Following last weekend, altcoins, including Shiba Inu (SHIB), witnessed significant price drops, with SHIB recording a decline of more than 24% in the past seven days. This dip was then followed by a significant price correction yesterday and today. Despite the market’s downturn, SHIB’s blockchain, Shibarium, continued to perform well, achieving new milestones.

Shibarium’s Current Status

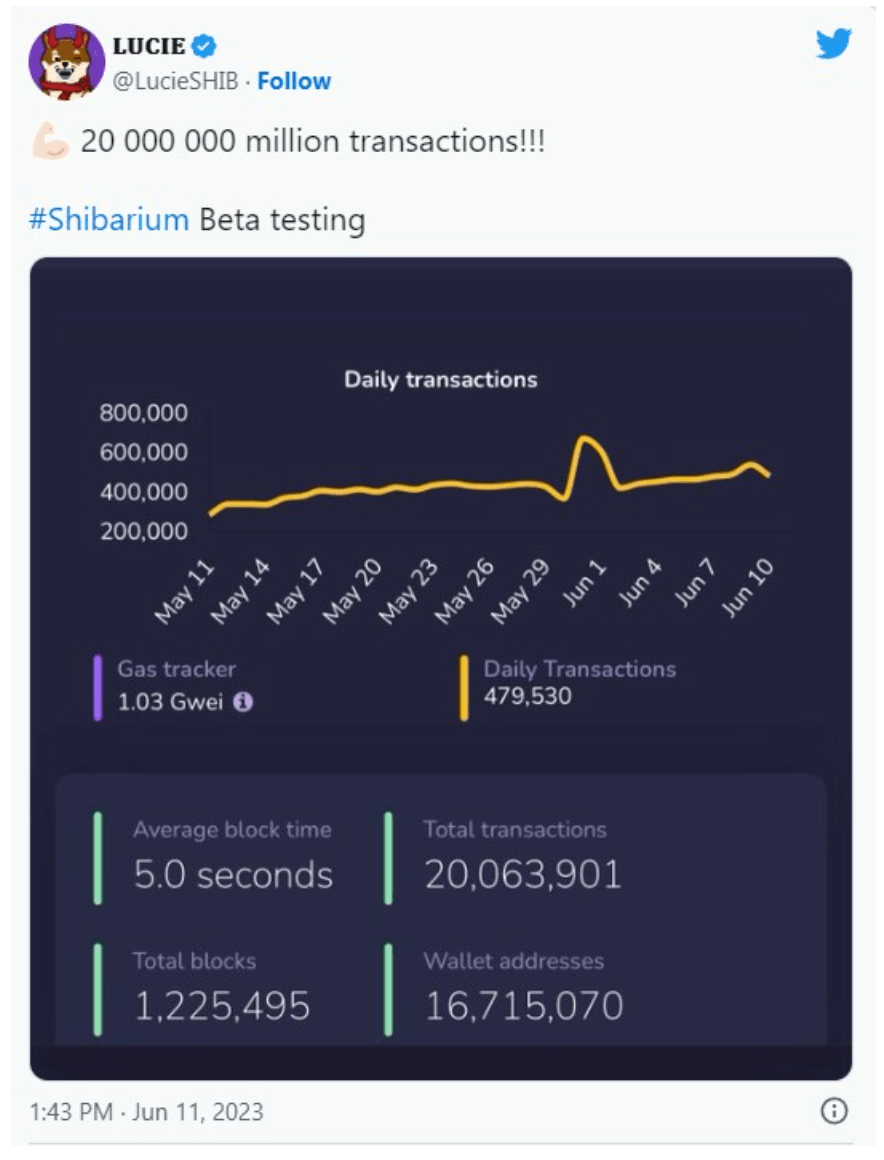

Developments on the Shibarium front continue. Following a tweet about the topic, it was revealed that the total number of transactions on Shibarium exceeded 20 million. Subsequently, a significant update occurred.

Data from Puppyscan revealed that daily transactions have gained upward momentum since May 2023. As of the time of writing, the daily transaction count was 491,994. The number of wallet addresses stood at 16,723,362. Moreover, 1,236,598 blocks, with an average block time of 5 seconds, had been created.

SHIB continued to face a dip as its price chart remained in the negative region. According to CoinMarketCap, SHIB’s price declined by more than 4% in the last 24 hours. At the time of writing, SHIB was trading at $0.000006559 with a market capitalization of over $3.8 billion. However, Shibarium’s success wasn’t enough to change the market sentiment surrounding SHIB.

The memecoin‘s social volume experienced a sharp decline, representing a decrease in its popularity. The negative sentiment surrounding SHIB increased in the past seven days, as inferred from the declining weighted sentiment of the token.

Shiba Inu Commentary: Whales Are Stepping Back

The price movement of SHIB affected its popularity among whales. According to Whalestats, SHIB was the most traded token among the top 100 ETH whales in the last 24 hours. However, it ranked 12th on the list of cryptocurrencies these whales bought. Therefore, it appears that major players in the crypto space might be selling their SHIB assets. CryptoQuant had recently pointed to a promising bull signal for better days ahead.

Shiba Inu’s Relative Strength Index (RSI) is in the oversold position, which could increase buying pressure in the coming days. SHIB’s net deposits on exchanges were also lower than the 7-day average.

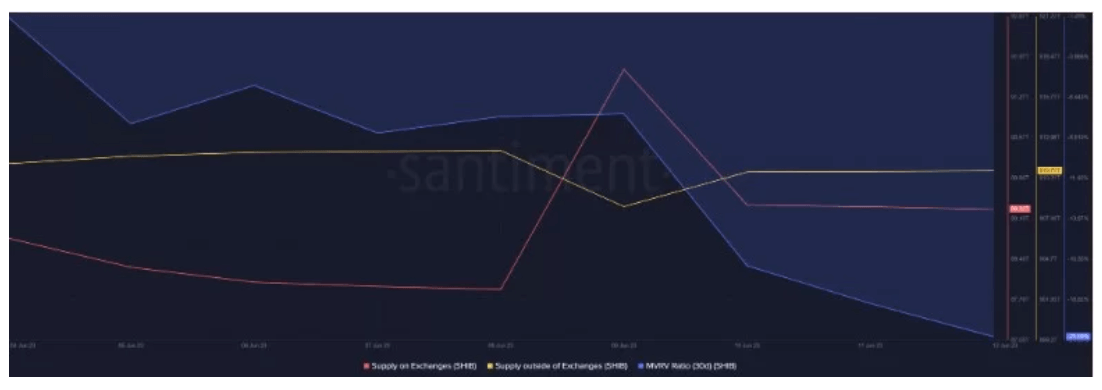

Moreover, SHIB’s off-exchange supply reversed its exchange supply. This is a typical bull signal and indicates buying pressure in the market. However, SHIB’s MVRV Ratio significantly dropped at the time of writing, which could pose a problem.