XRP fell over 12% on July 5, dropping to $0.381, marking a three-month low. The decline in the cryptocurrency reflects significant sell-offs in the Bitcoin market and the U.S. Securities and Exchange Commission’s (SEC) response to Ripple, mirroring negative movements elsewhere in the crypto market.

What is Happening with XRP?

XRP‘s price drop is primarily attributed to reports that the German government is liquidating hundreds of millions of dollars worth of Bitcoin seized from various crimes while still holding $2.4 billion worth of cryptocurrency in reserves.

Additionally, the now-defunct Mt. Gox exchange has begun returning the long-awaited 140,000 Bitcoins to its creditors. This development has led to speculation about how much of the $8 billion worth of Bitcoin will be sold. Smaller cryptocurrencies like XRP, Ethereum, and BNB have seen significant market value declines due to their high correlation with Bitcoin. For example, as of July 5, the daily correlation coefficient between XRP and Bitcoin was 0.94, close to a perfect score of 1. This may be because investors are liquidating altcoin positions to cover losses in the Bitcoin market.

Notable Details in the Futures Market

Today’s XRP price drop worsened due to significant long liquidations in the futures market. As of July 5, the XRP Futures market witnessed over $7 million in long position liquidations in the last 24 hours. In comparison, only $298,370 worth of short positions were liquidated during the same period.

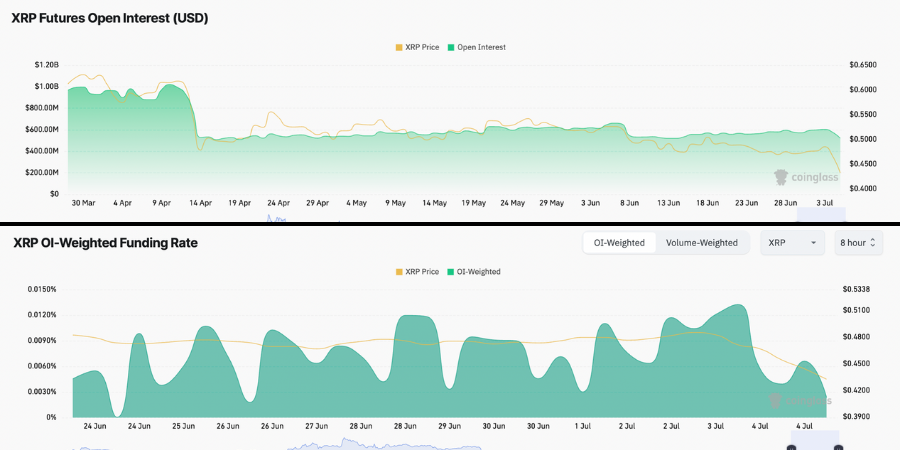

The liquidation of long positions means that bullish investors were forced to sell their positions. This sudden selling creates downward pressure on the price, accelerating the decline. Additionally, the XRP price is accompanied by a drop in open interest and funding rates.

For instance, as of July 5, the total number of outstanding XRP contracts fell from $577.74 million the previous day to $524.74 million. Meanwhile, XRP’s funding rates dropped from a weekly 0.13% to a weekly 0.05%. The decline in open positions indicates that investors are loosening their positions; the drop in funding rates shows decreased demand for long positions and increased caution among XRP investors.

Türkçe

Türkçe Español

Español