MicroStrategy, a company known for holding Bitcoin and frequently making headlines in this regard, has turned a profit for the first time since July of this year, as the price of BTC surpassed $30,000. Many companies are hesitant to take such a step due to legal issues in the United States.

MicroStrategy’s Bitcoin Journey

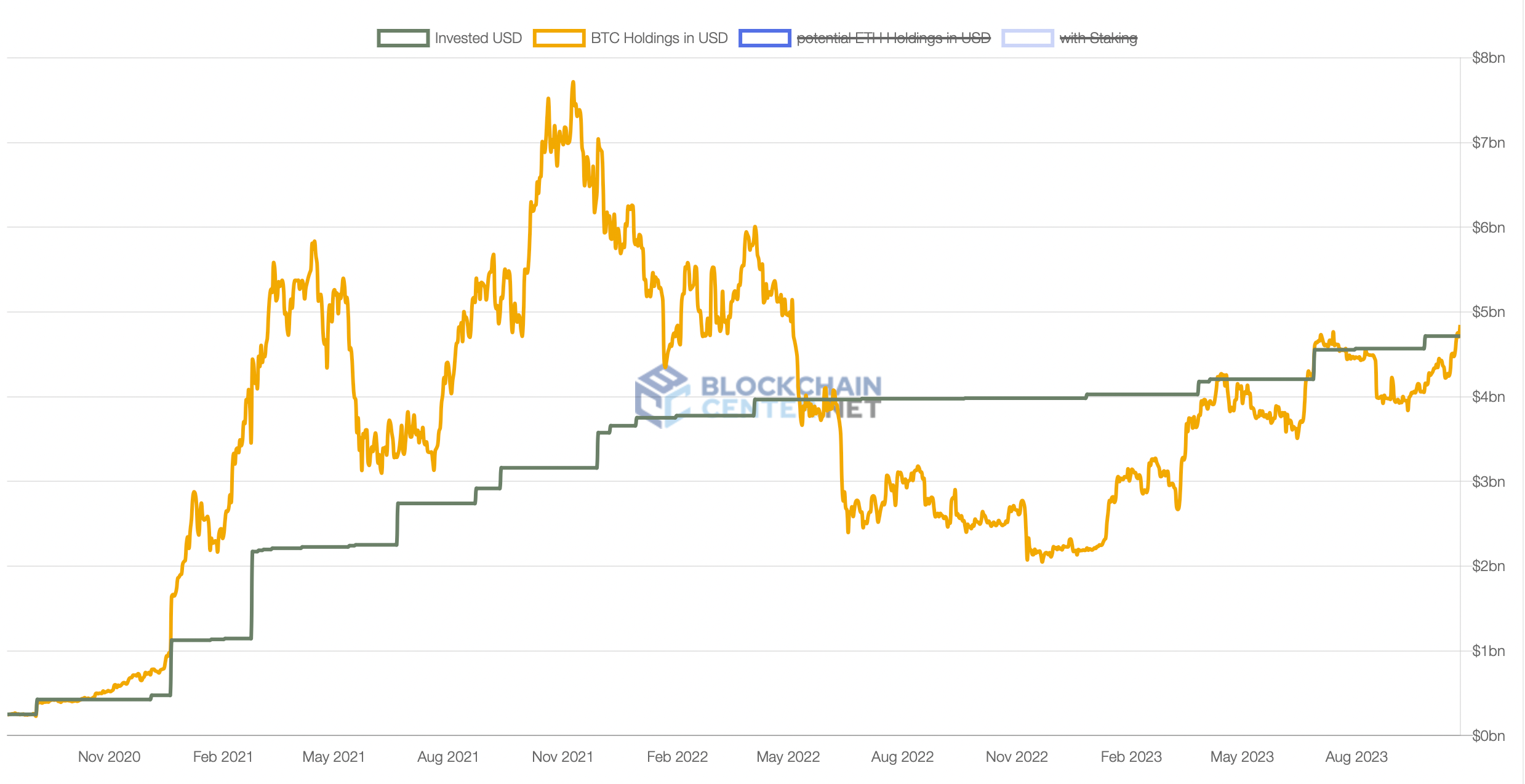

On October 23, MicroStrategy had 158,245 Bitcoins worth $4.847 billion, with an average investment increase of approximately $132 million at an average of $29,870 per Bitcoin. Looking at it from a different perspective, the company has gained $130 per Bitcoin.

