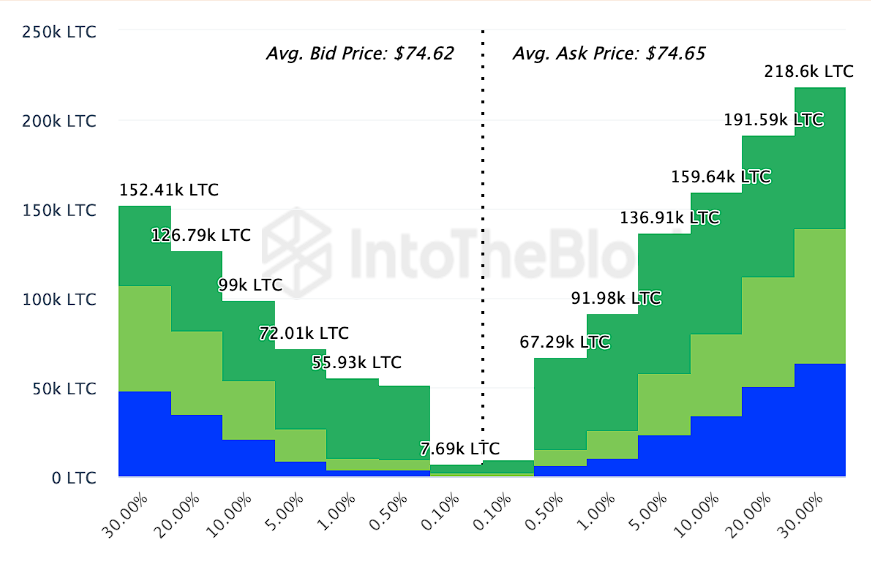

In the last week, LTC price rose by 2.18% and continues to find buyers at $73.22. However, if the downward buy orders in the exchange order books are met, all gains could quickly be erased. According to data provided by IntoTheBlock, on-chain exchange data revealed that there are more orders on the demand side compared to sales.

Litecoin’s Comments

As seen in the graph below, the amount of LTC on the offer side was noticeably lower. Specifically, it is seen that 928,200 coins worth approximately $70 million will be sold if Litecoin reaches $74.65.

If this scenario occurs, the price could start to decline, with possible targets slightly below $72 and $70. Another chart also supports the price decline.

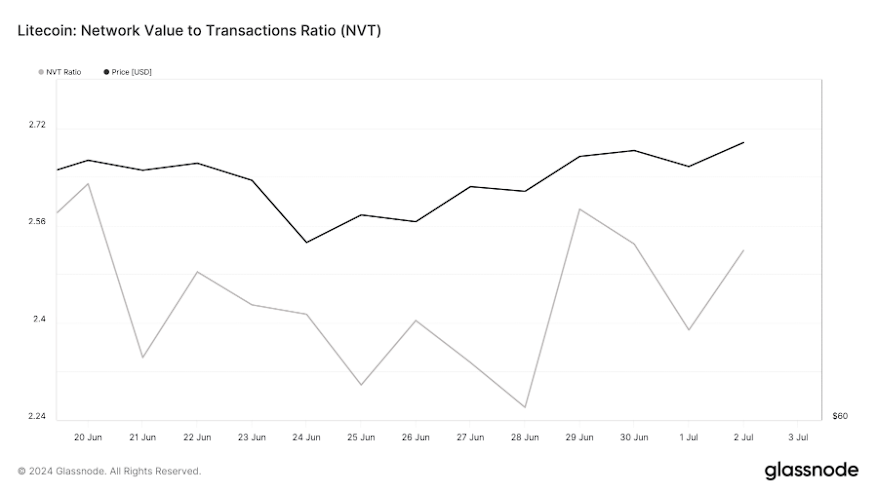

The Network Value to Transaction (NVT) ratio also supported the price decline. This metric links the existing market value with the transactions occurring on a network. When the market value grows faster than the volume, the NVT ratio increases, reflecting an overvalued environment in the network.

On the other hand, if the volume surpasses the market value, the NVT ratio decreases, indicating that the network’s value is lower than it should be.

According to data provided by Glassnode, as of the time of writing, Litecoin’s NVT ratio was rising. Therefore, considering the current market conditions, it wouldn’t be wrong to say that LTC is in an overvalued position according to the metric. This situation could trigger a short-term decline for LTC.

LTC’s Future

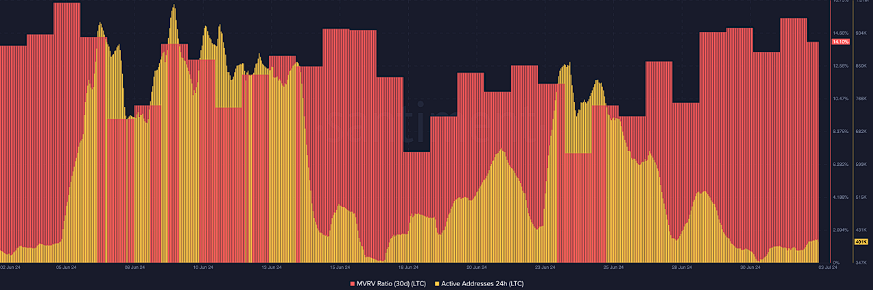

The MVRV ratio also reveals important data for LTC. Briefly, MVRV can be considered as Market Value – Realized Value. It is an indicator of how much profit holders are in relative to the price. A very high MVRV ratio indicates overvaluation for the coin.

On the other hand, if the data is negative, it may be considered undervalued and seen as a buying opportunity by investors. As of the time of writing, Litecoin’s 30-day MVRV ratio was seen at 14.10%. If investors holding LTC sell, the average income could be around 14%.

While the week started positively for cryptocurrencies, metrics turned negative later, and the Bitcoin price also fell to the $60,000 level. Considering the decline in the number of active addresses in LTC, it wouldn’t be wrong to say that a decline might be expected in the coming days.

The decrease in network activity may indicate a decline in demand for LTC. However, a positive outlook in the market could increase buying pressure on LTC and show that the price is starting to rise.

Türkçe

Türkçe Español

Español