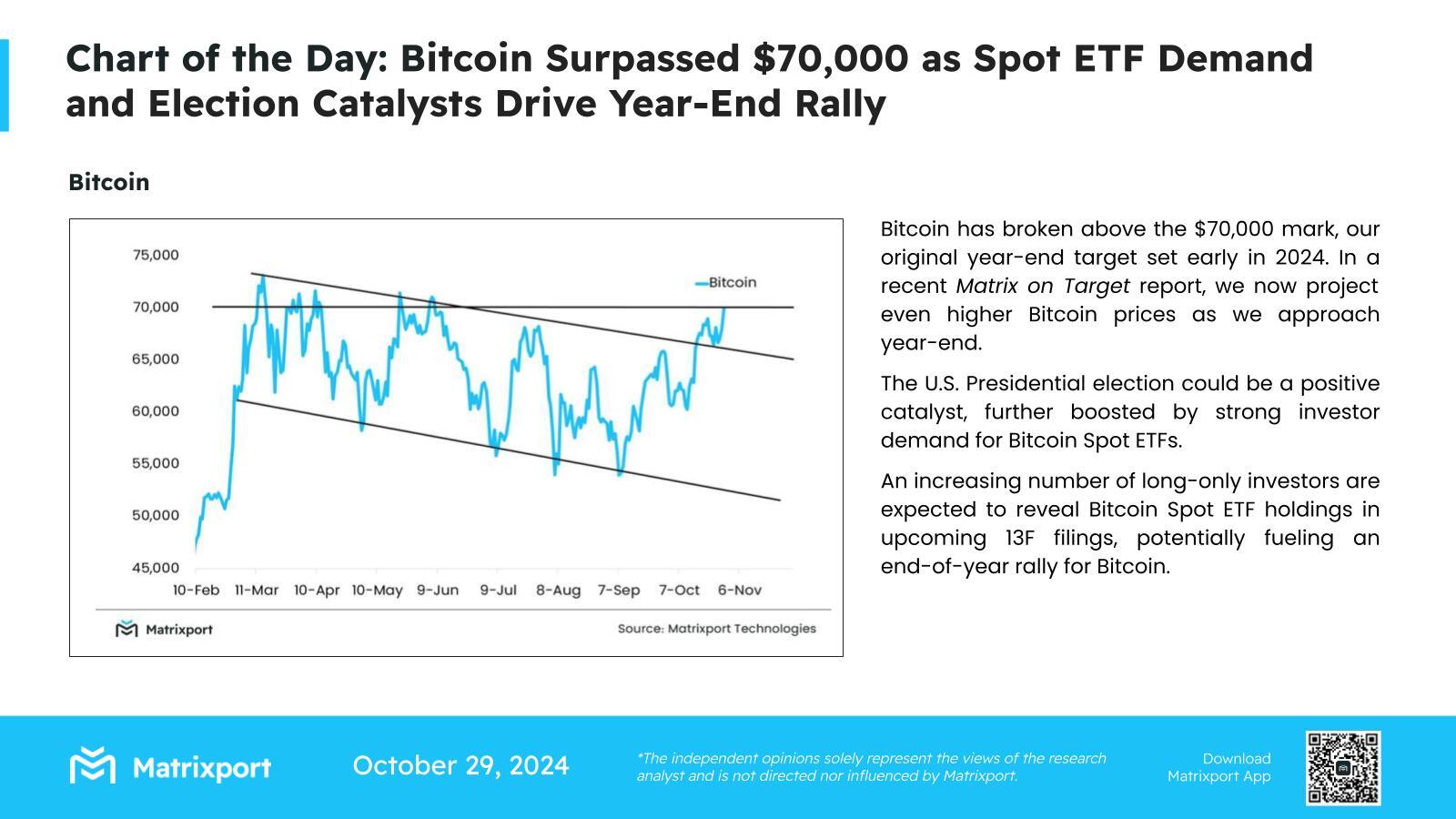

Bitcoin  $105,957 has surpassed the $70,000 target set at the beginning of the year, with new projections from Matrixport suggesting it could rise even further by year-end. Experts indicate that the upcoming presidential election in the U.S. may be a positive catalyst for the markets. This situation is likely to support further price increases, particularly driven by investor demand for spot Bitcoin ETFs.

$105,957 has surpassed the $70,000 target set at the beginning of the year, with new projections from Matrixport suggesting it could rise even further by year-end. Experts indicate that the upcoming presidential election in the U.S. may be a positive catalyst for the markets. This situation is likely to support further price increases, particularly driven by investor demand for spot Bitcoin ETFs.

U.S. Presidential Elections and ETF Demand Fuel Price Surge

According to Matrixport’s analysis, the U.S. presidential elections could provide significant momentum for Bitcoin. Election periods typically create volatility in financial markets, while investors seeking safe havens are increasingly drawn to the leading cryptocurrency. The strong demand for spot ETFs also plays a crucial role in this process.

Investors are entering the market primarily through spot Bitcoin ETFs, particularly favoring long-term positions, which supports the upward trend in the price of the leading cryptocurrency.

Institutional Investments and Rising Expectations

With the growing popularity of spot Bitcoin ETFs, many institutional investors are preparing to disclose their Bitcoin positions in their 13F filings. This development strengthens the expectation of a new rally in the cryptocurrency market by the year’s end. According to Matrixport’s report, particularly “long-only” investors focusing on long-term investments may increase demand for Bitcoin with these new disclosures, naturally fueling an upward movement in prices through the year-end.

Bitcoin’s robust performance has recently captured global market attention. Factors such as the U.S. presidential elections and rising ETF demand indicate that the king of cryptocurrencies could appreciate further by year-end.

As of the latest data, Bitcoin is trading at $70,975, having risen 3.82% in the last 24 hours. Experts believe the price could surpass the all-time high of $73,750 recorded this week.

Türkçe

Türkçe Español

Español