The cryptocurrency market did not experience the anticipated revival during the month. Adam, a researcher from Greeks.live, noted on social media that the upcoming U.S. Presidential elections and expected interest rate cuts did not create the expected impact on the cryptocurrency market. As a result, the anticipated market activity did not materialize, and price increases observed by traders did not occur.

Bitcoin’s Market Dominance Rises Again

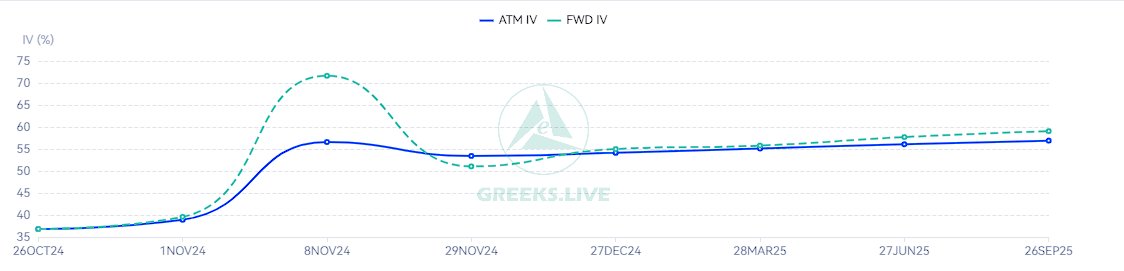

During the election week, market volatility (IV) remained around 55%. However, options from previous periods were affected by the moving and renewal processes, leading to a noticeable drop in IV. There has been a significant increase in high-volume options trading, which now constitutes 40% of the market’s trading volume. This indicates that large investors hold more sway and influence overall investor trends.

Bitcoin’s dominance in the options market has returned to 2021 levels. This rise is directly related to the weakening of Ethereum (ETH)  $4,206. Currently, market indicators are almost exclusively based on Bitcoin

$4,206. Currently, market indicators are almost exclusively based on Bitcoin  $117,252 data, as Ethereum’s poor performance during this period has redirected investors toward Bitcoin. Consequently, BTC’s impact on the market has increased.

$117,252 data, as Ethereum’s poor performance during this period has redirected investors toward Bitcoin. Consequently, BTC’s impact on the market has increased.

In recent weeks, large investors have particularly shifted their focus to BTC. As ETH loses its former strong position, BTC emerges as a more reliable option for investors. This preference among investors is altering market dynamics. Coupled with the general stagnation in October, this trend might herald a new phase for the cryptocurrency market.

U.S. Presidential Elections and Interest Rate Cuts Fail to Deliver Expected Results

There was a widespread expectation that the U.S. Presidential elections and interest rate cuts would positively affect the cryptocurrency market. However, these expectations have not yet materialized. Markets continue to adopt a cautious approach in light of economic uncertainties and political developments. Investors are closely monitoring election results and global economic policies, but substantial capital flow has not occurred during this process.

Thus far, the market movements in October have fallen short of expectations. Developments such as the elections and interest rate cuts have not led to a notable rise in the cryptocurrency market. The majority of investors continue to adopt a cautious strategy, keeping BTC at the center of their focus.

Türkçe

Türkçe Español

Español