LayerZero co-founder and CEO Bryan Pellegrino has accused Kyle Davies of Three Arrows Capital of trying to convince him to transfer the entire treasury to the now-bankrupt crypto hedge fund shortly before its insolvency process. Pellegrino made this claim in response to a post on March 21.

Significant Statements from LayerZero CEO

Regarding the issue, Davies allegedly promised better rates than other creditors in a last-ditch effort to save the interoperability protocol LayerZero before bankruptcy, and the LayerZero CEO stated the following:

“Being liquidated is one thing. Lying, exploiting your friends and those around you is another.”

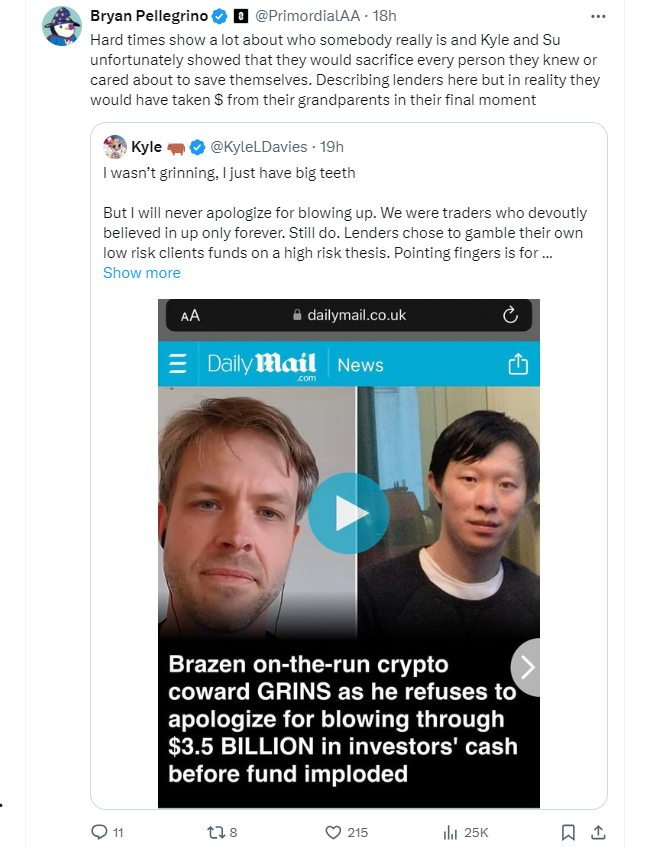

In an episode of the Unchained Podcast, Davies refused to apologize to investors for the billions lost during 3AC’s insolvency process and remained adamant that his professional reputation was still intact despite significant backlash on social media for past misconduct. Davies shared the following statement on social media:

“We were just investors who believed in an eternal uptrend. Still are. Lenders chose to gamble their low-risk clients’ funds on a high-risk thesis.”

However, Pellegrino criticizes Davies for misleading partners and associates and taking advantage of them. Pellegrino also claimed that 3AC was financially unstable when proposing the deal to LayerZero. Following the collapse of Terra Luna in May 2022, 3AC, a significant hedge fund manager with assets exceeding $3 billion, filed for Chapter 15 bankruptcy in July of the same year due to liquidity issues.

Noteworthy Developments in the Process

Co-founders Davies and Su Zhu later launched Open Exchange (OPNX), a platform for crypto derivatives and demand transactions, in April 2023. However, the platform ceased operations in February of this year.

On January 5, 2023, Davies and Zhu were summoned to court via social media for avoiding communication with authorities and failing to provide satisfactory cooperation with liquidators. Su Zhu was arrested in Singapore last September and remained in prison until December for not cooperating with the liquidation investigations of 3AC. However, Kyle Davies managed to avoid arrest during this period.

In a recent podcast, Davies stated that he stayed away from Singapore to avoid potential imprisonment. On December 21, a British Virgin Islands court froze assets worth $1.14 billion belonging to Davies and Zhu.

The 3AC liquidator Teneo is attempting to recover $1.3 billion directly from Zhu and Davies, alleging that they created significant leverage with investor funds after 3AC went bankrupt.

Türkçe

Türkçe Español

Español