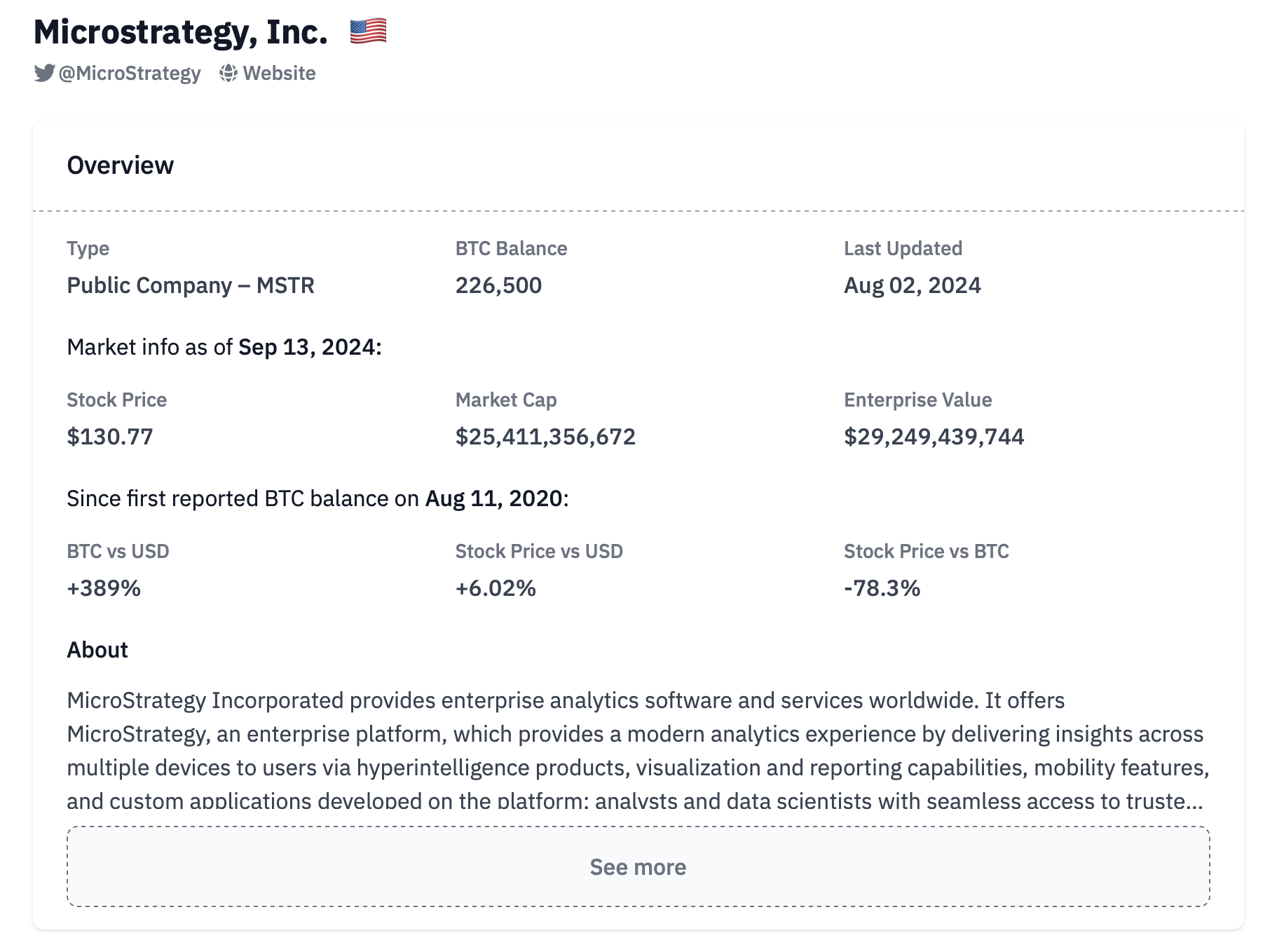

Software company MicroStrategy, led by Bitcoin advocate Michael Saylor, has significantly increased its Bitcoin (BTC)  $91,081 assets once again. The company recently announced the acquisition of 18,300 additional BTC for approximately $1.11 billion. With this latest purchase, MicroStrategy’s total Bitcoin holdings have surged to around $9.45 billion, comprising 244,800 BTC as of September 2024.

$91,081 assets once again. The company recently announced the acquisition of 18,300 additional BTC for approximately $1.11 billion. With this latest purchase, MicroStrategy’s total Bitcoin holdings have surged to around $9.45 billion, comprising 244,800 BTC as of September 2024.

MicroStrategy’s Strategy for Accumulating Bitcoin Continues Strong

MicroStrategy, which has transformed from a software firm into a notable Bitcoin entity, has made this recent purchase to solidify its position as the largest public institutional investor in Bitcoin. The company’s aggressive accumulation strategy, which began in 2020, is based on the belief that Bitcoin serves as a superior store of value compared to traditional fiat currencies.

Michael Saylor, MicroStrategy’s CEO, frequently expresses confidence in Bitcoin’s long-term potential, arguing that the largest cryptocurrency offers protection against inflation and economic uncertainty.

This latest acquisition was financed through a combination of cash reserves and a recently completed $750 million bond issuance. This financing strategy has become a cornerstone for the company, allowing it to enhance its Bitcoin reserves by leveraging both existing assets and external funding.

With this acquisition, MicroStrategy now controls approximately 1.3% of Bitcoin’s total supply (21 million BTC). The company had announced its previous purchase on August 1, revealing that it acquired 169 BTC.

Bitcoin’s Initial Reaction Was Negative

Interestingly, Bitcoin reacted negatively to MicroStrategy’s recent BTC purchase. Just prior to the announcement, Bitcoin was trading above $58,000 but dropped to $57,830 following the news.

As of the time of this writing, Bitcoin is trading at $57,834.