On the last trading day of October 1, 2025, in the United States, there was a substantial influx of funds totaling $675.8 million into spot Bitcoin  $91,081 ETFs. The most significant contributor was BlackRock’s iShares Bitcoin Trust (IBIT), which amassed $405.5 million in inflows. As a result, the total net inflows for IBIT reached $61.37 billion, propelling the ETF’s assets under management to $90.7 billion. This impressive growth enabled IBIT to enter the list of the “top 20 ETFs by managed assets.” On the same day, Bitcoin’s price rose by 4%, testing levels above $119,000.

$91,081 ETFs. The most significant contributor was BlackRock’s iShares Bitcoin Trust (IBIT), which amassed $405.5 million in inflows. As a result, the total net inflows for IBIT reached $61.37 billion, propelling the ETF’s assets under management to $90.7 billion. This impressive growth enabled IBIT to enter the list of the “top 20 ETFs by managed assets.” On the same day, Bitcoin’s price rose by 4%, testing levels above $119,000.

IBIT’s Historic Inflows Boost Market Ranking

According to data from Farside, spot Bitcoin ETFs in the U.S. recorded their strongest daily net inflow since September 10 on October 1. IBIT led the day with a net inflow of $405.5 million, demonstrating the continued trend of increasing access to the crypto market through regulated ETF products. This trend reflects Wall Street’s growing engagement with cryptocurrency investments.

IBIT’s asset management size surged to $90.7 billion, securing its position among the top 20 in the ETF market. Bloomberg ETF Analyst Eric Balchunas reported that since its launch in January 2024, the ETF has provided 175% returns. According to Balchunas, an additional $50 billion in assets would be needed to break into the top 10. He also noted that if the past 12 months’ growth pace continues, reaching this target is feasible. Other major ETFs are also expanding rapidly, with December 2026 as a potential milestone.

ETF Support Catalyzes 4% Bitcoin Price Surge

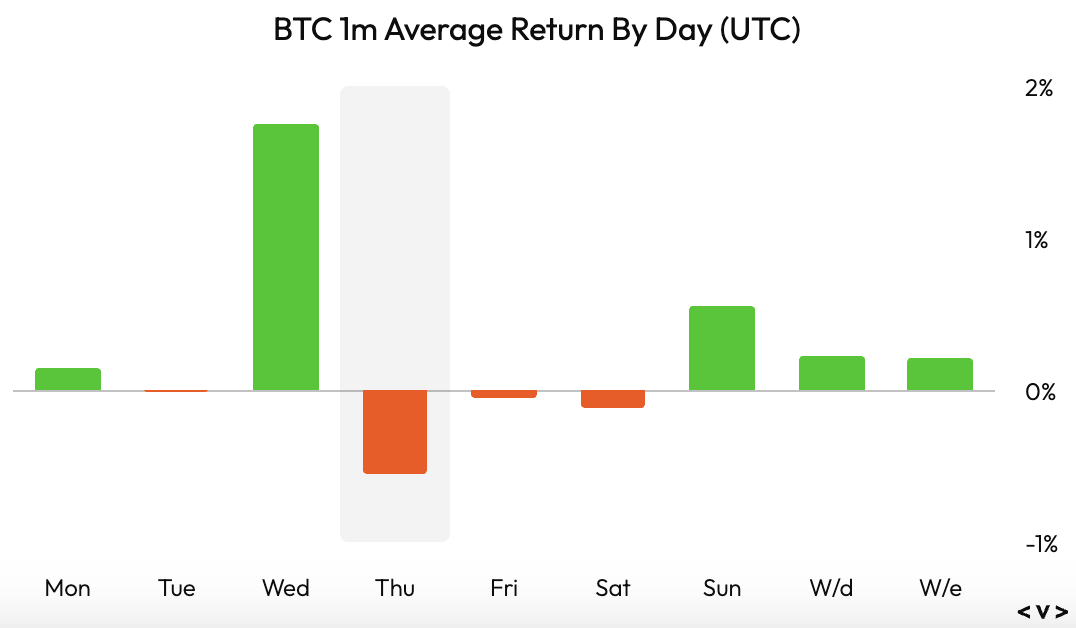

On October 1, Wednesday, Bitcoin’s price increased by 4%, briefly surpassing $119,000. The significant net inflow in the spot ETF sector bolstered risk appetite and led to Bitcoin approaching resistance levels shortly. Data provider Velo indicated that, over the past year, the strongest average performance occurred on Wednesdays, while Thursdays saw the weakest, suggesting that trading days could remain flat or negative.

Currently, the focus is on the sustainability of high-frequency inflows and IBIT’s pace in increasing its market share. As IBIT approaches the list of the top 10 ETFs by managed assets, it could serve as a reference point for institutional portfolios considering Bitcoin allocation. Additionally, the growth trend in competing ETFs could act as a secondary catalyst, enhancing competition and liquidity depth across the market.