The market turmoil on Monday, now known as “Black Monday,” felt like a nightmare for many investors. After the severe sell-off, global markets and the cryptocurrency market have largely recovered. What happens next remains uncertain, especially for Bitcoin (BTC) and altcoins.

Continued Selling Pressure Expected

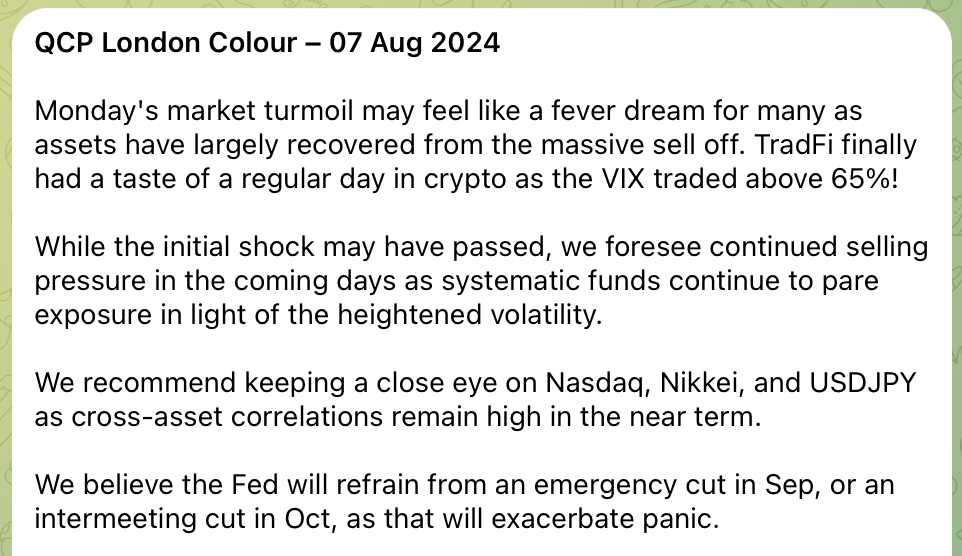

QCP Capital analysts noted in their latest market commentary and analysis that traditional finance (TradFi) finally experienced an ordinary crypto day with the VIX trading above 65%. The Singapore-based cryptocurrency trading firm emphasized that the events once again demonstrated how highly volatile the markets can be.

Analysts expect the selling pressure to continue in the coming days, even though the initial shock wave has passed. This pressure will persist as systematic funds continue to reduce their positions in light of increasing volatility. QCP Capital noted that it is essential to consider that indices like Nasdaq, Nikkei, and cross-asset correlations like USD/JPY will show high volatility in the near future.

Analysts added that the events and movements on this front could provide significant insights into the market health of global markets and the cryptocurrency market.

Fed Unlikely to Intervene Urgently

On the other hand, QCP Capital analysts believe that the U.S. Federal Reserve (Fed) will not make an emergency rate cut in September or an out-of-meeting cut in October. It was noted that such a move is believed to increase panic in the markets further.

As is well known, central banks’ monetary policy decisions are critically important to balance market volatility. Therefore, analysts believe that the Fed needs to maintain its composure to instill confidence in the markets and avoid triggering a larger wave of panic.

Türkçe

Türkçe Español

Español