Corporate demand for cryptocurrencies continues to grow exponentially, with record entries seen last week. MicroStrategy is certainly continuing its purchasing spree during this process. Michael Saylor, who ties his company’s fate to cryptocurrencies, constantly seeks opportunities to buy more. Although these purchases lead to short-term declines in Bitcoin (BTC)  $118,096, they ultimately represent significant entry points in the medium and long term.

$118,096, they ultimately represent significant entry points in the medium and long term.

Recent Developments in Bitcoin

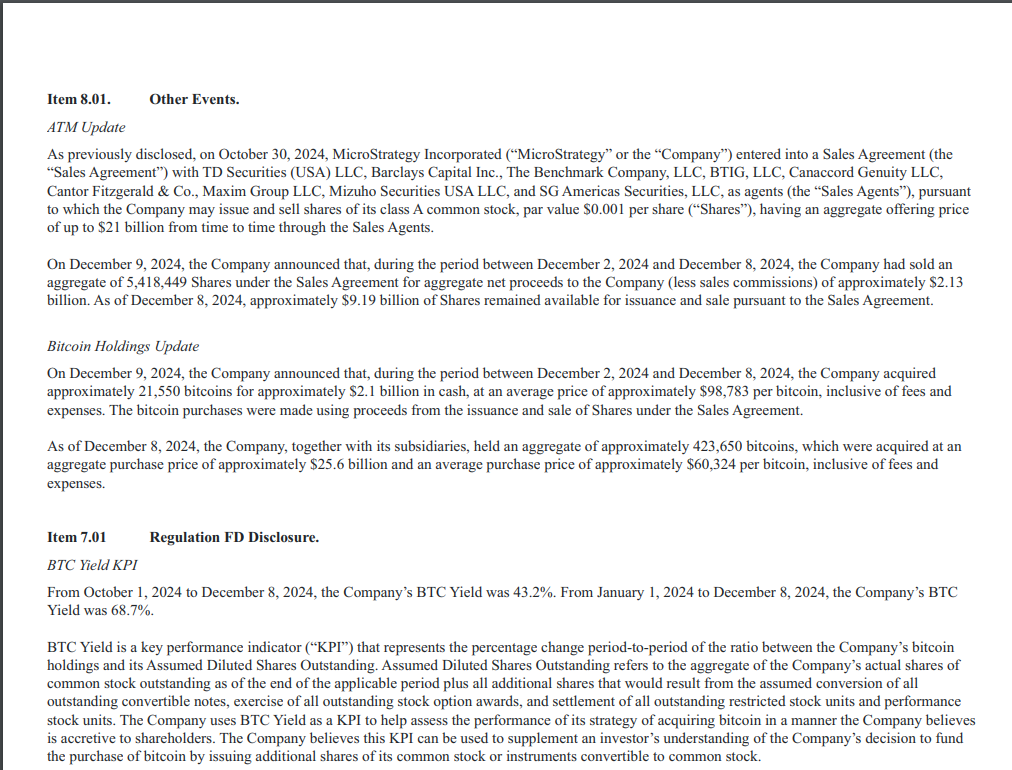

According to information shared by MicroStrategy in the 8K form submitted to the SEC, the company purchased an additional 21,550 BTC for $2.1 billion between December 2-8. With nearly 70% annual gains, the company now holds 423,650 BTC as of today, with an average acquisition cost of $60,324 and a total market value of over $25.6 billion.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

MicroStrategy’s Future Plans

As stated in a recent announcement, MicroStrategy plans to continue its billion-dollar purchases for the next three years. This indicates that this massive supply is unlikely to be sold for at least three years. The high demand for both Spot BTC ETFs and purchases from companies like MicroStrategy supports the notion that Bitcoin prices could reach six-figure peaks.

Türkçe

Türkçe Español

Español