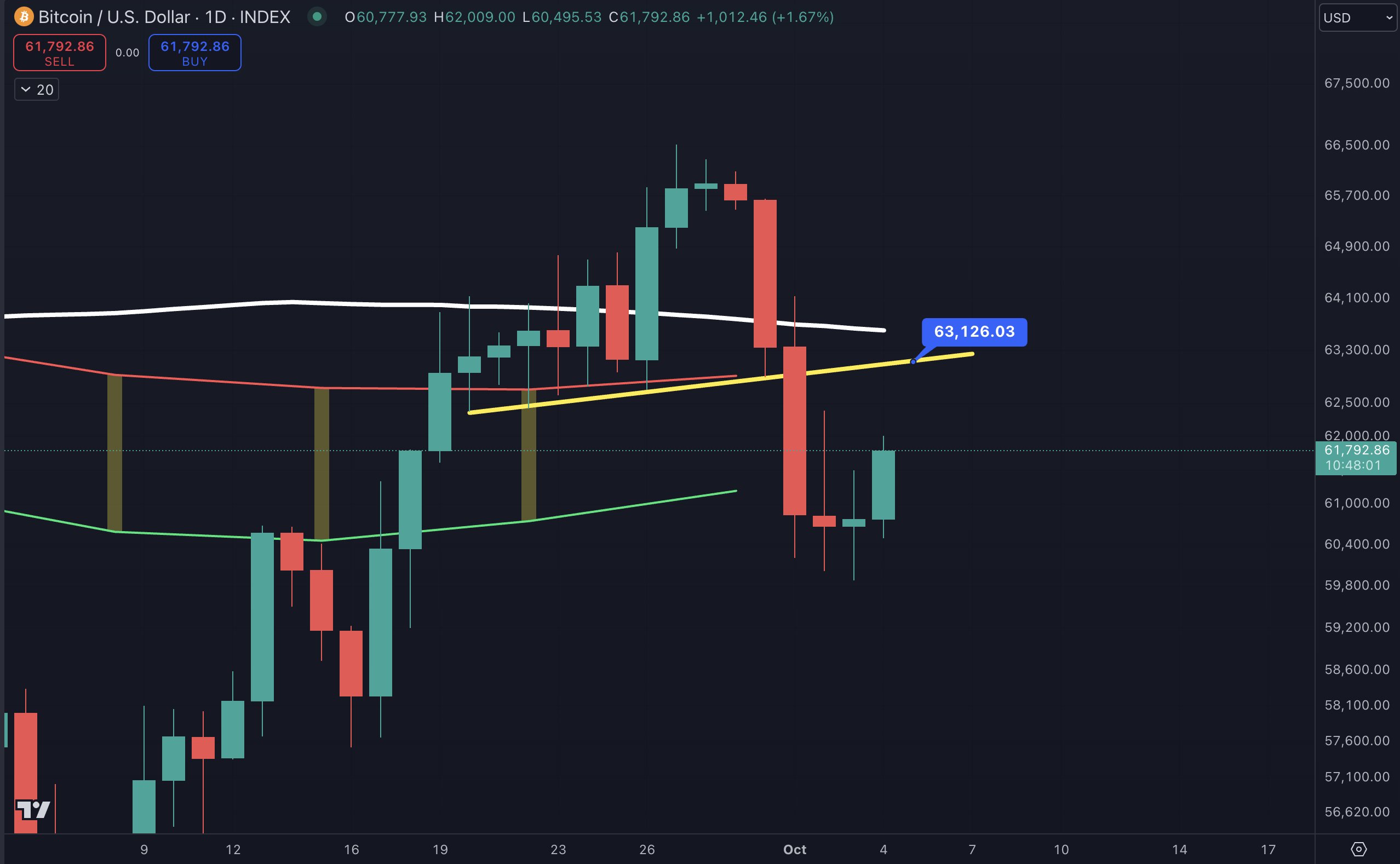

As Bitcoin (BTC)  $91,967 price hovers around $61,700 and tests $62,000 again, further developments are crucial. Recent economic data from the United States highlights significant implications, and interpreting these numbers correctly is essential. The question arises: what will the price of Chainlink

$91,967 price hovers around $61,700 and tests $62,000 again, further developments are crucial. Recent economic data from the United States highlights significant implications, and interpreting these numbers correctly is essential. The question arises: what will the price of Chainlink  $13 (LINK) be? This article reviews expert opinions to provide insights into these queries.

$13 (LINK) be? This article reviews expert opinions to provide insights into these queries.

Current State of the US Economy

Fed has started reducing interest rates, favoring risk markets following several months of monetary expansion. Although BTC is currently in a transition phase and cannot fully price this, a rise in cryptocurrencies is typically inevitable with interest rate cuts. Recent data contains signals regarding the Fed’s pace of interest rate cuts and recession concerns, warranting careful scrutiny.

The Kobeissi Letter discussed the contradictions regarding upcoming data extensively, emphasizing that the market logic has shifted. For instance, a better-than-expected employment report leads to stock buying as it suggests recovery from recession, while a worse report also triggers stock purchases due to anticipated Fed rate cuts.

In the latest employment report, the US economy added 254,000 jobs in September, exceeding expectations by 107,000. Meanwhile, the unemployment rate dropped to 4.1%, slightly below the anticipated 4.2%. This report suggests a hawkish stance, indicating the economy’s resilience, as evidenced by upward revisions in previous employment numbers.

Chainlink (LINK)

Michael Poppe highlights LINK Coin as a prominent cryptocurrency, particularly strong in the RWA sector. Its long-term outlook remains positive due to expanding institutional partnerships through CCIP. In his recent market assessment, Poppe noted that the price should consolidate above key resistance levels to ensure stability.

He identified the $9-$11 range as a favorable buying opportunity, asserting that this could yield lifetime satisfaction for investors.