MicroStrategy started buying Bitcoin in 2020 and began increasing its purchases in 2023, as it recovered from significant losses caused by the Federal Reserve’s interest rate policy and bankruptcy shocks in the crypto sector.

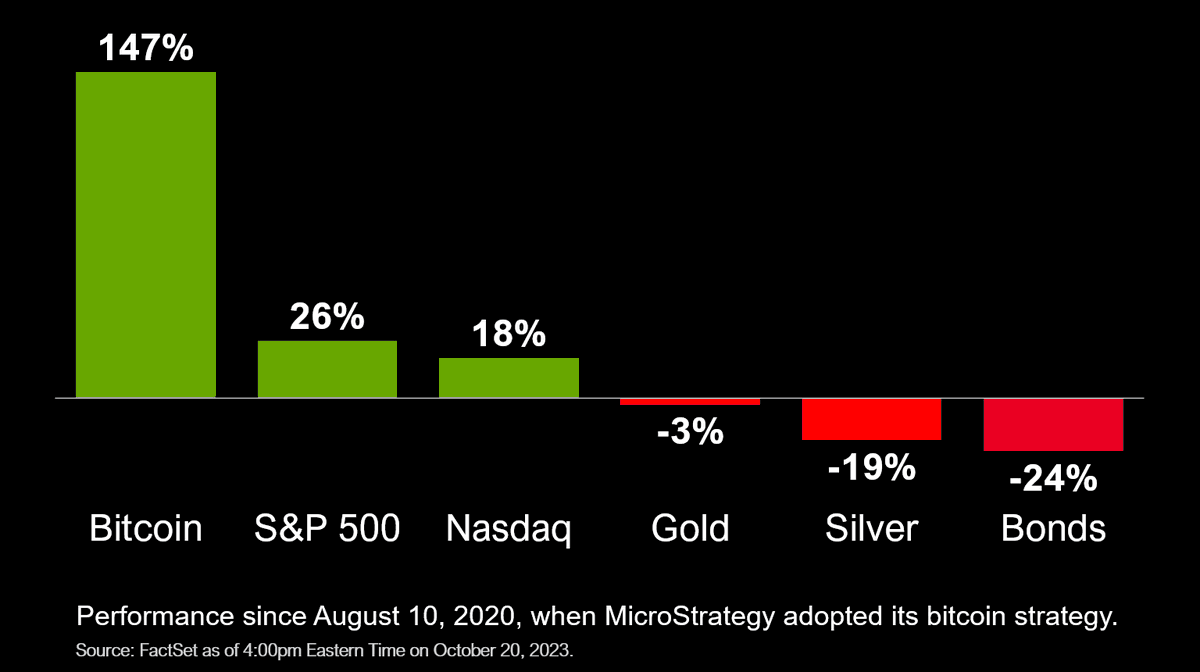

In September, MicroStrategy raised capital and bought 5,444 Bitcoins. This approach reflected the company’s strategy of buying approximately 12,333 Bitcoins earlier this year through fundraising. Michael Saylor, the co-founder and CEO of MicroStrategy, shared data indicating that Bitcoin has outperformed traditional investment instruments since the company adopted a cryptocurrency buying strategy in August 2020.

