Cryptocurrency markets experienced a promising environment in 2025, but macroeconomic developments disrupted everything. Despite significant positive developments such as the initiation of FTX refunds, resolution of the Genesis event, and the near completion of MTGOX refunds, cryptocurrencies have not achieved the desired levels. With the return of Trump to office removing some pressure on crypto, trillion-dollar giants remain hopeful for the future.

Solana (SOL) ETF

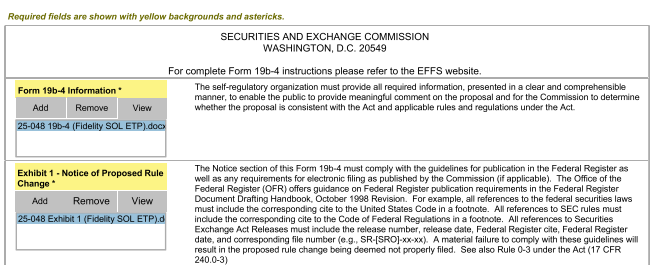

ETF issuers are continuing their applications as they anticipate a lifting of the pressure on cryptocurrencies in the coming months. While BlackRock has repeatedly expressed reluctance towards altcoin ETF applications excluding ETH, competitor Fidelity holds a different view. This trillion-dollar asset manager submitted its application for a SOL Coin ETF before BlackRock, similar to its BTC and ETH submissions.

This indicates their intention to seize the opportunity for approval in the flexible regulatory environment provided to cryptocurrencies before the year concludes. Currently, the number of cryptocurrency ETFs has approached 50, and new decisions from the SEC regarding nearly all altcoins are expected before November.

Details of the ETF Application

The cryptocurrency ETF process has already taken shape with the BTC ETF. Since it represented a first, many discussions occurred during BTC’s approval process, taking time to establish a framework. Today, applications can be made more clearly and are likely to receive approvals with fewer revisions.

Even the SEC, which does not view meme coins as securities, encourages issuers in altcoin ETF applications. CME’s futures listing also serves as another supportive step toward approval for SOL Coin. This detail is mentioned within the application.

The application dated March 25 discusses many aspects of the Solana  $148 network’s structure.

$148 network’s structure.

“It is a decentralized, peer-to-peer (P2P) network maintained by users.

Proof-of-History (PoH): Ensures a timestamped transaction ordering.

Proof-of-Stake (PoS): An energy-efficient, virtual mining system.”

It remains uncertain from whom custody services will be obtained, but Coinbase is usually chosen. Major companies like Reuters and Bloomberg will provide data support.

The risks section includes details such as volatility, similar to other applications.

“There is a risk of ‘slashing’ (penalized coin loss) due to security vulnerabilities during staking, provider failure, or malicious validators. Additionally, liquidity risk may arise if staked SOL remains locked.

Security of private keys for digital asset storage carries risks of loss due to cyberattacks, technological failures, or operational errors.

The SEC does not have direct jurisdiction over such products, creating uncertainty in investor protection. SOL is not subject to a clearly defined regulatory framework by the SEC or CFTC.

The fund explicitly states it will not claim rights to new assets arising from blockchain forks or airdrops.

Fund shares are traded within stock exchange hours (9:30 – 16:00 ET), while the SOL market operates 24/7. This time difference may increase value discrepancies that investors could face.”

Türkçe

Türkçe Español

Español