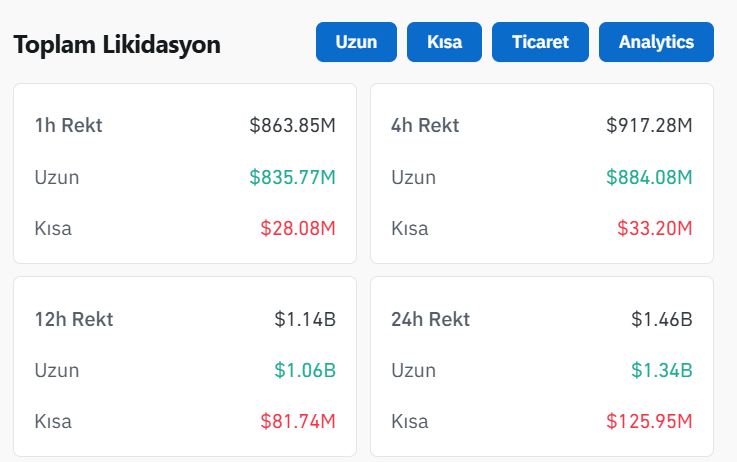

This morning, we witnessed a significant liquidity hunt as the price of BTC spiked to $94,150. The sudden drop, reported in the last minute, led to nearly $900 million worth of positions being liquidated within minutes. Previously, BTC experienced a similar spike at $90,500, but altcoins did not incur such large losses.

Cryptocurrency Drop

In the last 24 hours, $1.5 billion in long positions were liquidated across cryptocurrencies. ETH faced the largest losses, with $250 million worth of liquidations, surpassing BTC. Following a price surge over $4,000, the rapid decline to the $3,400 region, although not heavily leveraged, negatively impacted those holding long positions.

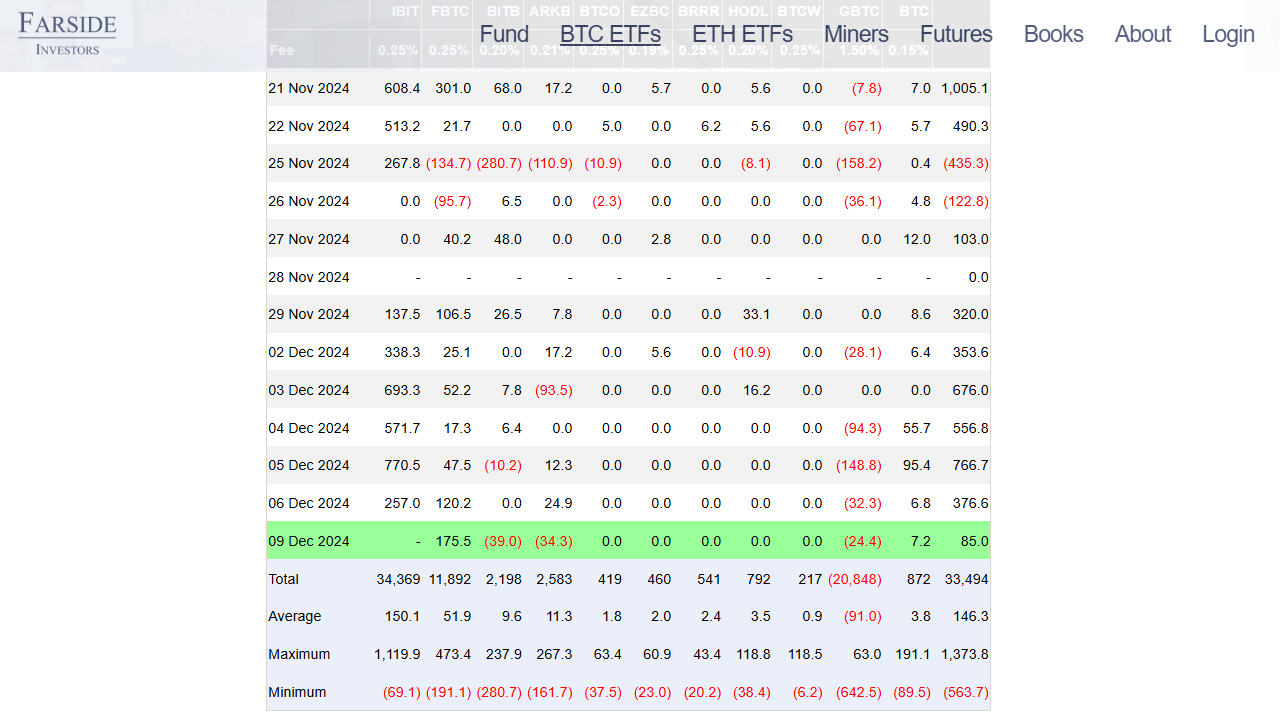

Bloomberg reported an outflow of $2 billion from IBIT ETF earlier today. However, these outflows have yet to be reflected on Farside screens. Additionally, since FBTC saw an inflow of $175 million, it appears that the total net inflow on December 9 was $85 million. Should the IBIT outflows be confirmed, it would validate the trend of rapid profit-taking among institutions.

Current Status of Altcoins

SOL, DOGE, XRP, BNB, PEPE, and ADA Coin experienced significant liquidations ranging from $59 million to $23.3 million. In the past 24 hours, POPCAT, IOTA, WIF, FLOW, BRETT, SAND, and MANA saw the largest losses, exceeding 18%. The fear and greed index fell approximately 10 points to a level of 76 after the recent drop.

According to CMC data, Bitcoin  $91,081‘s market dominance climbed to 55.6%, with volumes nearing $350 billion, representing a more than 100% increase in the last 24 hours.

$91,081‘s market dominance climbed to 55.6%, with volumes nearing $350 billion, representing a more than 100% increase in the last 24 hours.

Yesterday, Shiba Coin spiked to $0.00002424, resulting in a 25% drop on the daily chart. Although it has rebounded to $0.000026, the price returning to levels seen at the end of November has caused panic among investors.

Even during bullish market conditions, we noted that such double-digit declines are typical due to the high interest in futures trading. Following BTC’s record high above $104,000, preparations may begin for the upcoming U.S. inflation report and the Fed’s interest rate decision on December 18, leading to Trump’s inauguration in January.