Cryptocurrency enthusiasts paid little attention to U.S. economic data until the interest rate signals around the end of 2021. However, as markets grew, their sensitivity to macroeconomic developments increased significantly. Consequently, while Bitcoin (BTC)  $91,081 faced declines due to the ISM PMI report, the promising ADP Employment Change data suggested potential, followed by rapid drops in altcoins after the Non-Farm Payroll figures.

$91,081 faced declines due to the ISM PMI report, the promising ADP Employment Change data suggested potential, followed by rapid drops in altcoins after the Non-Farm Payroll figures.

The Fed Pivot is Officially Over

The Kobeissi Letter commented on the recent data, noting that for a long time, financial data sources hinted at the Fed possibly slowing down. By November, these claims began to appear logical, and by the December meeting, they seemed validated. Now, the consensus is that the Fed pivot is officially over.

The U.S. Federal Reserve’s shift in policy, characterized by earlier rate cuts, has now turned into a tightening phase. After one of the fastest series of interest rate hikes in history, the Fed began to cut rates, but it now appears to be hitting a wall. This situation remains negative for cryptocurrencies, despite an increase in BTC strength even as DXY numbers have risen by 10%.

What’s Happening? What Are the Expectations?

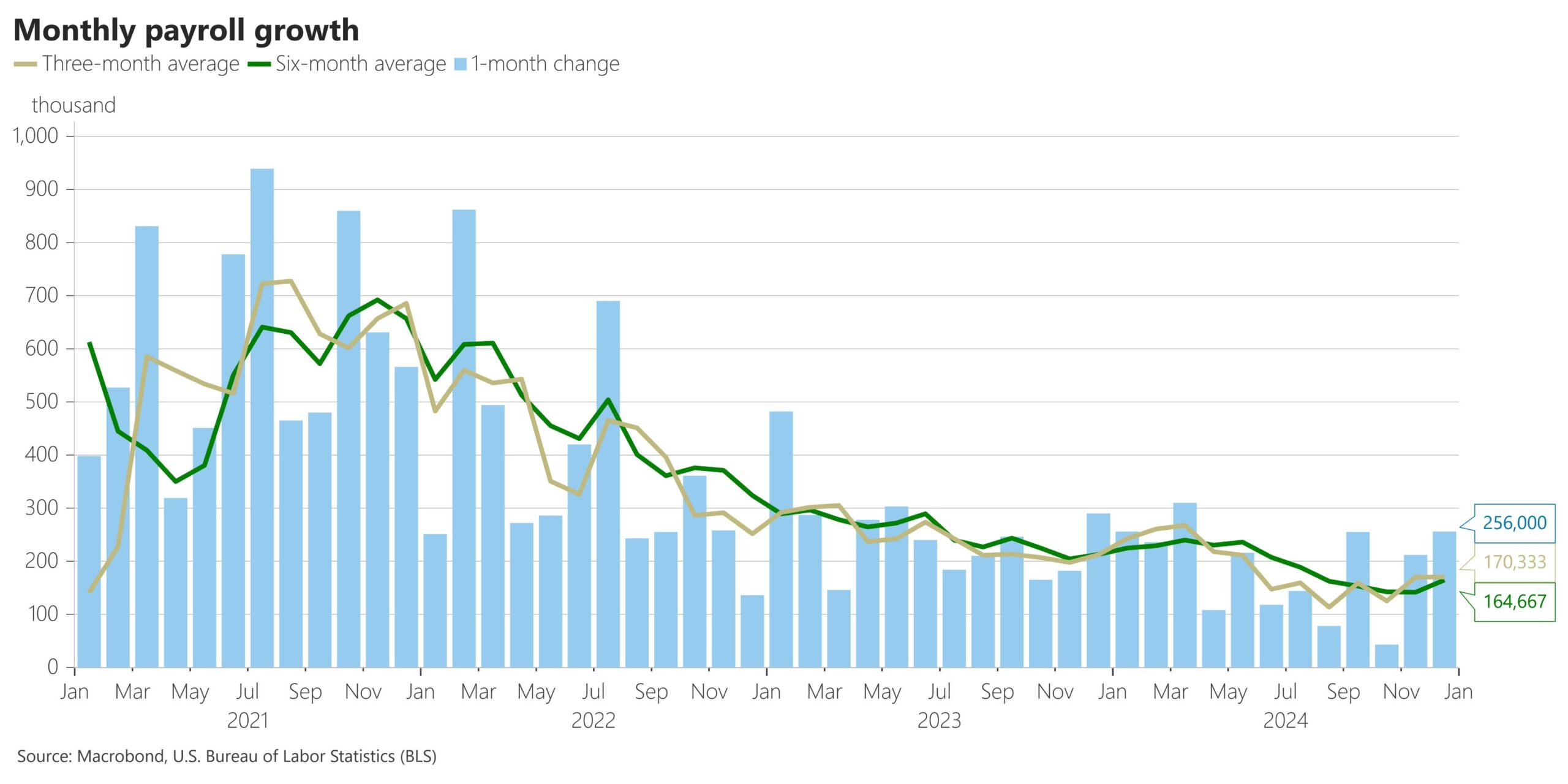

The recent employment data prompted The Kobeissi Letter to analyze the situation further. The employment numbers from the previous month exceeded expectations by approximately 92,000, with an average of 165,000 jobs created over the last six months. This signals the highest six-month average since the postponement of Fed rate cuts in July 2024.

“Despite being STRONGER than expected, stock markets plummeted after the employment report. This initially seemed illogical.”

The recent employment figures led to a ten-basis point rise in the 10-year bond yield, marking a 120-point increase since the inception of the Fed pivot. Powell described this scenario as one likely to be “short-lived.”

“Since the Fed’s 50-basis point rate cut, consumer inflation expectations have surged to their highest since 1980!”

In summary, the experts declare that the Fed pivot is dead. The year 2025 is expected to be extremely active, and if next week’s inflation data falls short of expectations, it could trigger an exciting surge in the cryptocurrency market.