Leading Bitcoin mining company Marathon Digital has revised its 2024 hashrate growth target upwards in response to the fourth block reward halving, which cuts the block reward for miners in half in terms of BTC. Initially planning to increase its hashrate by about 46 percent over the year, Marathon Digital now aims to reach a fully funded hashrate of around 50 exahashes per second (EH/s) by the end of 2024 and double the scale of its mining activity. This adjustment follows increased mining device orders and capacity resulting from recent purchases.

Marathon Digital’s Strong Growth Objective

Marathon Digital’s Chairman and CEO Fred Thiel expressed confidence in reaching their growth targets without needing additional capital. Thiel highlighted the company’s current liquidity position and plans to utilize cutting-edge equipment and proprietary technology to enhance mining device efficiency.

Although Bitcoin‘s block reward halving tends to impact miners’ revenue streams, Marathon Digital still aims to optimize operations and approach 21 joules per terahash while growing to 50 exahashes.

Despite concerns about the impact of block reward halving on mining revenues, industry leaders remain optimistic about the future of Bitcoin mining. Marathon Digital’s Vice President of Corporate Communications Charlie Schumacher emphasized that the mining sector has already overcome significant challenges in 2023, including a doubling of Bitcoin’s difficulty rate. This resilience is a result of preparations made by major miners like Marathon Digital, strategically positioning themselves for such events.

Meanwhile, analysts at research and brokerage firm Bernstein reported that although mining companies’ stocks generally underperform compared to Bitcoin, some mining companies are still at their highest levels of revenue in US dollars. This positive outlook is supported by the miners’ strong balance sheets and relatively low debts following the block reward halving. For instance, Marathon Digital’s shares rose post-halving, indicating investors’ confidence in the company’s growth expectations.

Mining Difficulty Increases for the First Time Following a Block Reward Halving

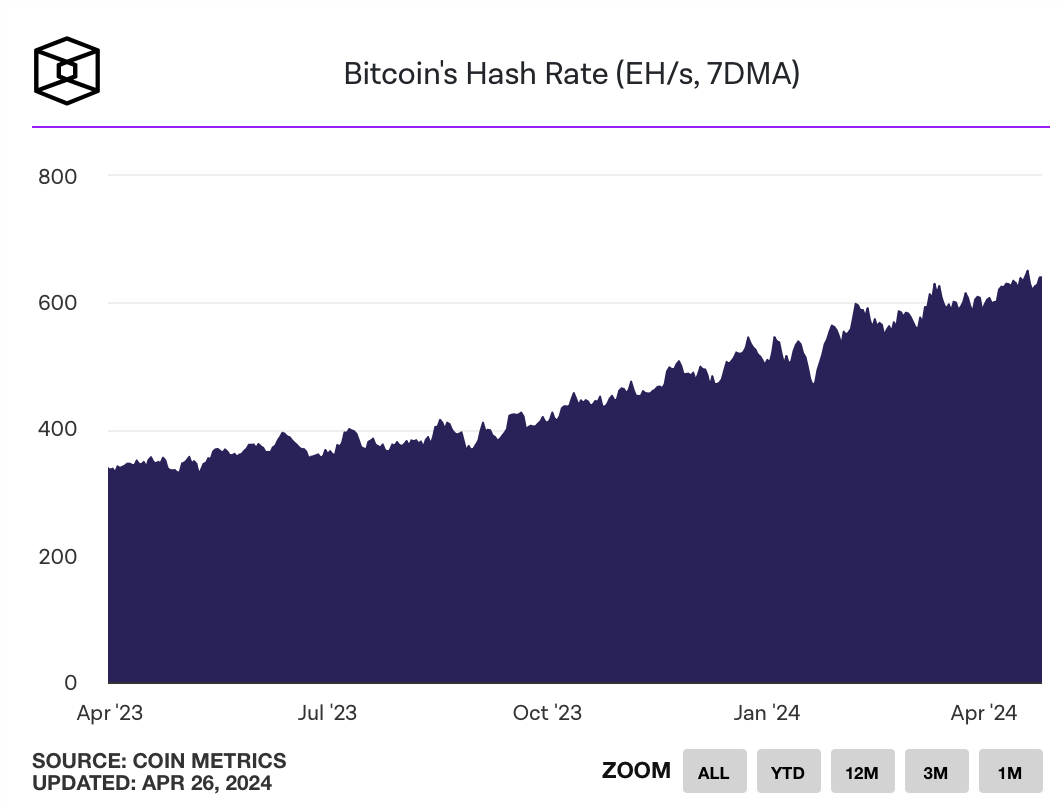

Moreover, Bitcoin’s mining difficulty recently reached an all-time high, marking the first time the metric has increased following a block reward halving adjustment. This contrasts with previous halvings where the hashrate typically dropped immediately afterward. This time, the hashrate remains near all-time highs due to increased transaction fee revenues following the block reward halving.

The increase in mining difficulty is fueled by speculative activity surrounding new protocols on Bitcoin, such as Runes. As a result, despite the drop in block rewards, miners continue to participate in the Bitcoin network.

Türkçe

Türkçe Español

Español