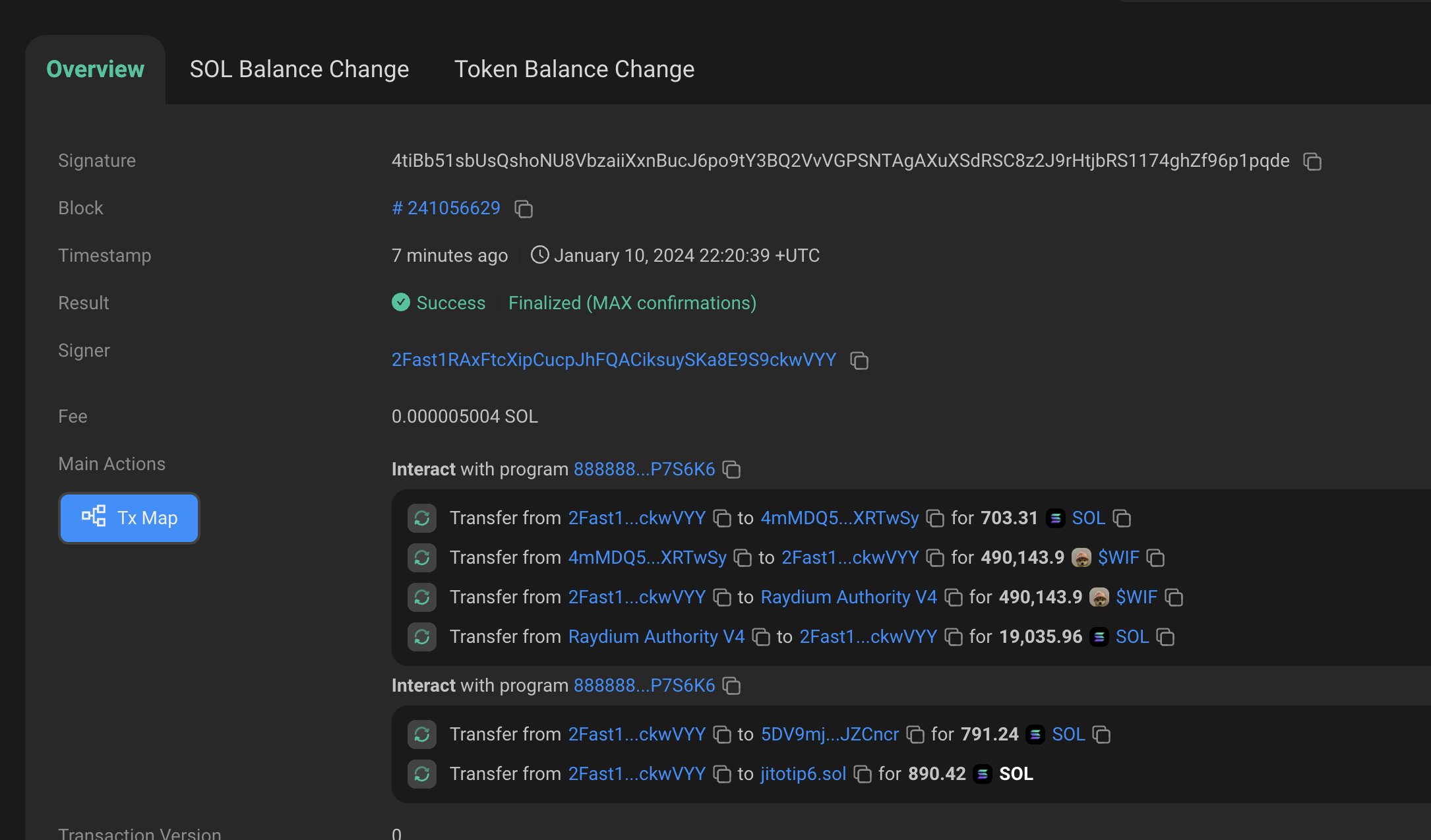

A MEV arbitrage bot managed to earn a profit of 1.8 million dollars from a single transaction package on the Solana network. The bot, managed by 2Fast, converted 70,000 dollars worth of 703 SOL into 1.9 million dollars worth of 19,035 SOL in 20 seconds. A portion of the profit, 890 SOL, was given as a tip to a network validator, Figment.

Intriguing Details About Arbitrage

The profit made by the bot was achieved through a MEV strategy targeting trading transactions of the memecoin project dogwifhat (WIF) on January 10th. With the transactions in question, 2Fast secured significant gains.

MEV was captured through an execution tool developed by Jito Labs, which allows users to find MEV and bid to add transaction packages to Solana, similar to Ethereum’s Flashbots.

An investor who suffered a serious loss due to carelessness spent nearly 9 million dollars by mistake in a low liquidity pool to acquire dogwifhat (WIF), leading to the purchase of the memecoin at 3 dollars per unit; a figure several times higher than the market rate of 0.2 dollars at the time.

What is Back-running?

This situation created a back-running opportunity for MEV bots that quickly took action to capitalize on it. Back-running is a type of MEV strategy that involves profiting from temporary price movements caused by another transaction.

Back-running bots continuously monitor the mempool, a holding area for unconfirmed transactions in the blockchain ecosystem. These bots search for target transactions and prepare their own transactions to follow. 2Fast alone earned approximately 1.8 million dollars, but according to blockchain data, other bots also took a share of the pie.

MEV became possible on Solana following the development of Jito Block Engine by Jito Labs, an off-chain block space auction system where investors can submit transaction packages along with a bid to be included in the blockchain network. This mechanism aims to increase the reliability of transaction execution on the Solana network.

Türkçe

Türkçe Español

Español