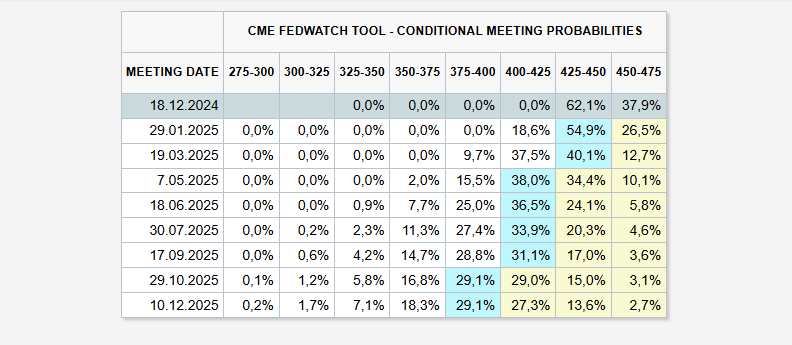

While the influence of Trump’s support remains significant, macroeconomic developments play a crucial role. For a sustained increase in the cryptocurrency markets, the Federal Reserve and other central banks need to continue their monetary easing. The Fed is expected to implement a total reduction of 100 basis points this year, but unexpected inflation could alter the current outlook.

US Inflation Data

Recent statements from Fed members indicated that a surprising rise in inflation could lead to a pause in interest rate cuts. This highlights the importance of today’s inflation data. The Fed is expected to announce a 25 basis point reduction in its December decision approximately 35 days from now.

However, for further rate cuts, a surprising increase in inflation is essential. Today’s inflation expectation was set at 2.6%, compared to the previous month’s 2.4%. The core inflation expectation remains consistent with last month’s figure of 3.3%.

The recently released inflation data aligned with expectations. Consequently, Bitcoin  $119,377‘s price is once again testing the $89,000 mark. At the time of writing, the price was above $88,600. The weak annual increase of the data, which many feared would be disappointing, has been a positive revelation. Altcoins may experience further growth in the coming hours, and Bitcoin’s price could continue to rise depending on the performance of US stocks.

$119,377‘s price is once again testing the $89,000 mark. At the time of writing, the price was above $88,600. The weak annual increase of the data, which many feared would be disappointing, has been a positive revelation. Altcoins may experience further growth in the coming hours, and Bitcoin’s price could continue to rise depending on the performance of US stocks.

Türkçe

Türkçe Español

Español