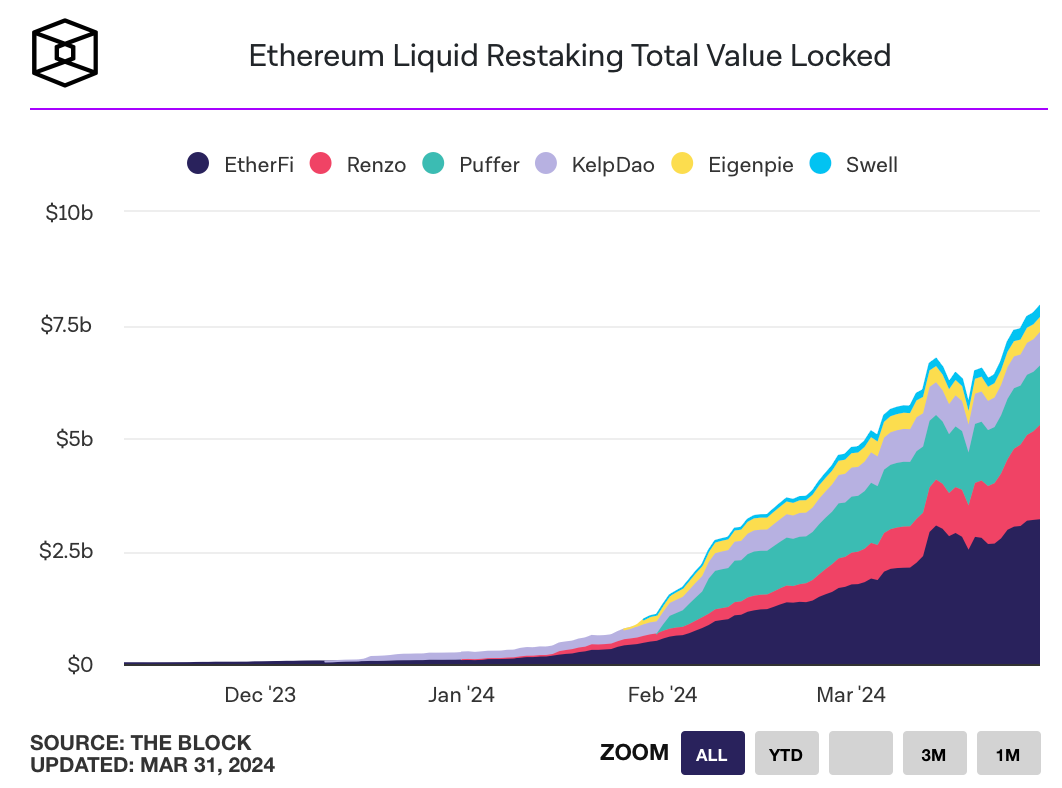

Liquid staking protocols, or liquid re-staking protocols, have seen a significant increase in user deposits across platforms like Etherfi, Renzo, Kelp, Puffer, and others, with the total value locked (TVL) approaching $8 billion. This increase in TVL is attributed to users leveraging EigenLayer through these protocols, which allows them to participate in liquid re-staking while maintaining access to their funds.

Etherfi Leads the Pack

According to data compiled by The Block, Etherfi is at the forefront with a TVL exceeding $3.2 billion, followed by Renzo with $2 billion and Puffer with $1.3 billion. Kelp, EigenPie, and Swell also boast significant TVL figures, highlighting the growing popularity of liquid staking protocols.

As is known, liquid re-staking protocols enhance economic security by allowing token holders to stake their assets on EigenLayer. Unlike traditional staking methods, liquid re-staking involves direct staking of tokens through platforms like Etherfi and Renzo, offering users the flexibility to earn rewards while preserving liquidity. The contribution of EigenLayer to the growth of these protocols’ TVL is notable, as the platform facilitates the deposit and reclamation of ETH in various liquid staking protocols.

With a TVL exceeding $13 billion, EigenLayer aims to use the deposited funds to enhance the security of other networks, such as rollups, oracles, and data availability platforms. Although the window for reclaiming funds through liquid staking protocols was briefly opened in February, these protocols continue to accept deposits, offering users an alternative way to participate in liquid staking and potentially earn rewards from both EigenLayer and the respective protocol.

The Rise of Protocols and the AirDrop Detail

Re-staking protocols like EtherFi, Renzo, and Kelp continue to be active in depositing ETH, withdrawing, and issuing derivative tokens. Users are encouraged to participate through AirDrops from both EigenLayer and the aforementioned protocols, increasing their chances of earning token rewards. For example, users reclaiming tokens through Kelp earn points from both EigenLayer and KelpDAO, enhancing their reward opportunities.

As users increasingly benefit from liquid re-staking protocols to deposit funds into EigenLayer, the prospect of dual AirDrop becomes more attractive. EigenLayer rewards users with points for deposit transactions, increasing their chances of earning tokens from the platform. This dual incentive mechanism indicates a growing synergy between liquid re-staking protocols and EigenLayer.

Türkçe

Türkçe Español

Español