Litecoin (LTC), Dogecoin (DOGE), and Ripple (XRP) have been in the market much longer than many other projects. While LTC and XRP emerged in 2011, Dogecoin appeared two years later. Let’s take a look at the current approach towards LTC among these long-standing coins.

Litecoin Comments

Generally, when reviewing a cryptocurrency, the number of its owners can be considered an important metric. In the past few days, there has been a noticeable decline in Litecoin investors.

As of the time of writing, LTC had over 8 million investors. On the other hand, XRP and DOGE have seen an increase in their numbers. Despite the rise in these two cryptocurrencies, Litecoin still has more investors compared to Dogecoin and Ripple, which have 6.70 million and 5.26 million investors, respectively.

A high number of investors indicates confidence in the cryptocurrency, regardless of current price movements. This belief might also be based on Litecoin’s supply. Litecoin has a maximum supply of 84 million, which is much lower compared to its competitors. Despite this, it has faced performance questions this year.

This year, Litecoin’s price movement has shown a weaker performance compared to its rivals DOGE and XRP. This situation could imply that LTC investors are not focused on short-term investments. On the other hand, there has been a noticeable increase in the number of addresses holding 1000 LTC. According to data provided by IntoTheBlock, the number of addresses holding between 1 million and 10 million LTC has increased by 33% over the past month.

This indicates that the demand for the coin is rising, and market participants are taking advantage of the price drop to increase their holdings.

IntoTheBlock Marketing Director Vincent Maliepaard noted that Litecoin has made significant progress in terms of volume recently. Maliepaard said:

Litecoin’s transaction volume has steadily increased over the past three months, reaching an average of 49 million LTC per day. This represents an impressive 66% of the current market value. (For perspective, this rate is quite high compared to other similarly sized coins like AVAX at 2.9% and LINK at 0.77%).

How Much Will LTC Be Worth?

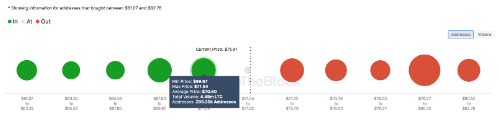

As of the time of writing, LTC is trading at $71.32. However, data provided by In/Out of Money Around Price (IOMAP) suggests that the price could rise further in the future.

IOMAP measures resistance and support by looking at addresses that are in profit or loss within a specific price range. If many addresses are in profit, the price may act as support. However, if the concentration is out of profit, it will be a resistance zone.

According to data provided by IntoTheBlock, 295,350 addresses holding LTC are in profit, having purchased LTC at around $70.60. Additionally, 286,450 addresses that bought the cryptocurrency at $72.88 are in loss. It is suggested that the investor group with significant profitability could keep the LTC price between $69.67 and $71.54, making this area a support level.

If this level is confirmed as a real support, the price could enter an upward trend. Following this, the price could rise to $74.52 or $77.08 after surpassing $72.88. However, if the trend turns downward and confidence wanes, the price could drop to $68.23.

Türkçe

Türkçe Español

Español