Today, we felt the selling pressure on the cryptocurrency markets created by a report published by Matrixport. BTC dropped to $40,750, and altcoins experienced double-digit losses. The increased risk appetite, swelling open interest, and inflated prices indicated that such a correction could happen. However, such a large drop was a surprise for everyone.

Explanation for Bitcoin’s Decline

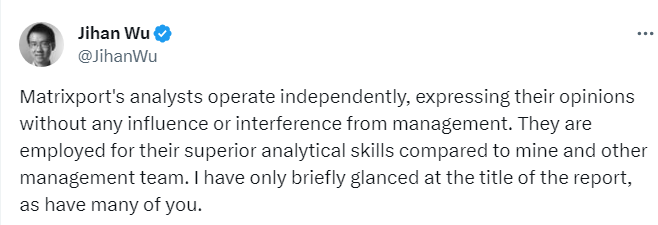

Jihan Wu, the founding partner of the company Matrixport that caused the decline, has something to say about the recent fluctuations. Wu recently stated on his social media account:

“Matrixport’s analysts work independently and express their views without any influence or intervention from the management. They are employed for their superior analytical skills compared to me and the rest of the management team. Like many of you, I only briefly glanced at the title of the report.

Markus, a talented analyst, wrote a study last year detailing the price history of cryptocurrencies titled ‘Crypto Titans.’ Markus’s work sometimes recounts events more vividly than my own memories, even when I have suffered financial losses.

Matrixport was among the few institutions/individuals that correctly predicted Bitcoin‘s bottom at the beginning of 2023 and displayed an extremely bullish stance.

As intended, this latest report was prepared for Matrixport’s clients. However, its widespread dissemination by the media was not planned by Matrixport and is beyond our control.

As far as I know, Matrixport consistently advises our clients to be cautious about risks and leverage, especially considering the market fluctuations caused by expectations related to Exchange-Traded Funds (ETFs). This fluctuation is clearly seen in the high funding fees in the market and the recent decline in crypto-related stocks on the exchange in the last two trading days before today.

Looking at Bitcoin’s past and future expectations, the current fluctuation and the potential approval uncertainty of a Bitcoin ETF in January 2024 ultimately have no significance. In the long run, Bitcoin will always come out on top. In my opinion, the approval of a Spot ETF that will attract new investment to Bitcoin by the SEC is inevitable. Bitcoin is preparing to solidify its position as a store of value and a better hedge against risk than gold.”

Current Bitcoin Situation

Bitcoin’s price does not seem to take into account the statements made by Wu. Amidst news that the SEC will have a meeting with exchanges today, BTC failed to hold $43,000. The fear of a decline among investors is currently dominant.

However, the good news is that open interest has retreated to the figures from the days when BTC’s levels were much lower. Therefore, in an environment where demand is rapidly increasing again, for example with an ETF approval, it can be expected that BTC’s price will rise much faster with support from the futures side.

Türkçe

Türkçe Español

Español