Expectations for Bitcoin

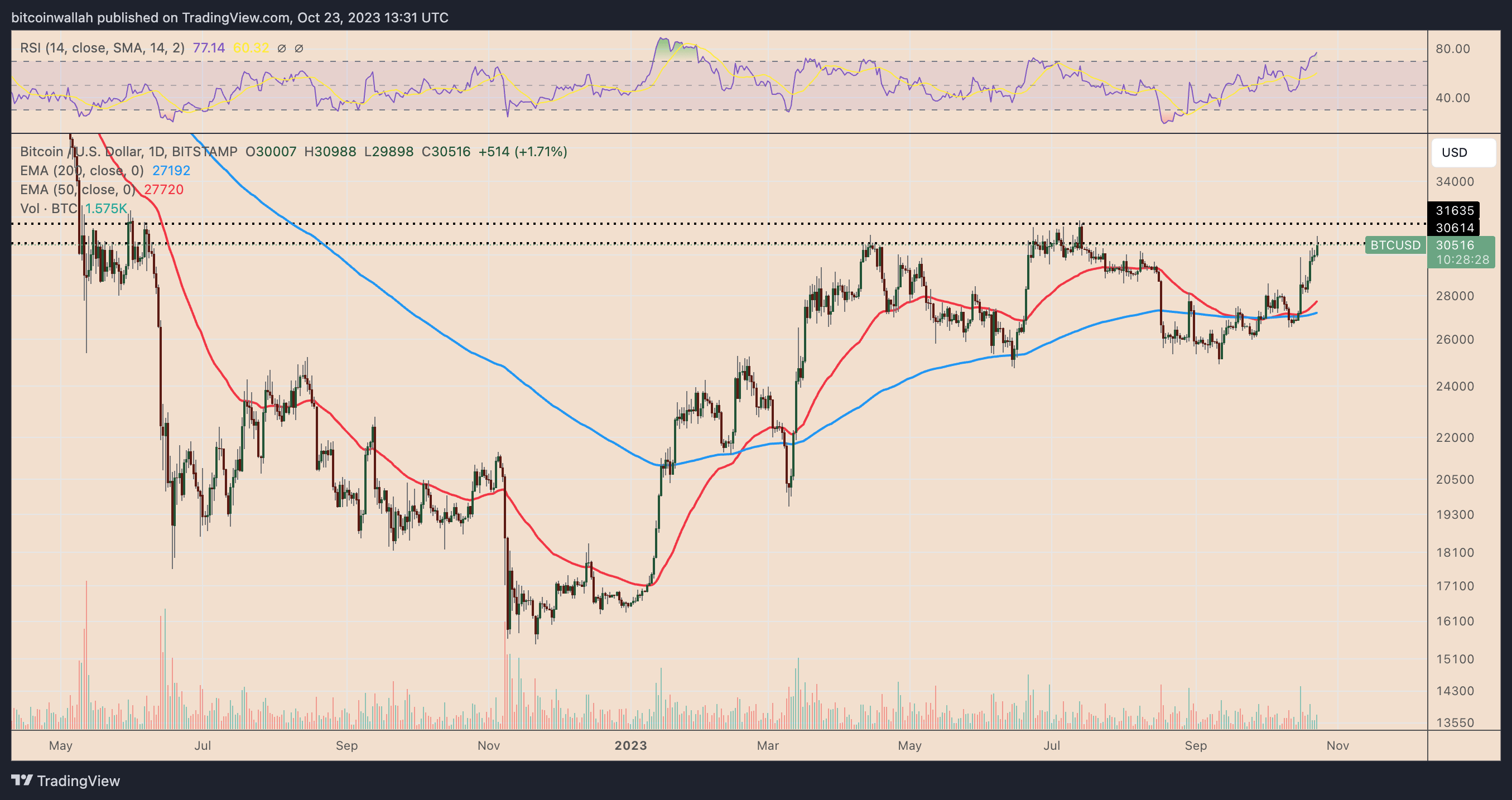

Since surpassing $30,000 in May 2022, Bitcoin has not been able to sustain a clear upward momentum. This scenario could repeat in the coming weeks and result in MicroStrategy’s Bitcoin investment falling below the average purchase price once again.

Bitcoin’s daily relative strength index (RSI) has been at extremely overbought levels since January 2023. One noteworthy aspect of technical analysis is that an overbought RSI (above 70) can cause the Bitcoin price to decline or consolidate horizontally.

In a correction scenario, the Bitcoin price could approach the 50-day exponential moving average (red level) near $27,720 with a roughly 10% decrease in November.

However, if the support level of $30,000 is maintained and confirmed, it could pave the way towards the next major resistance area at $32,000, an unprecedented level since May 2022.