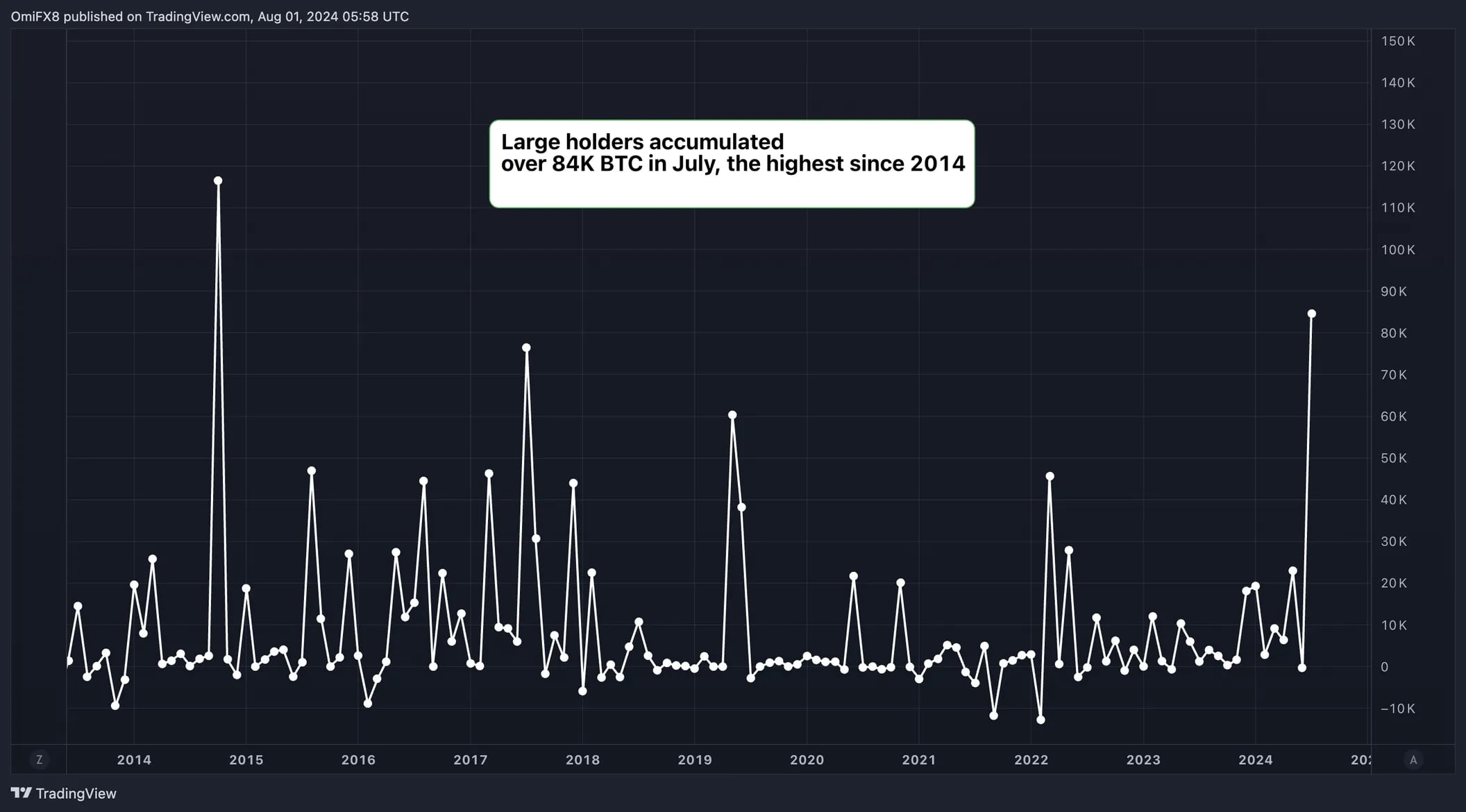

In July, major Bitcoin (BTC) investors significantly increased their BTC holdings by taking advantage of market fluctuations. Despite the overall decline in Bitcoin’s price, this purchase by large investors shows their confidence in the cryptocurrency market.

They Purchased Over 84,000 Bitcoins

According to IntoTheBlock’s data, major Bitcoin investors purchased over 84,000 BTC worth approximately $5.4 billion in July, marking the highest monthly purchase since 2014. These purchases particularly involved accumulating BTC below $55,000, taking advantage of the price drop at the beginning of July. Although Bitcoin only rose by 3% by the end of the month, these acquisitions by large investors reflect their expectations for future price increases.

Analysts indicate that these strategic accumulations by major investors are believed to result in a bullish breakout from BTC’s prolonged consolidation phase between $50,000 and $70,000. This expectation could further extend Bitcoin’s rise from $16,000.

Additionally, Federal Reserve Chairman Jerome Powell stated in a meeting yesterday that a rate cut is on the table for September, emphasizing that economic data should support this move. It is known that rate cuts can increase interest in investment options outside of traditional assets, potentially boosting demand for Bitcoin and altcoins.

Interest in Stablecoins Continues to Grow

On the other hand, the growing interest in stablecoins also supports the positive sentiment in the cryptocurrency market. In July, the total market value of stablecoins increased by 2.11% to reach $164 billion. This indicates new capital inflows into the market and positive movements in cryptocurrency prices.

Overall, large investors remain hopeful as the market has not been significantly affected by recent negative news. Potential negative developments such as Mt. Gox’s Bitcoin distribution, the German government’s Bitcoin sales, and other major chain movements have not substantially impacted Bitcoin’s price. All these factors are seen as a sign of extremely high confidence in the market.

Türkçe

Türkçe Español

Español