MicroStrategy, a major Bitcoin  $0.000041 investment firm based in the U.S., continues to expand its BTC portfolio. On January 6, the company announced the acquisition of 1,070 BTC at an average price of $94,000. This recent purchase follows news that the company aims to raise up to $2 billion through perpetual preferred shares.

$0.000041 investment firm based in the U.S., continues to expand its BTC portfolio. On January 6, the company announced the acquisition of 1,070 BTC at an average price of $94,000. This recent purchase follows news that the company aims to raise up to $2 billion through perpetual preferred shares.

Spot Market Activity

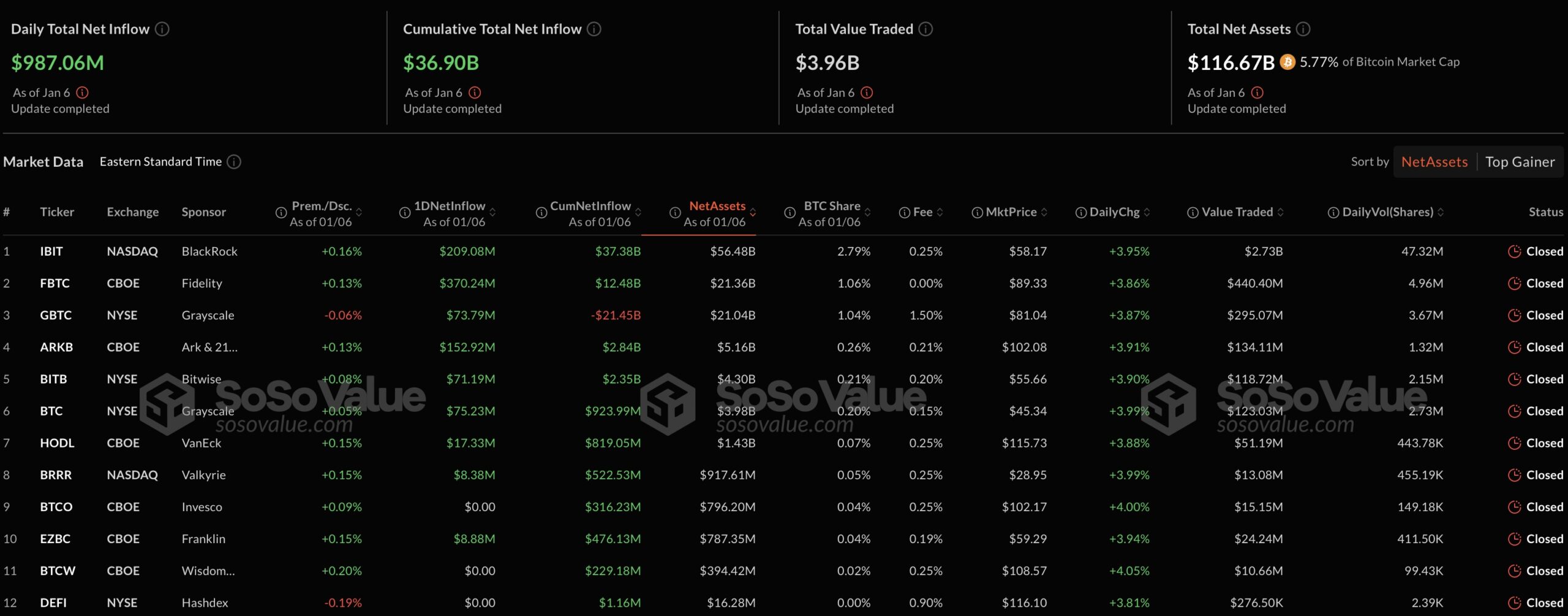

Bitcoin has surpassed the $100,000 mark on the Coinbase exchange for the first time in two weeks. This price increase coincides with a resurgence in net fund inflows into spot ETFs.

The activity on the cryptocurrency exchange is boosted by ETF issuers trading through Coinbase and utilizing direct custody services. Signs indicate that institutional investors are increasing their Bitcoin allocations for 2025, aligning with analyses conducted at the end of last year.

Regulatory Developments and Risks

In Canada, pro-cryptocurrency politician Pierre Poilievre has emerged as a leading candidate to replace Justin Trudeau as Prime Minister. According to Polymarket data, Poilievre is currently the favorite, fostering a positive atmosphere for regulatory conditions and supporting the cryptocurrency market.

However, significant risks loom over the markets throughout January. The reactivation of the U.S. debt ceiling may necessitate “extraordinary measures” to finance government expenditures, potentially increasing market volatility and causing uncertainty for investors amid escalating debates.

The current dynamics in Bitcoin and the cryptocurrency market are shaped by ongoing regulatory developments and rising institutional interest. Nevertheless, macroeconomic risks are expected to play a critical role in determining future market conditions.

Türkçe

Türkçe Español

Español