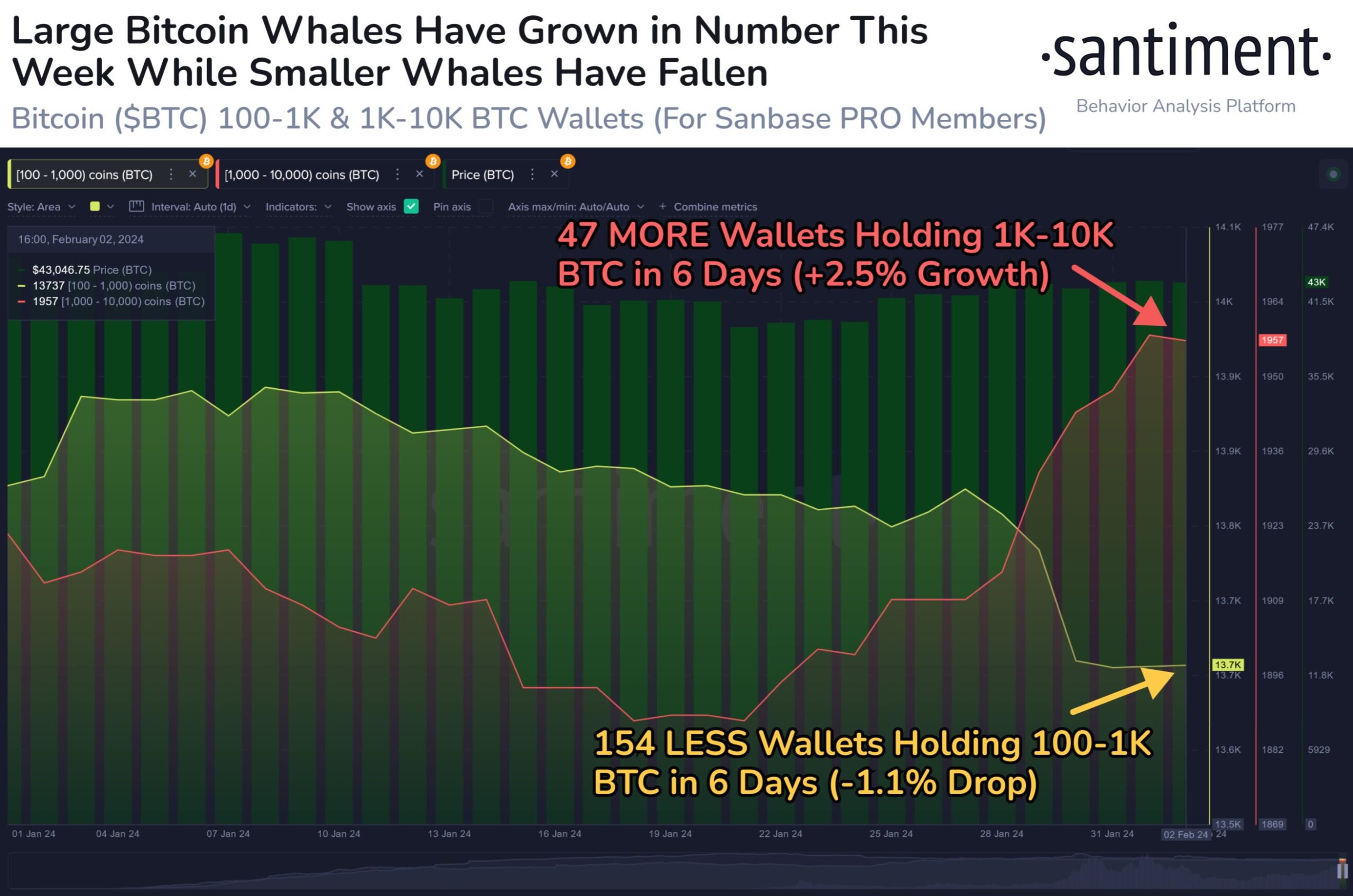

Major cryptocurrency investors are capitalizing on the stability of Bitcoin‘s price, ranging between $41,000 and $44,000, as the number of whale wallets for the leading cryptocurrency Bitcoin (BTC) has risen to its highest point since November 2022.

Bitcoin Wallet Numbers Surge

According to on-chain analysis firm Santiment, the number of wallets holding between 1,000 and 10,000 BTC has reached a new high of 1,958 since November 2022, while the number of wallets holding between 100 and 1,000 BTC has dropped to its lowest level. These large whales are accumulating BTC at a time when a significant price indicator has started to signal a buying opportunity.

This situation could indicate that the flagship cryptocurrency’s price may continue to rise after consolidating around $43,000 and could recover from the drop to $19,000. The data comes alongside the launch of spot-traded funds in the US market. The data also arrives during a period when Bitcoin miners have been selling their BTC holdings, moving over 4,000 coins worth approximately $173 million from their wallets to cryptocurrency exchanges in a single day.

Current State of BTC Miners

The reported data is the highest figure seen since May 16, 2023. Bitcoin miners are adding selling pressure to the cryptocurrency market at a time when the flagship cryptocurrency’s price is moving towards gains for the fifth consecutive month, the longest period since the pandemic-induced rally.

If the cryptocurrency continues to rise, it could reach the highest monthly gain streak since the rally between October 2020 and March 2021 and may approach the peak of about $69,000 in November 2021. Notably, earlier this month, Skybridge Capital’s founder and managing partner Anthony Scaramucci stated his belief that the upcoming halving event for BTC will be a significant catalyst for its growth, pointing to a price target of $170,000 per cryptocurrency.

Türkçe

Türkçe Español

Español