As of the time of writing, Bitcoin (BTC)  $91,967 is priced at $90,200, having surged to $92,300 before experiencing a decline. Such fluctuations offer short-term trading opportunities for altcoins, yet they excite those anticipating further price increases. What are the crypto forecasts from experts?

$91,967 is priced at $90,200, having surged to $92,300 before experiencing a decline. Such fluctuations offer short-term trading opportunities for altcoins, yet they excite those anticipating further price increases. What are the crypto forecasts from experts?

Bitcoin (BTC) Price Trends

Despite reaching a daily peak of $92,300, Bitcoin remains relatively close to its all-time high. The current market situation resembles the excitement of previous bull markets. If we begin to witness peaks above $94,000, altcoins could present substantial profit opportunities before the end of the first quarter next year.

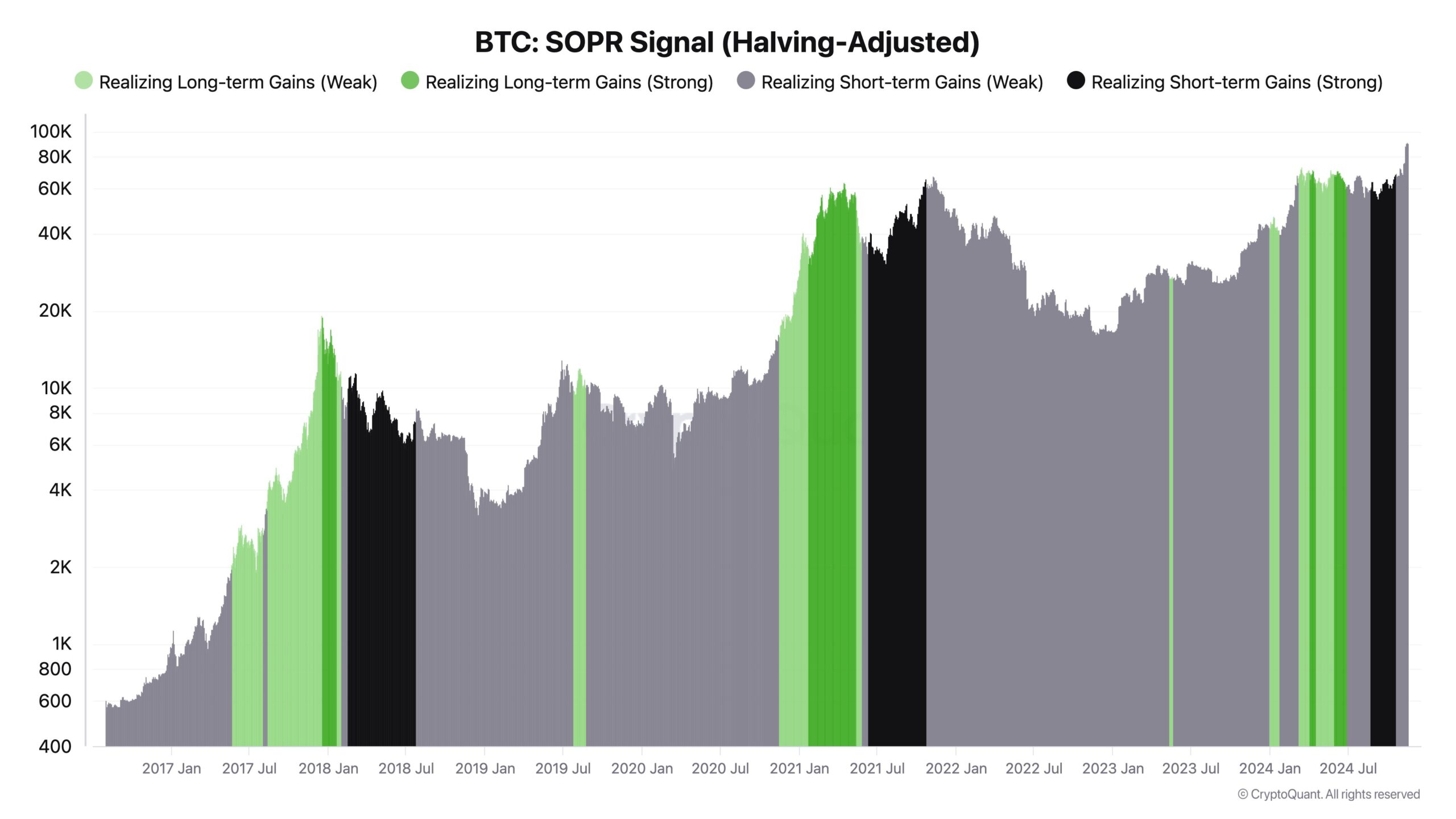

Ki Young Ju shared the above chart, stating, “Buying is technical; selling is an art. Following long-term Bitcoin investors might be the wisest move. I’ve set alerts to track significant profit moments compared to short-term investors.” He mentions the timing to consider selling as “Weak sell” and “Strong sell” for optimal selling times.

Bitcoin Chart Analysis

CryptoQuant’s CEO believes that it is not yet the right time to sell, reflecting a bullish outlook for the medium to long term. Although we might see fluctuations until Trump’s inauguration on January 20, next year is expected to be considerably optimistic for cryptocurrencies, especially with clearer regulations anticipated under Republican leadership in Congress.

Moustache recalled his market assessment shared earlier this month, noting BTC’s tendency to reach new peaks every four years. He expressed satisfaction with the price surpassing $90,000, predicting further increases.

Lastly, analyst Daan Crypto Trades mentioned that the current rise is expected due to the CME gap. He explained that Bitcoin futures tend to close gaps shortly after reopening, making it a good level to monitor at the market’s open. However, he advises not to overvalue the gaps if the price is too far away, suggesting they act like magnets when close.