In a claim made on June 9, Michaël van de Poppe argued that Bitcoin (BTC) needs to break the $26,800 barrier to maintain its latest surge. Poppe believes that if the leading cryptocurrency manages to convert this price point into $27,500, other interconnected assets like Litecoin (LTC) and Ripple (XRP) may also explode.

BTC Faced a Resistance Level!

According to a chart shared by the CEO of MN Trading, BTC encountered a significant resistance at $27,446 on June 9. Regrettably, the leading cryptocurrency lost its $26,000 mark and, at the time of writing, it is trading at $25,698.

However, along with BTC, XPR, and LTC also lost 6.48% and 12.76% in value, respectively, in the last 24 hours. Despite the widespread decline in the market, the three cryptocurrencies showed strength during a period when the SEC scrutinized the world’s two largest exchanges.

The predictions of LTC reaching $100 or XRP rising to $0.6 have been suppressed due to price movement. Recently, XRP experienced a rally due to high expectations of winning its SEC case. For Litecoin, its planned halving in August caused a rise. As the surge declines, how will these cryptocurrencies progress?

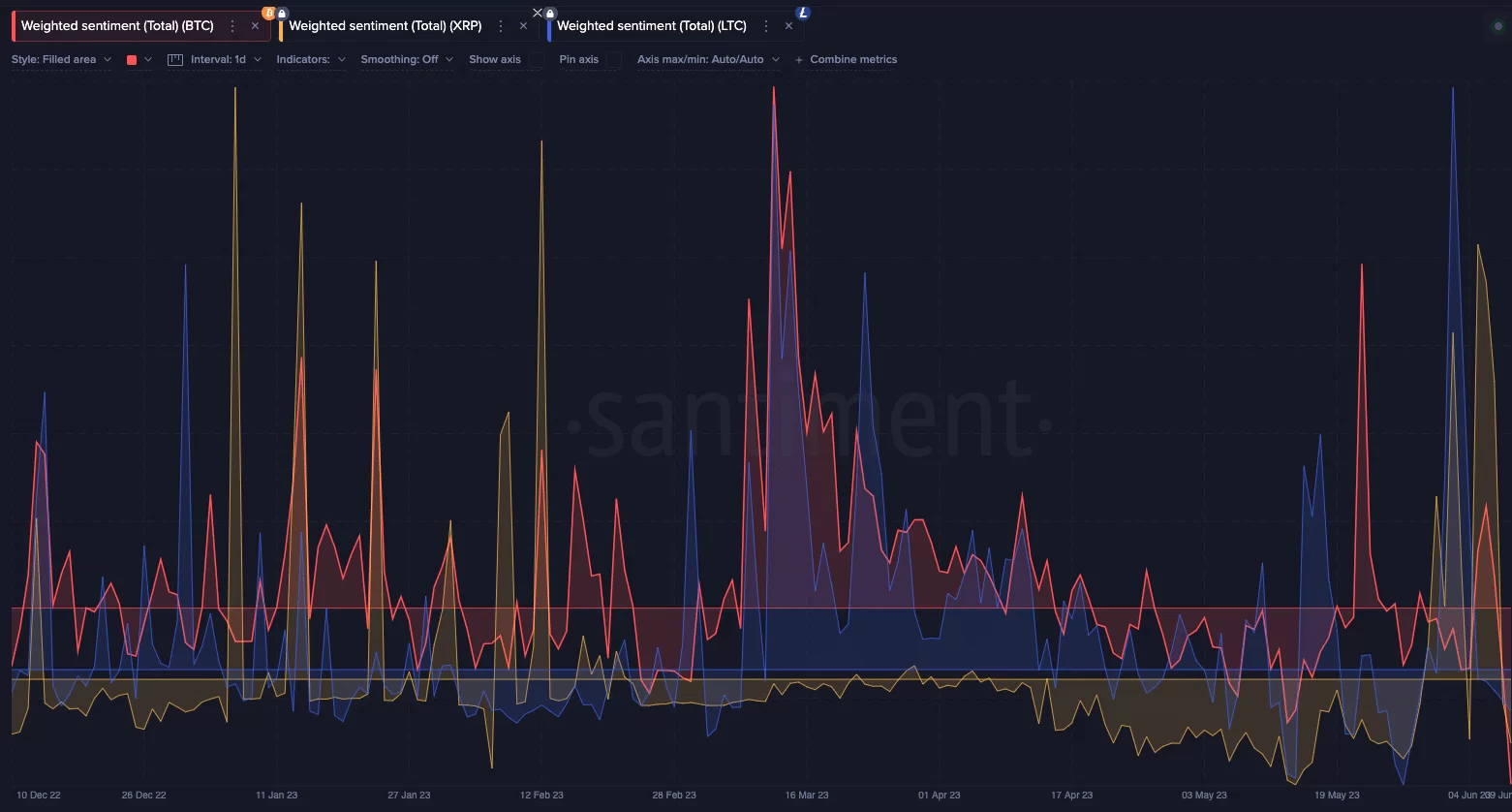

Santiment Data!

According to Santiment, Bitcoin’s volume rose timely to 16.78 billion at the time of writing, indicating a significant increase in transactions. While XRP’s volume also increased to 2.17 billion, LTC’s volume rose to 966.27 million. As the volume serves as an indicator to determine the price movement, BTC might indeed affect the direction of LTC and XRP.

Similarly, the weighted sentiment of all assets followed a similar pattern. The weighted sentiment takes into account the unique social volume surrounding an asset according to broader intelligence. Between the last week of May and June 2, LTC’s weighted sentiment shot up. During the same period, the same metric rose from the perspective of XRP. Like the other two, BTC’s weighted sentiment also increased.

However, at the time of writing, the metric for BTC, LTC, and XRP dropped into the negative zone. This might mean that the broader perception towards these cryptocurrencies may not align with a short-term price increase.