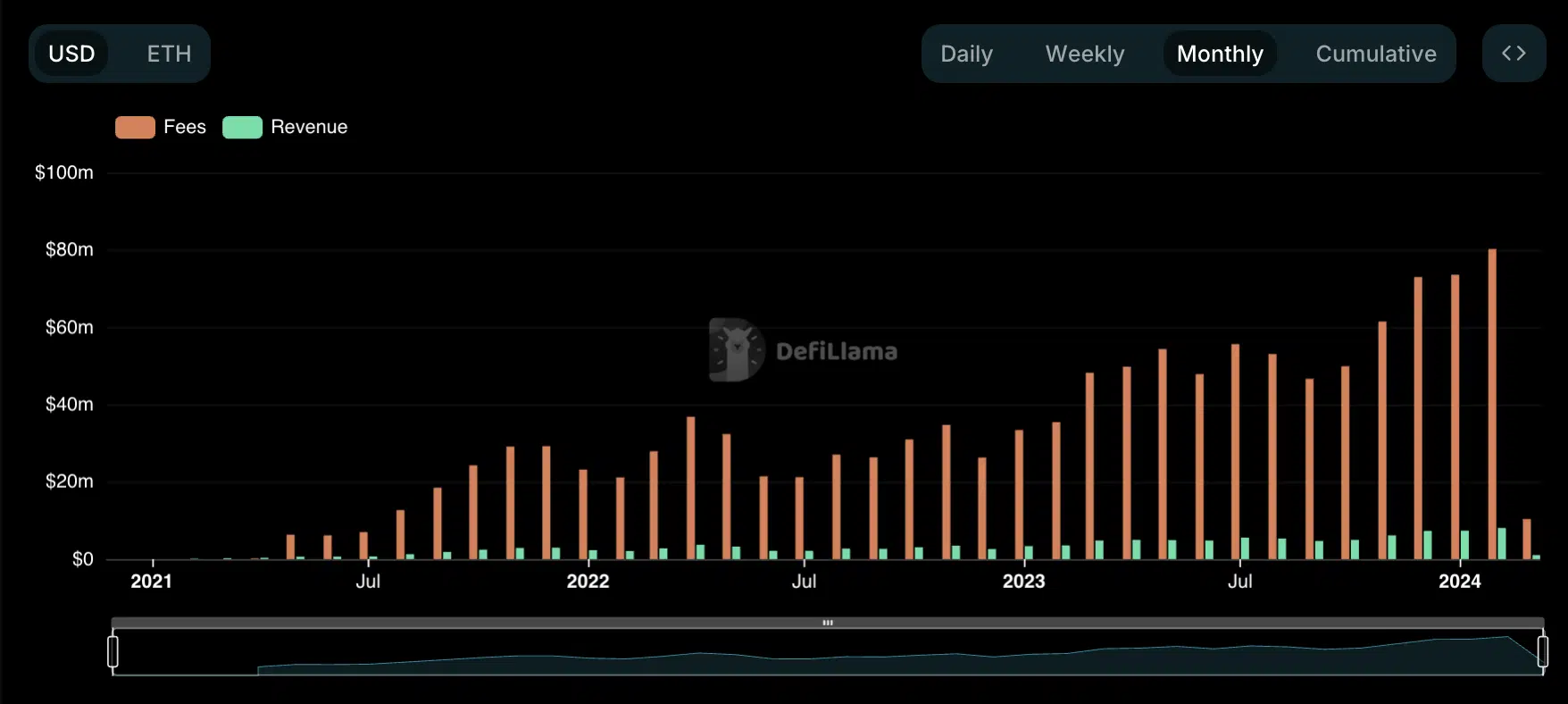

Cryptocurrency analytics firm DefiLlama reports that leading liquid staking protocol Lido Finance (LDO) closed February with monthly fees and revenue at their highest levels to date. The significant increase in the amount of Ethereum (ETH) staked last month is cited as the reason for this surge.

Current Data on Lido

CryptoQuant’s data indicates that the total value of staked ETH increased by nearly 10% during this period. At the time of writing, 31.5 million ETH valued at 109 billion dollars were staked. According to DefiLlama, transaction fees on Lido reached a total of 80 million dollars in February, marking a 10% increase from the 73 million dollars recorded in January.

On-chain data shows that the revenue generated from these fees during the 29-day period increased by 9% to 8.02 million dollars compared to January’s figures. The rise in staking activity is said to have contributed to an increase in Lido’s total value locked (TVL). DefiLlama’s data indicates that the liquid staking protocol’s TVL surged by 57% last month. At the time of writing, Lido’s TVL stood at 34 billion dollars, maintaining its status as the largest decentralized finance (DeFi) protocol by TVL.

Staked Tokens on Lido

In Lido, the increase in ETH staking not only follows the recent surge above the $3,400 price mark but also stems from an increase in the annual percentage rate (APR) for staking. According to a Dune Analytics dashboard prepared by Lido Finance, the APR offered to ETH stakers on the platform has been steadily increasing since February 24. Additionally, the seven-day moving average APR for staking was at 3.42%, with a nearly 5% rise over the past eight days.

Data from Dune Analytics indicates a significant decline in withdrawals from Lido this year. Contrary to assumptions, daily deposits to the protocol continued to rise, reaching a year-to-date (YTD) high of 71,000 ETH deposits on February 9. Last week, the total net deposits in Lido reached 48,000 ETH. Moreover, according to Dune Analytics, Lido’s market share in the ETH staking ecosystem reached 31.16%. Of the total 986,000 validators on the Ethereum network, 31% are staked through Lido.

Türkçe

Türkçe Español

Español