There are new developments regarding FTX, which declared bankruptcy in November 2022 and was the second-largest cryptocurrency exchange at the time. Next year will reveal how long SBF will remain in prison, and steps are being taken to compensate the victims. However, the latest step is of the kind that dampens spirits.

FTX Claims

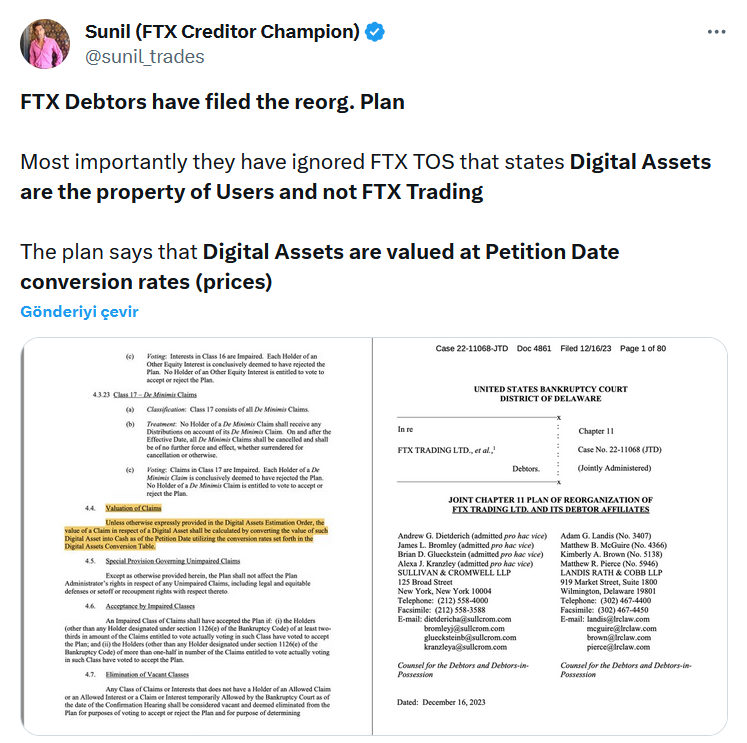

FTX creditors will receive the return of their assets at the value on the date of the petition, as stated in the revised Chapter 11 restructuring plan. The now-defunct cryptocurrency exchange FTX has presented a plan that states the value of customer asset claims will be determined retrospectively according to the time of the exchange’s collapse in November 2022.

This is a step that is extremely detrimental to the victims due to current market prices. According to a recent application in the United States Bankruptcy Court for the District of Delaware, crypto claims will be converted and returned to the victims. At the time of filing, Bitcoin was valued at $17,036, but with the rise in 2023, BTC is now over $42,000.

Victims who have been waiting for over a year to collect their claims are now concerned about the decision presented against them. Especially considering the losses they will face in altcoins, which could be much larger, and some cryptocurrencies have gained more than five times their value in 2023, the new plan could lead to additional lawsuits.

The court may approve the new plan for the full return of claims due to the complex debt structure. Reports published on December 9th revealed that addresses connected to the bankrupt FTX exchange transferred $23.59 million worth of cryptocurrency to different exchanges.

FTT Coin Commentary

In mid-December, a selection was to be made among the companies that bid to reopen the FTX exchange. However, as of December 17th, no decision has been made or announced between the three bidders. In the coming days, if a potential decision is announced, we could see significant fluctuations in the price of FTT Coin.

Initially, the announcement of the agreement or intention in this direction could boost the price, but the company likely to revitalize the exchange will probably declare no connection with FTT Coin. Indeed, this year the FTX Bankruptcy Committee stated that they had no future plans regarding this token, and it also seems difficult for this troubled exchange token to have a presence in the US region due to regulatory uncertainty.

Türkçe

Türkçe Español

Español