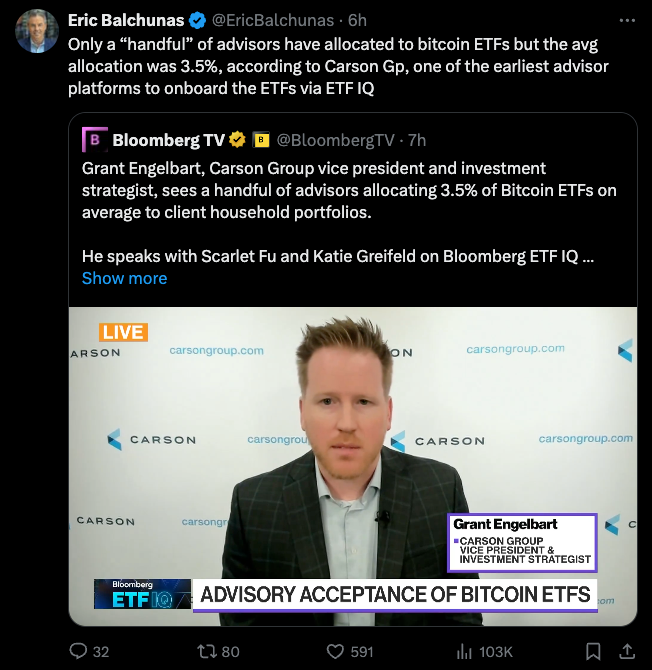

The vice president of investment firm Carlson Group, Grant Englebart, stated in an interview with Bloomberg TV that only a handful of the firm’s advisors had allocated funds to Bitcoin ETFs, and this allocation represented an average of about 3.5% of the total funds.

Commenting on the interview, Bloomberg ETF analyst Eric Balchunas said that the interview was consistent with what they heard from Bitcoin ETF issuers and that only a handful of early adopters were making meaningful allocations to identify Bitcoin ETF funds. Balchunas added the following statement:

“So far, there are only those who have entered Bitcoin, they are a handful of early adopters, questioners, and then allocators. Advisors are not yet asking for the rest of their clients. All these flows are coming from incoming traffic.”

Other commentators pointed to the amount of Bitcoin remaining in GBTC’s records, approximately 370,000 Bitcoin, as a reason for a long-term bullish outlook on ETF flows. Crypto market commentator Allesandro Ottavani wrote in a post to X on March 19th:

“GBTC had 378,000 Bitcoin and sold 9,600 Bitcoin today. The good news is they can’t continue at this pace for long.”

Grayscale Bitcoin Trust was converted from a corporate fund to a spot ETF fund on January 11th, following the approval of nine other spot Bitcoin ETFs from issuers like BlackRock and Fidelity.