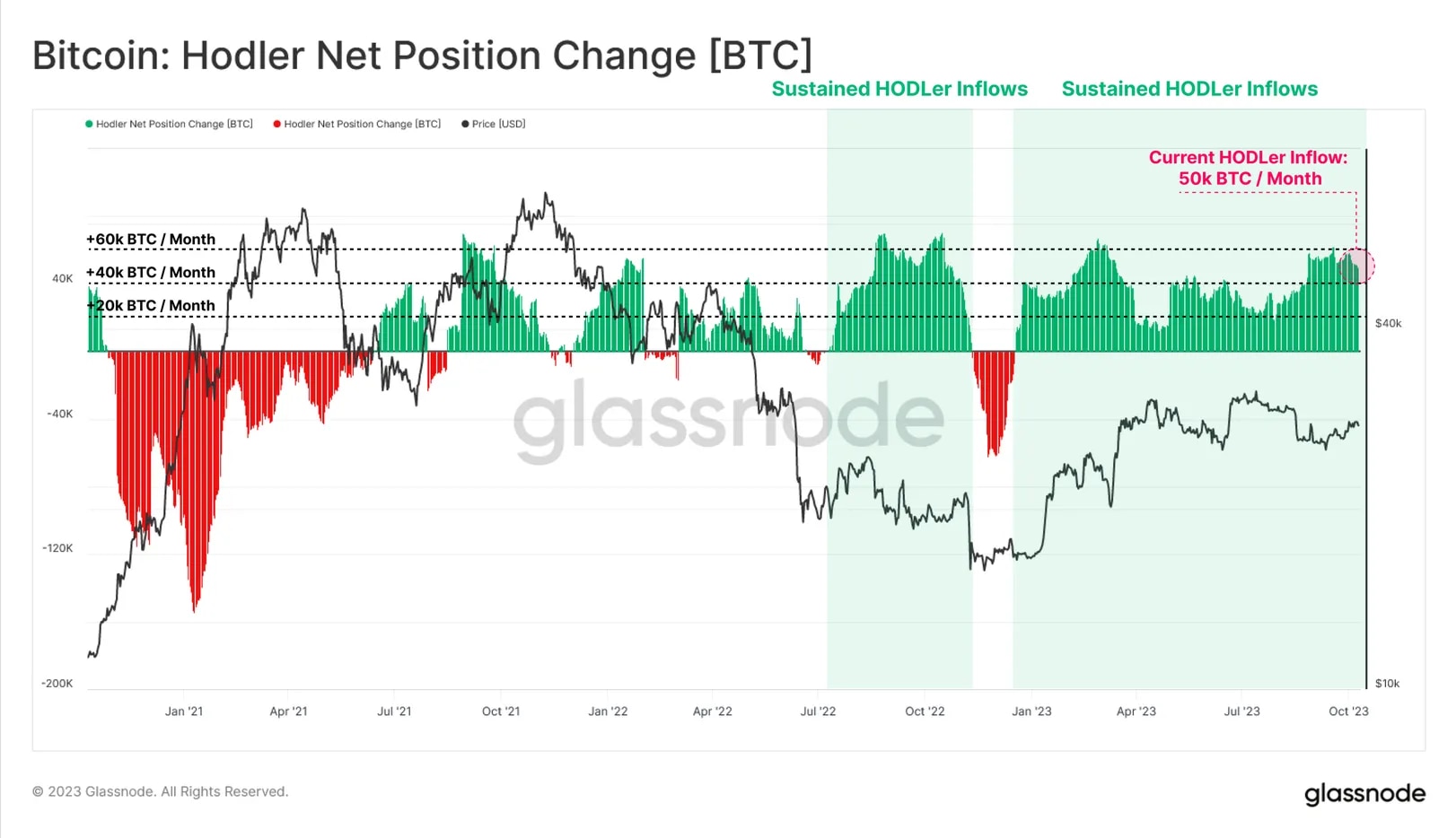

According to data provided by the on-chain data and analytics platform Glassnode, long-term investors persistently continue to buy Bitcoin (BTC), contributing significantly to the liquidity shortage in the market. The data indicates the signal of an exaggerated price rally.

Bitcoin HODLers Continue to Accumulate BTC

The metric showing HODLers’ net position change reveals that long-term investors or wallet addresses with a holding history of at least 155 days have accumulated 50,000 BTC worth $1.35 billion per month.

The total number of BTC held by long-term investors has surpassed 14.85 million, reaching the all-time highest level. The 14.85 million BTC represents 76% of the circulating supply of the largest cryptocurrency.

In its latest weekly report, Glassnode stated, “HODLers are accumulating over 50,000 BTC per month. This indicates both a tightening supply and a widespread reluctance to trade.” The on-chain data and analytics platform also added that the market is experiencing a continuous sleep mode in BTC.

Increasing Coin Dormancy Trend in Bitcoin

Dormant coins are those that have not been spent on the chain for a certain period of time. The increasing trend of coin dormancy in Bitcoin implies that coins are being held in illiquid conditions for longer periods. In other words, it indicates a relatively weak supply-side pressure and an exaggerated price rally on the horizon. Historical data shows that Bitcoin has experienced a strong upward movement during similar trends.

Data from the cryptocurrency data and price platform CoinMarketCap shows that the largest cryptocurrency BTC traded at $27,261, a decrease of 1.06% in the last 24 hours. Current data indicates that BTC has decreased by 1.11% in the last 7 days and increased by 6.25% in the last 30 days. Furthermore, Bitcoin is priced at approximately 60% below its all-time high of $68,789 reached on November 10, 2021.