CoinGecko, the crypto data platform, has created a list of altcoins classified as securities by the U.S. Securities and Exchange Commission (SEC). The list includes BNB (BNB), the service token of the world’s largest cryptocurrency exchange Binance, as well as Cardano (ADA), Solana (SOL), TRON (TRX), and many other altcoins.

Altcoins Classified as Securities by the SEC

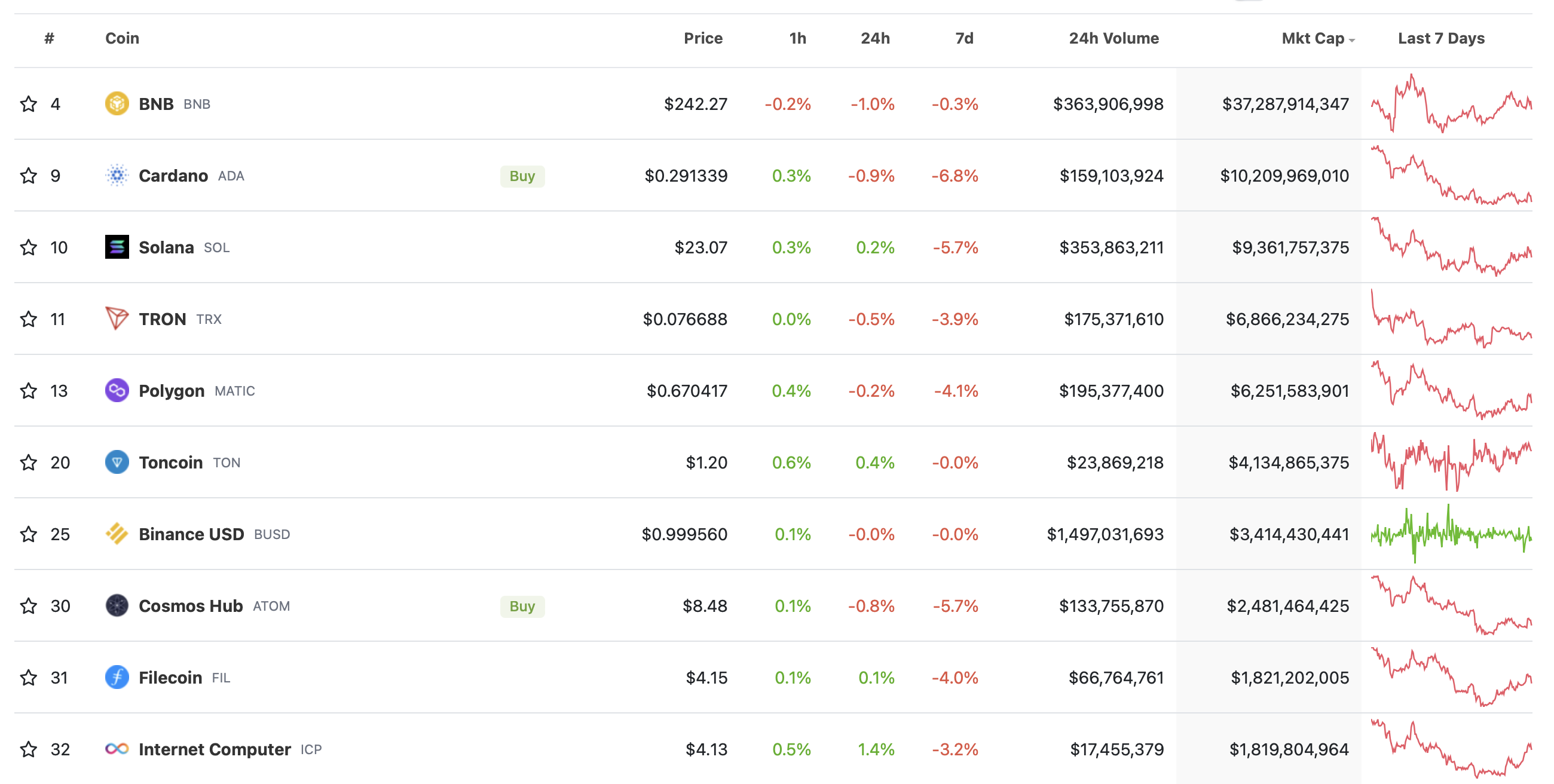

CoinGecko has compiled a list of altcoins classified as securities by the SEC, including those in cases brought against crypto exchanges like Binance and Coinbase.

The list contains 48 altcoins. When ranked by market capitalization, the top five altcoins are BNB (BNB) with a market cap of $37.28 billion, Cardano (ADA) with $10.2 billion, Solana (SOL) with $9.36 billion, TRON (TRX) with $6.86 billion, and Polygon (MATIC) with $6.25 billion. Other altcoins on the list include Toncoin (TON), Binance USD (BUSD), Cosmos (ATOM), Filecoin (FIL), and Internet Computer (ICP).

According to CoinGecko, the total market capitalization of the 48 altcoins on the list is $91.29 billion, with a total trading volume of $3.42 billion in the last 24 hours.

What are Securities?

Securities are financial instruments issued by companies, governments, or other organizations to meet their funding needs. They represent a specific value and can take various forms such as stocks, bonds, and notes. They provide certain rights to their owners. For example, a stock represents a certain share of ownership in a company, while a bond guarantees the repayment of borrowed money with interest. These instruments can be bought and sold on platforms like stock exchanges and are subject to regulation by the SEC.

The SEC argues that almost all altcoins, except Bitcoin (BTC), are securities and that their trading without proper registration with the SEC is illegal. As expected, this stance by the SEC puts significant pressure on the cryptocurrency market, especially the altcoin market.

Türkçe

Türkçe Español

Español