Bitcoin  $105,377‘s price is currently stagnant at $82,000, with significant losses exceeding 5% for many altcoins. The uncertainty has escalated as Trump has affected the global economy with heavier tariffs than expected. As the desire to avoid risk grows stronger, recent data presents a troubling picture. Let’s take a closer look at the current state of markets and cryptocurrencies.

$105,377‘s price is currently stagnant at $82,000, with significant losses exceeding 5% for many altcoins. The uncertainty has escalated as Trump has affected the global economy with heavier tariffs than expected. As the desire to avoid risk grows stronger, recent data presents a troubling picture. Let’s take a closer look at the current state of markets and cryptocurrencies.

U.S. Markets

The S&P 500 wiped out $1.7 trillion in market value at the opening. Specifically, the losses faced by major global companies such as Apple and Microsoft are detailed below. The potential for the EU and others to impose priority sanctions on technology firms has raised concerns about an economic contraction, causing seven major companies to suffer significant blows.

It was already anticipated that the opening would be disheartening, and after the tariffs, some major companies experienced losses of up to 7% in futures trading. The Russell 2000 index fell by 4.5%, heading towards a bear market, while the U.S. S&P Services PMI Report was released, containing critical warnings.

“Concerns regarding the impact of federal government policies, especially tariffs, have caused confidence in the outlook to fall to its second-lowest level since late 2022.” – U.S. S&P Services PMI Report

- U.S. ISM Services PMI Reported: 50.8 (Forecast 52.9, Previous 53.5)

Although the services PMI data was reported substantially lower, there was no significant loss in labor data. Tomorrow’s employment figures are crucial. At 19:30 and 21:30, Fed officials Jefferson and Cook will make statements. Trump will respond to reporters’ questions at 23:55 and make announcements at 02:30 on April 4.

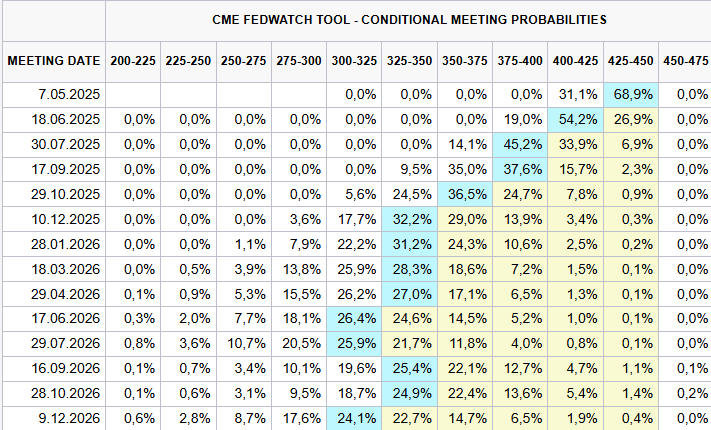

According to FedWatch, investors expect a 75% chance of a rate cut in June. Expectations have strengthened for four rate cuts totaling 100 basis points this year.

Cryptocurrency Markets

According to Coinglass data, $557 million was liquidated in the last 24 hours. Of this amount, $347 million was from long positions. As volumes significantly weakened, the half-billion-dollar liquidation is considerable. Risk-averse traders closed their positions, and the total size of open positions fell to $98.7 billion, down 4%.

Cryptocurrency fear index dropped to 25, while the general index fell to 11. Among the top 100 cryptocurrencies, HYPE, PI, ENA, TRUMP, BERA, BONK, and JTO experienced losses between 12.5% and 17%. JUP saw the largest weekly drop at 33%. DEXE and EOS have remained among the few altcoins with positive trends, with EOS maintaining a weekly gain of 45% while DEXE fell 15% weekly.

Türkçe

Türkçe Español

Español