Cryptocurrency enthusiasts have seen significant price increases in Bitcoin, which in turn has affected altcoins. However, the market faced uncertainty when the Polygon Foundation transferred MATIC to Binance. Now, there is speculation about a potential resurgence for MATIC. Let’s delve into the details.

MATIC Gears Up for a Resurgence

In recent days, the cryptocurrency Bitcoin dropped to $48,300 following the release of US CPI data. However, a swift recovery ensued, pushing the price up to $52,060. This uptrend positively influenced Ethereum and other leading altcoins.

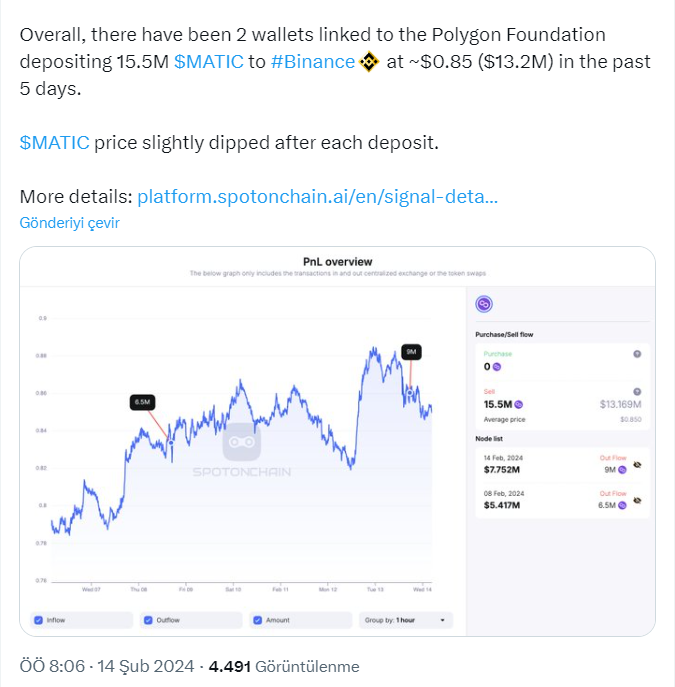

Before the latest Bitcoin rally, MATIC experienced a decline from $0.8856 in February 2024 to $0.8432, due to market sensitivity to US inflation data and sales by the Polygon Foundation. According to the crypto analysis platform Spot On Chain, two wallets associated with the Polygon Foundation sent a total of 15.5 million MATIC, worth $13.2 million, to Binance in the last five days. These transactions coincided with a drop in the price of the cryptocurrency MATIC.

Following Bitcoin’s recent rally, MATIC quickly recovered from selling pressure and began trading close to its February 2024 high of $0.8890. This shift has sparked a new wave of price movement for MATIC. Now, whether the cryptocurrency will reach the psychological level of $0.9 is a subject of speculation.

Is MATIC Undervalued?

Unlike most major crypto assets, the altcoin MATIC did not achieve significant gains last year. For instance, while some cryptocurrencies created new annual highs in February alongside Bitcoin, MATIC has declined by 8.4% since the beginning of the year, despite predictions of a price surge in 2024, due to its range-bound price action.

MATIC’s lackluster price performance emerges despite several technological achievements by Polygon Labs as the Polygon network progresses towards a multi-chain future. In the latest development, the team launched a Type 1 zkEVM prover that allows any EVM Layer-1 chain to become a ZK Layer-2 without a full transition or significant changes.