Participants in the cryptocurrency market are eagerly anticipating the start of an altcoin season. However, short-term volatility is not on the horizon. Ethereum’s lackluster performance, coupled with investors’ tendency to seek refuge in stablecoins, is hindering altcoin recovery. The decline of the Altcoin Season Index to 45 has further postponed expectations. According to prominent market analysis, Bitcoin  $104,465 dominance needs to exceed 70% for the market to gain new momentum.

$104,465 dominance needs to exceed 70% for the market to gain new momentum.

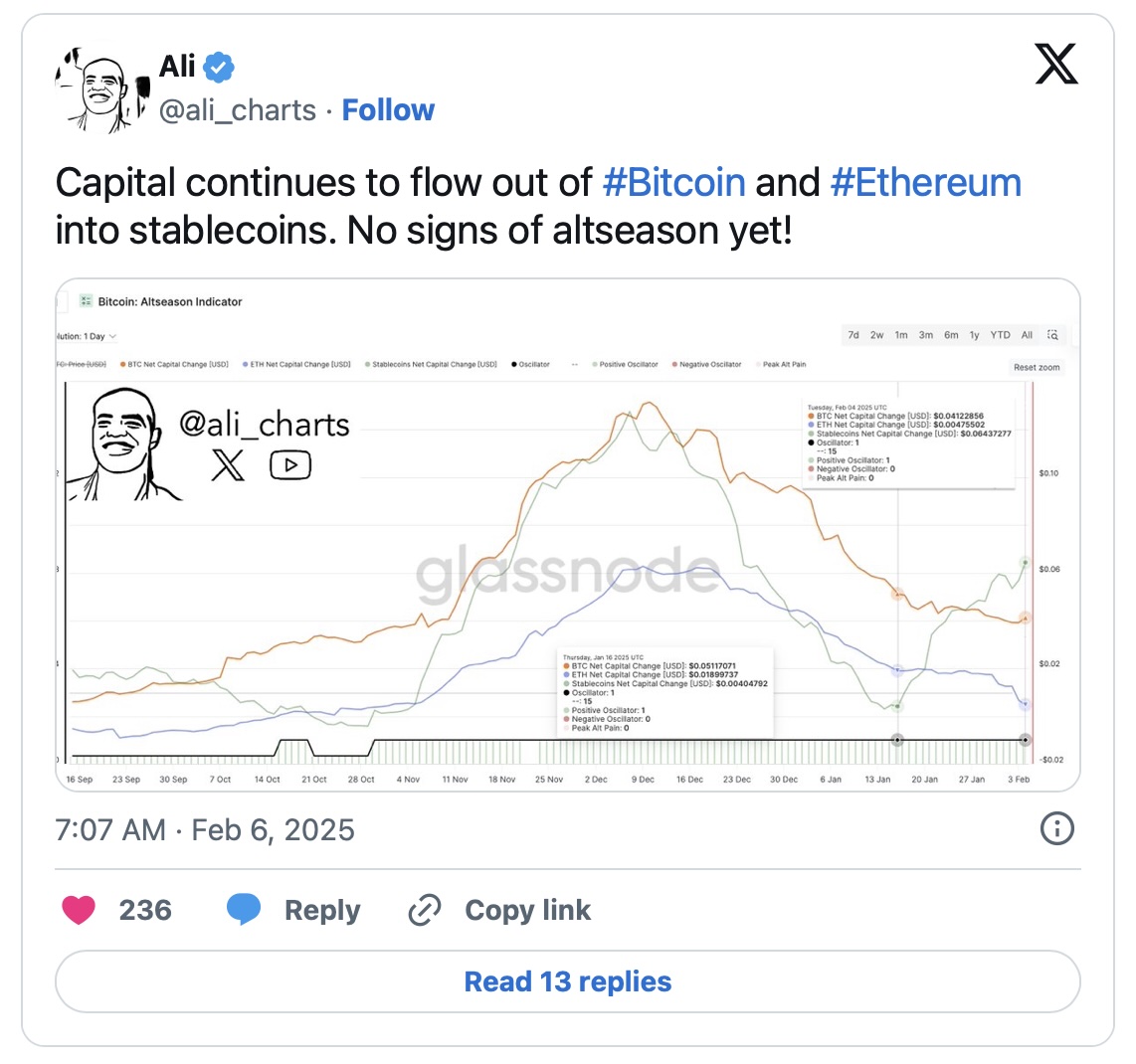

Capital Shifts Toward Stablecoins

Recently, investors have favored stablecoins over altcoins. Analyst Ali Martinez attributes this trend to market uncertainty, resulting in capital flowing from Bitcoin and Ethereum  $2,514 to stablecoins. This shift highlights a clear aversion to riskier investments. The total market capitalization of stablecoins, such as Tether (USDT) and USD Coin (USDC), has recently reached record levels.

$2,514 to stablecoins. This shift highlights a clear aversion to riskier investments. The total market capitalization of stablecoins, such as Tether (USDT) and USD Coin (USDC), has recently reached record levels.

Tether’s $113 billion investment in U.S. Treasury bonds enhances the influence of stablecoins in the financial system. The surge in stablecoin issuance following Donald Trump’s electoral victory has also drawn attention. Experts suggest this liquidity could eventually return to the cryptocurrency market, but currently, investors continue their search for safe havens.

Ethereum’s Underwhelming Performance

Historically, Ethereum has triggered altcoin seasons, but it currently fails to meet expectations. In past bull markets, ETH led trends in DeFi and NFTs, but it is now facing pressure. Limited price movement is redirecting investor interest toward other Layer 1 projects.

Crypto analyst Picolas Cage emphasizes that for altcoins to recover, Ethereum must reclaim leadership. The inability of ETH to initiate a new trend negatively impacts the altcoin market. Additionally, global developments, such as Trump’s imposition of extra tariffs on China, have triggered sell-offs in the cryptocurrency space.

It is important to note that the total market capitalization of altcoins has decreased from $1.46 trillion to $1 trillion since early February.

Türkçe

Türkçe Español

Español