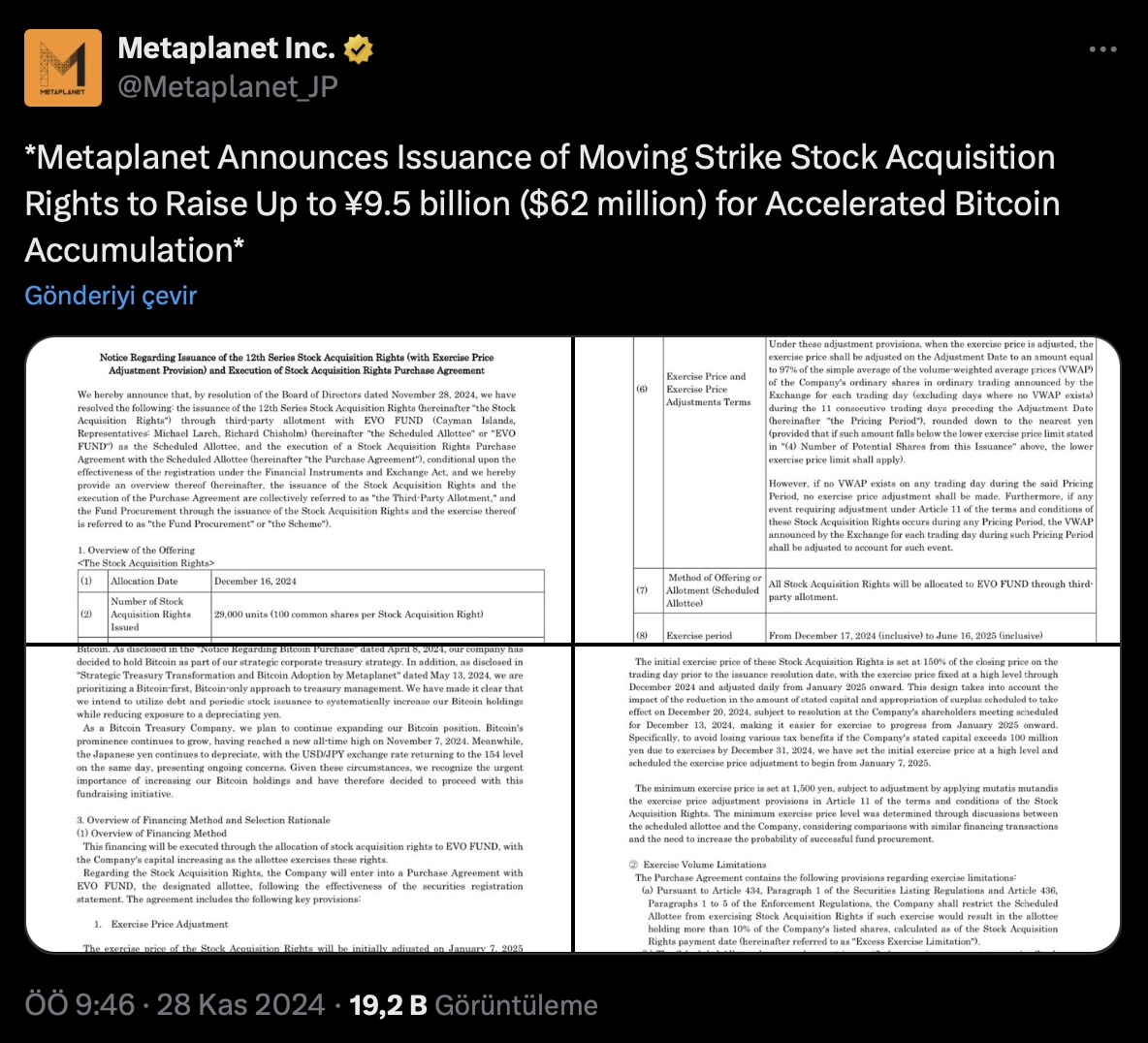

The publicly traded Japanese company Metaplanet aims to boost its cryptocurrency investments through a new initiative. The company announced its plan to raise 9.5 billion Japanese yen (approximately 62 million dollars) via new stock purchase rights to accelerate its Bitcoin (BTC)  $105,181 accumulation. This move showcases the company’s commitment to reinforcing its cryptocurrency investment strategy and focusing on the market leader, Bitcoin.

$105,181 accumulation. This move showcases the company’s commitment to reinforcing its cryptocurrency investment strategy and focusing on the market leader, Bitcoin.

Strategically Aiming to Increase Bitcoin Holdings

Metaplanet’s financing plan aims to generate resources by offering existing shareholders new stock purchase rights. The official announcement from the Japanese company stated that this initiative is part of its strategy to enhance Bitcoin accumulation. The new stock purchase rights provide existing shareholders with a preferential opportunity to buy new shares, aligning with the company’s goal to strengthen its asset base and build a more resilient portfolio against market fluctuations.

The company’s strategy underscores Bitcoin’s central role in the cryptocurrency market. Metaplanet also highlighted its confidence in Bitcoin’s long-term value preservation potential as a key reason for this strategic move. The management emphasized that this decision aims to add value to its shareholders and secure the company’s financial future.

Impact of the Financing Plan on the Cryptocurrency Market

Metaplanet’s initiative to increase Bitcoin holdings is being closely monitored within the cryptocurrency market. This move could potentially guide other publicly traded companies towards similar strategies. The company’s announcement indicates an increasing acceptance of cryptocurrencies in tightly regulated markets like Japan.

Metaplanet’s initiative also provides important insights into the future direction of the market. As Bitcoin’s value and popularity continue to rise, such actions may contribute to increased institutional adoption. The company’s strategy is expected to resonate widely in the financial world as a notable move.

Türkçe

Türkçe Español

Español