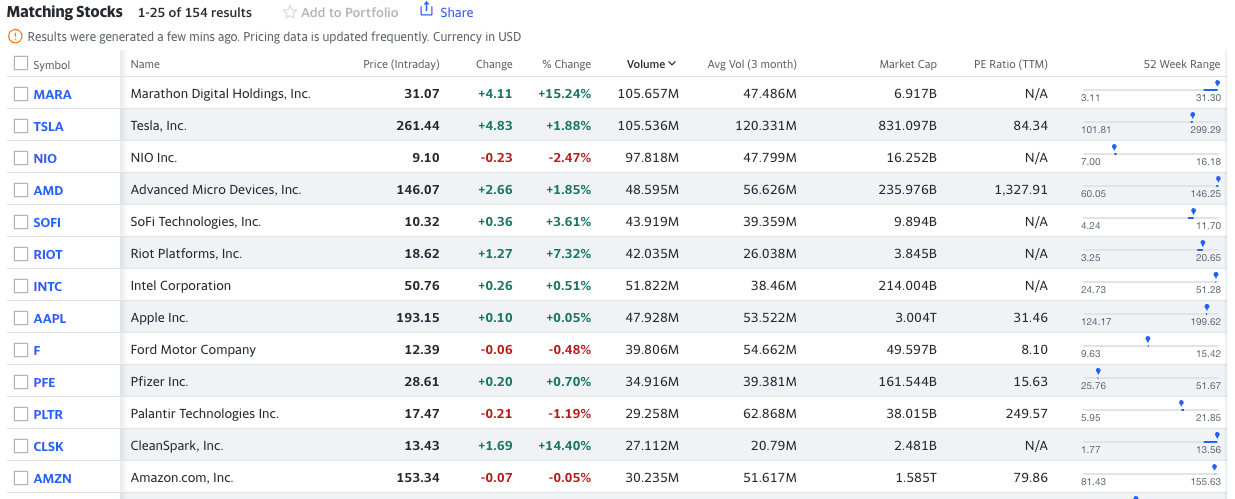

Bitcoin miner Marathon Digital’s stock trading volumes have soared to the top of the list just weeks before the anticipated approval of a spot Bitcoin exchange-traded fund (ETF). According to Yahoo Finance market data, the publicly traded company surpassed $105 million in share trading volume in the last 24 hours, outperforming stocks of giant corporations like Tesla, Apple, and Amazon.

Significant Developments in Marathon Digital Stocks

Another Bitcoin miner, Riot Platforms, was the sixth most traded stock on the chart with over $40 million in trading volume in the last day. The increase in trading activities for public Bitcoin mining stocks occurred during a period when mining companies were expanding their operations ahead of the expected approval of a spot Bitcoin ETF in early January and the Bitcoin halving event in April.

On December 19th, Marathon announced plans to acquire two mining centers for $179 million, adding 390 megawatts to its existing 584-megawatt production capacity. Two weeks prior, Riot Platforms indicated the largest hash rate increase in the company’s history by purchasing an additional $291 million worth of Bitcoin mining equipment.

Crypto Companies Continue to Please Investors

Even though Bitcoin has recorded a significant increase of more than 163% since the beginning of 2023, shares of Bitcoin miners have performed much better than Bitcoin itself. According to TradingView data, Marathon Digital has risen by 767% since the start of the year, while Riot Platforms has gained 452% in value.

Coinbase, the largest public crypto exchange, has gained more than 450% in value since the beginning of 2023, marking a significant momentum during this period. Despite the ongoing turmoil in the crypto sector following the collapse of FTX and numerous other bankruptcies in 2022, stocks related to the crypto industry started the year as a popular investment choice.

However, investors willing to take risks in the crypto sector have faced significant losses this year, with over $6 billion in crypto-related short positions being liquidated in the futures market so far.

Türkçe

Türkçe Español

Español