Financial research firm Bernstein has updated forecasts for 2025, revealing significant downward revisions for leading Bitcoin  $104,783 miners’ stock price targets. Companies such as CleanSpark, IREN, and Riot Platforms have underperformed relative to Bitcoin’s decline since the start of the year. Bernstein highlights that corporate interest has increasingly shifted toward artificial intelligence and high-performance computing (AI/HPC), impacting Bitcoin miners negatively. The decrease in Bitcoin production efficiency, rising costs, and the suspension of expansion plans triggered these price target adjustments.

$104,783 miners’ stock price targets. Companies such as CleanSpark, IREN, and Riot Platforms have underperformed relative to Bitcoin’s decline since the start of the year. Bernstein highlights that corporate interest has increasingly shifted toward artificial intelligence and high-performance computing (AI/HPC), impacting Bitcoin miners negatively. The decrease in Bitcoin production efficiency, rising costs, and the suspension of expansion plans triggered these price target adjustments.

Price Targets for IREN, CLSK, and RIOT Declined

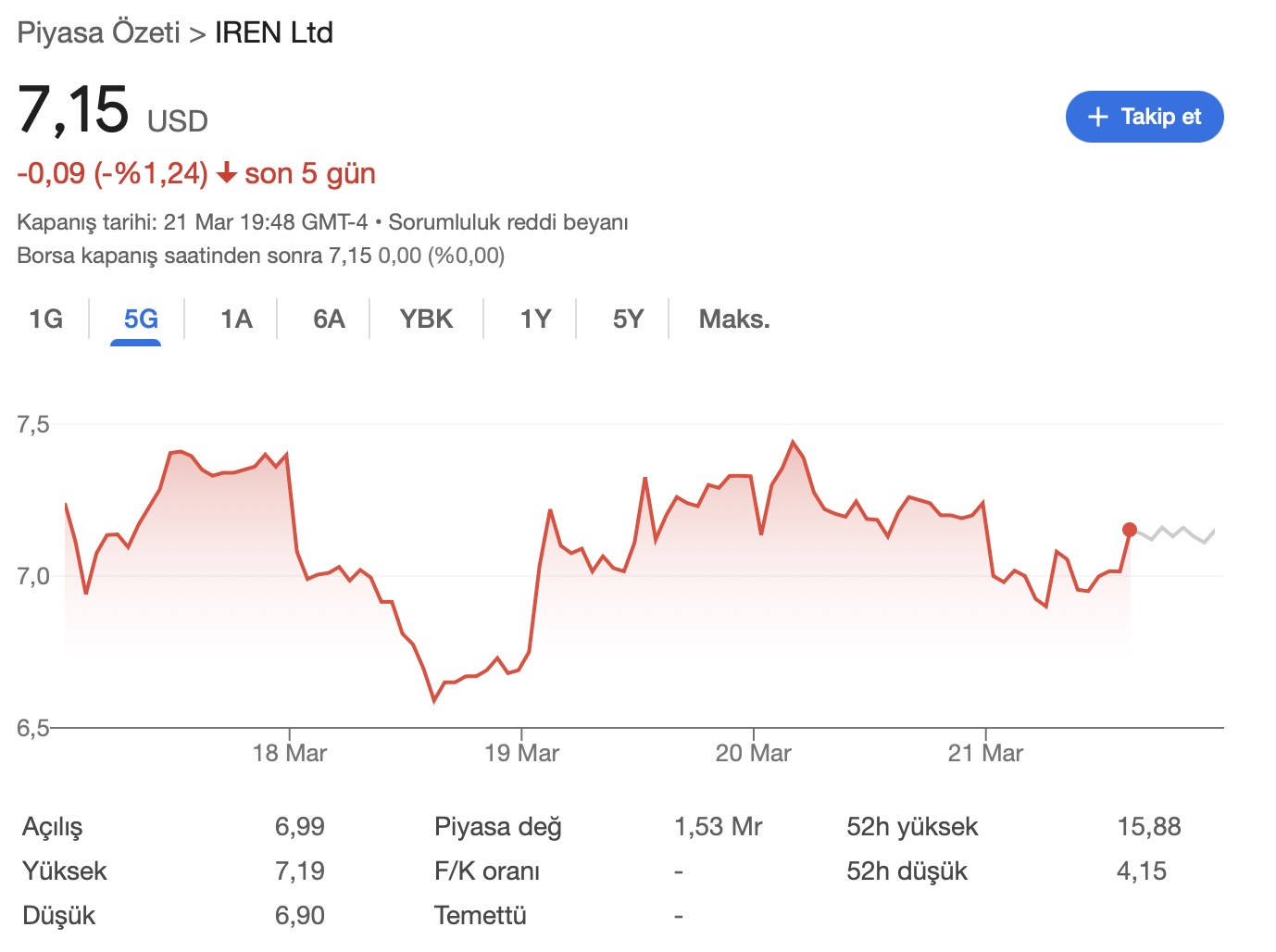

Bernstein has revised the price targets for Bitcoin miners downward for the end of 2025. IREN’s target was decreased from $26 to $20 due to the increased network hash rate negatively affecting its production capacity and high cash outflows from its Bitcoin investments. IREN shares closed the week down 1.24% at $7.15, with a market capitalization of $1.53 billion.

Similarly, CleanSpark’s target was lowered from $30 to $20 based on its Bitcoin storage strategy and declining cash flows. CleanSpark shares ended the week down 4.97% at $7.43, bringing its market value to $2.09 billion.

For Riot Platforms, the price target fell from $22 to $19. The company redirected resources toward AI/HPC projects, halting its Bitcoin mining investments, which led to lowered revenue expectations. RIOT shares closed the week up 3.11% at $7.95, with a market valuation of $2.73 billion.

MARA and CORZ Price Targets Remain Unchanged

Bernstein maintained the price targets for MARA and Core Scientific without changes, keeping MARA at $23 and Core Scientific at $17. MARA’s substantial Bitcoin holdings and valuable energy contracts with CoreWeave were primary factors in this decision. MARA shares closed the week down 5.50% at $12.38, while CORZ shares fell 1.73% to $8.51.

Bernstein also provided a positive assessment for Coinbase (COIN), assigning it an “outperform” rating and setting a price target of $310. Despite COIN’s approximately 26.2% decline since the start of the year, analysts believe the company has significant potential. Robinhood’s target was set at $105, supported by its 12.4% rise since the beginning of the year, indicating growth expectations in crypto services.

Türkçe

Türkçe Español

Español