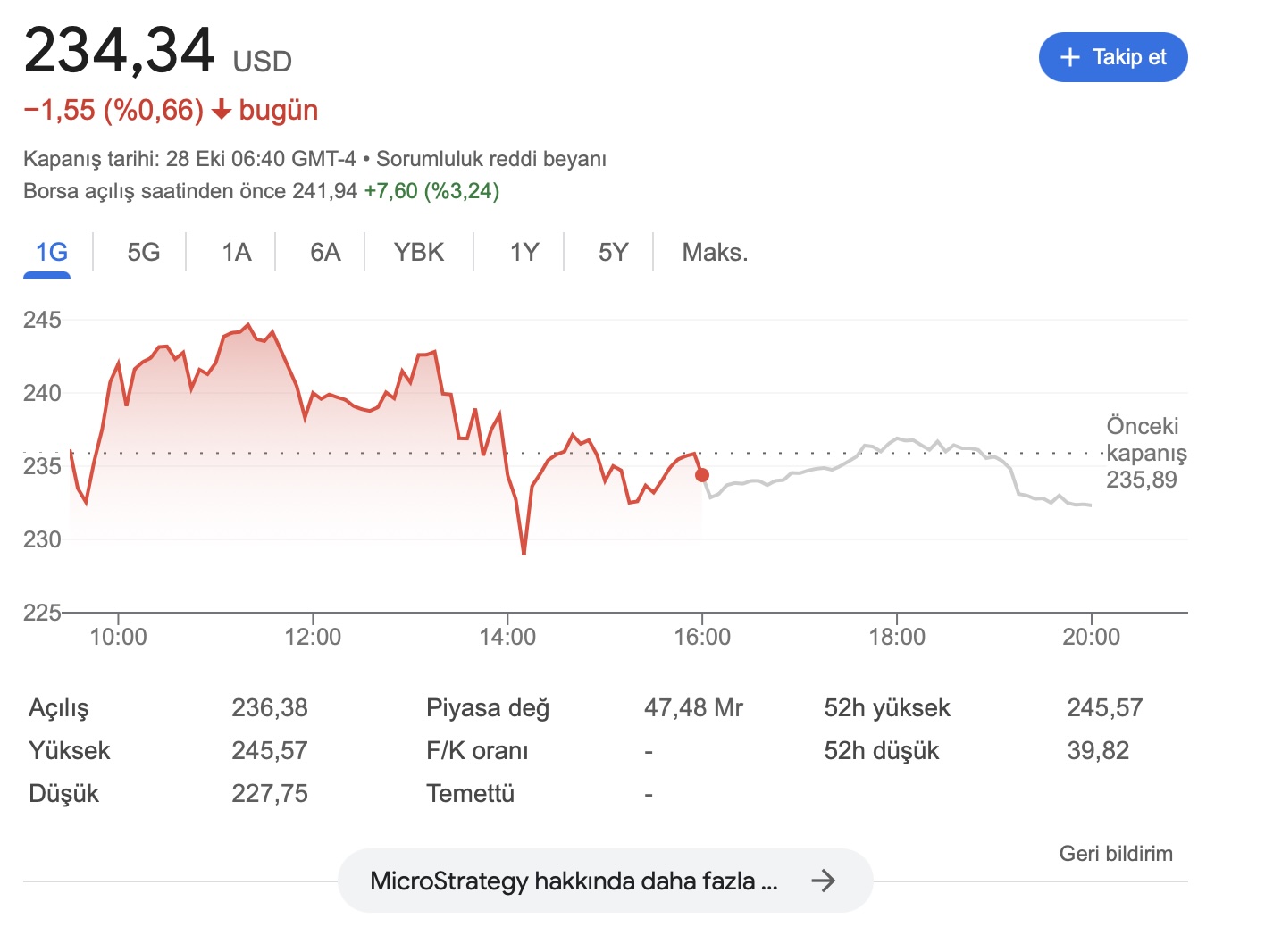

The value of shares for the U.S. software company MicroStrategy, known for its Bitcoin  $91,967 investments, is trading at approximately 300% above its held BTC assets. According to Steno Research, this premium rate is not sustainable in the long term. The recent stock split executed by the company and the anticipated options on spot Bitcoin ETFs in the U.S. could weaken demand for MicroStrategy shares.

$91,967 investments, is trading at approximately 300% above its held BTC assets. According to Steno Research, this premium rate is not sustainable in the long term. The recent stock split executed by the company and the anticipated options on spot Bitcoin ETFs in the U.S. could weaken demand for MicroStrategy shares.

Impact of Stock Split Diminishes, Demand May Drop

Analyst Mads Eberhardt from Steno Research noted that the effects of MicroStrategy’s recent 10-for-1 stock split are waning. Given that the company’s stock premium was under 200% even during the bull market of 2021, the current 300% premium significantly deviates from the company’s assets and fundamental business indicators.

Despite the rise following the stock split, this premium is evaluated as unsustainable.

ETFs May Offer Alternatives to MicroStrategy Shares

The recent launch of options on spot Bitcoin ETFs in the U.S. may lead investors to shift towards direct ETFs or BTC instead of MicroStrategy. According to Steno Research’s report, as institutional interest in Bitcoin grows, investors may prefer direct investments in cryptocurrencies. Additionally, a favorable shift in the U.S. regulatory stance towards Bitcoin could encourage investors to choose spot Bitcoin ETFs over MicroStrategy.

Although the company’s shares have maintained a high premium since 2021, analysts emphasize that this premium is not sustainable against the expected strong performance of BTC next year.

Currently, Bitcoin is trading at $68,714 after a 2.37% increase in the last 24 hours, while MicroStrategy shares (MSTR) are preparing to start the new trading week at $234.34.