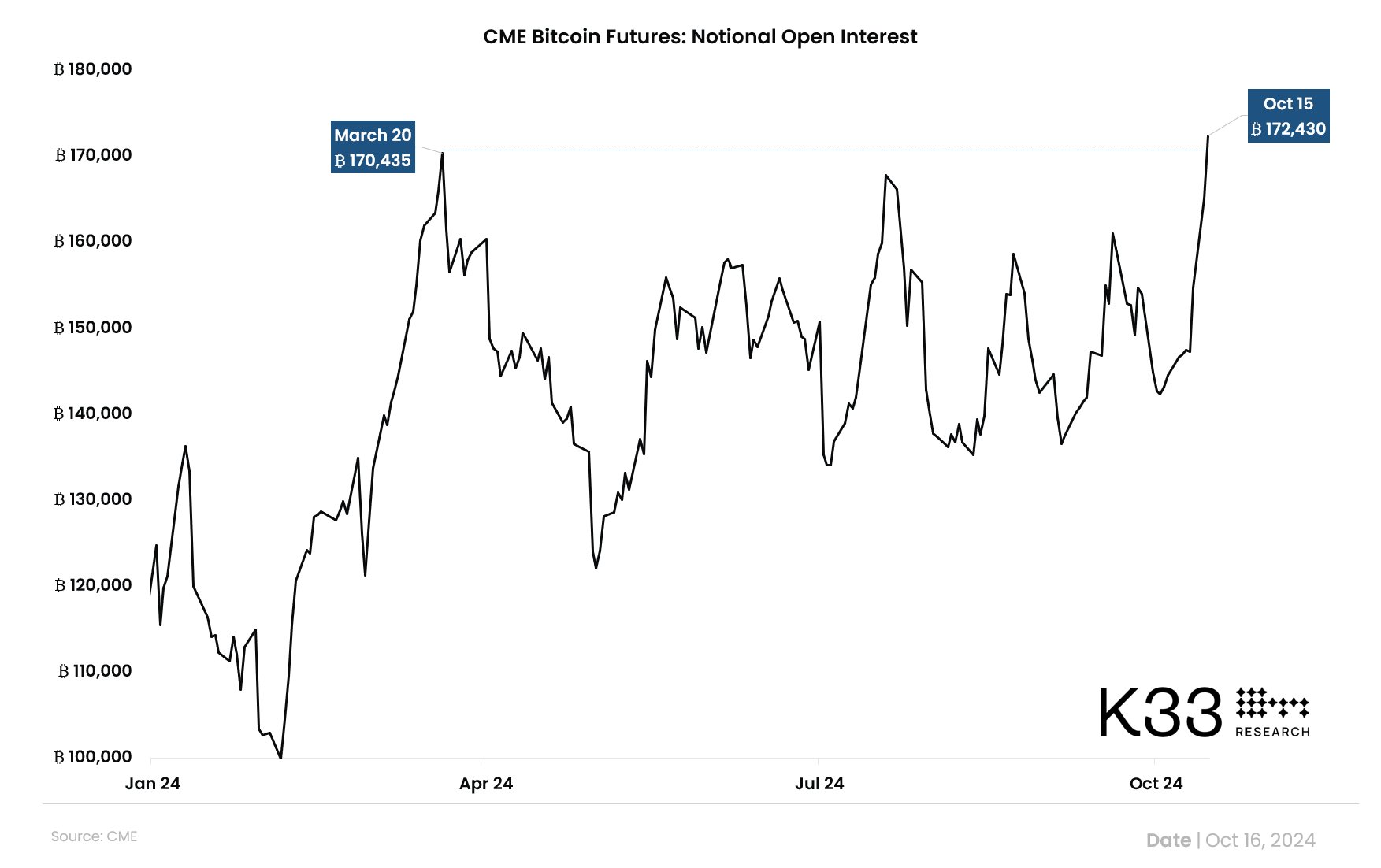

According to Vetle Lunde, a senior researcher at K33 Research, Bitcoin  $108,032 futures traded on the Chicago Mercantile Exchange (CME) reached an all-time high of 172,430 BTC in open interest as of October 15. This significant increase in open interest indicates considerable activity in the futures market, particularly as institutional participants continue to take long positions. The growth in open interest has led to futures premiums hitting their highest levels in the past five months.

$108,032 futures traded on the Chicago Mercantile Exchange (CME) reached an all-time high of 172,430 BTC in open interest as of October 15. This significant increase in open interest indicates considerable activity in the futures market, particularly as institutional participants continue to take long positions. The growth in open interest has led to futures premiums hitting their highest levels in the past five months.

Institutional Participants Take Action

The observed increase in CME Bitcoin futures is attributed to the active participation of market players. Lunde emphasized that this rise is not due to inflows into futures-based ETFs but directly from trading activities of market participants. Notably, there was an increase of 19,120 BTC in open interest over the last three trading days, marking the largest three-day growth since June 2023.

This development is emerging as one of the most significant movements in Bitcoin futures recently. Traders focusing on November futures are demonstrating their expectations for a price increase in Bitcoin by taking long positions in the market.

Futures Premiums Also Rise

Additionally, the rise in futures premiums alongside open interest is noteworthy. The premium for Bitcoin futures traded on the CME has reached its highest level in the last five months, reinforcing positive investor sentiment towards Bitcoin.

Market participants believe Bitcoin will reach higher price levels in the future and are consequently expanding their positions. The ongoing developments in the Bitcoin futures market illustrate the increasing impact of institutional investors on the market.

Türkçe

Türkçe Español

Español