Crypto markets are currently focused on the ongoing Coinbase hearing, with the SEC cornered. Despite heavy selling after ETF approvals pulling markets down, the overall outlook isn’t bad. The US data released before the end-of-month Fed meeting was negative. So, what’s the latest on the Litecoin front?

Litecoin (LTC)

On the weekly chart, the LTC price has been declining since the peak of $115 in July last year. This decline led the price to fall to $56 in August. After a brief recovery, a deeper dip followed. The excitement caused by the halving at that time led to new peaks, but historically, we have seen a decline before and after the halving.

Currently, the LTC price has confirmed a long-standing rising support trend line, in place for approximately 600 days. The RSI is still in the neutral zone, making it difficult to predict a clear direction, but the SEC’s ongoing hearing defining most altcoins as securities, except for a few, could work in favor of LTC, being a miner’s altcoin.

In the future, we might see the SEC distinguishing altcoins with a structure similar to BTC from securities, strengthening its hand in lawsuits.

Litecoin Miners

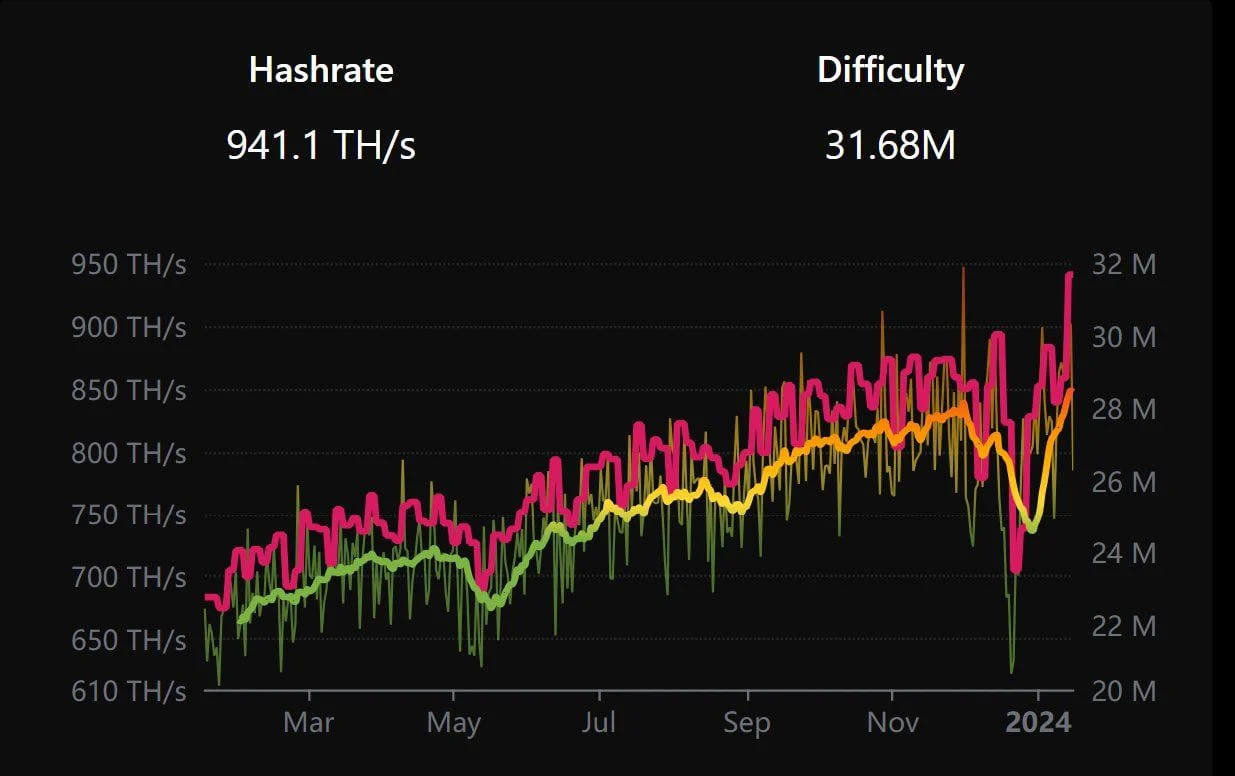

Speaking of miner’s altcoins, the difficulty for LTC has reached an all-time high today. The announcement by the team pointed to the ATH level, which is a positive development for the LTC price. Additionally, the team announced that 18,000,000 ordinals have already been inscribed on the Litecoin network.

Ordinals have significantly increased miner revenues across many networks, balancing profitability in the last 9 months and offsetting miner losses during downturns.

LTC Price Prediction

As with the weekly chart, it is not possible to determine a clear direction on the shorter-term two-day chart. However, according to the most likely Elliott wave count, the LTC price is continuing its 5-wave upward trend. The most likely scenario is for the price to increase by 75% and test the $122 resistance for a new peak.

Despite this bullish prediction for LTC’s price, closures below the lowest level of September 2023, which is $57.30, could lead to a pullback to as low as $48.

Türkçe

Türkçe Español

Español