The recent impressive rise in MicroStrategy’s stock has stirred significant reactions in the markets. The company’s stock value increased by 16% in just one week, reaching a record market capitalization of $43 billion. This momentum is expected to continue into the foreseeable future, with critical developments on the horizon that may impact Bitcoin (BTC)  $83,671 and the wider cryptocurrency market.

$83,671 and the wider cryptocurrency market.

How MicroStrategy’s Success Affects Bitcoin Pricing

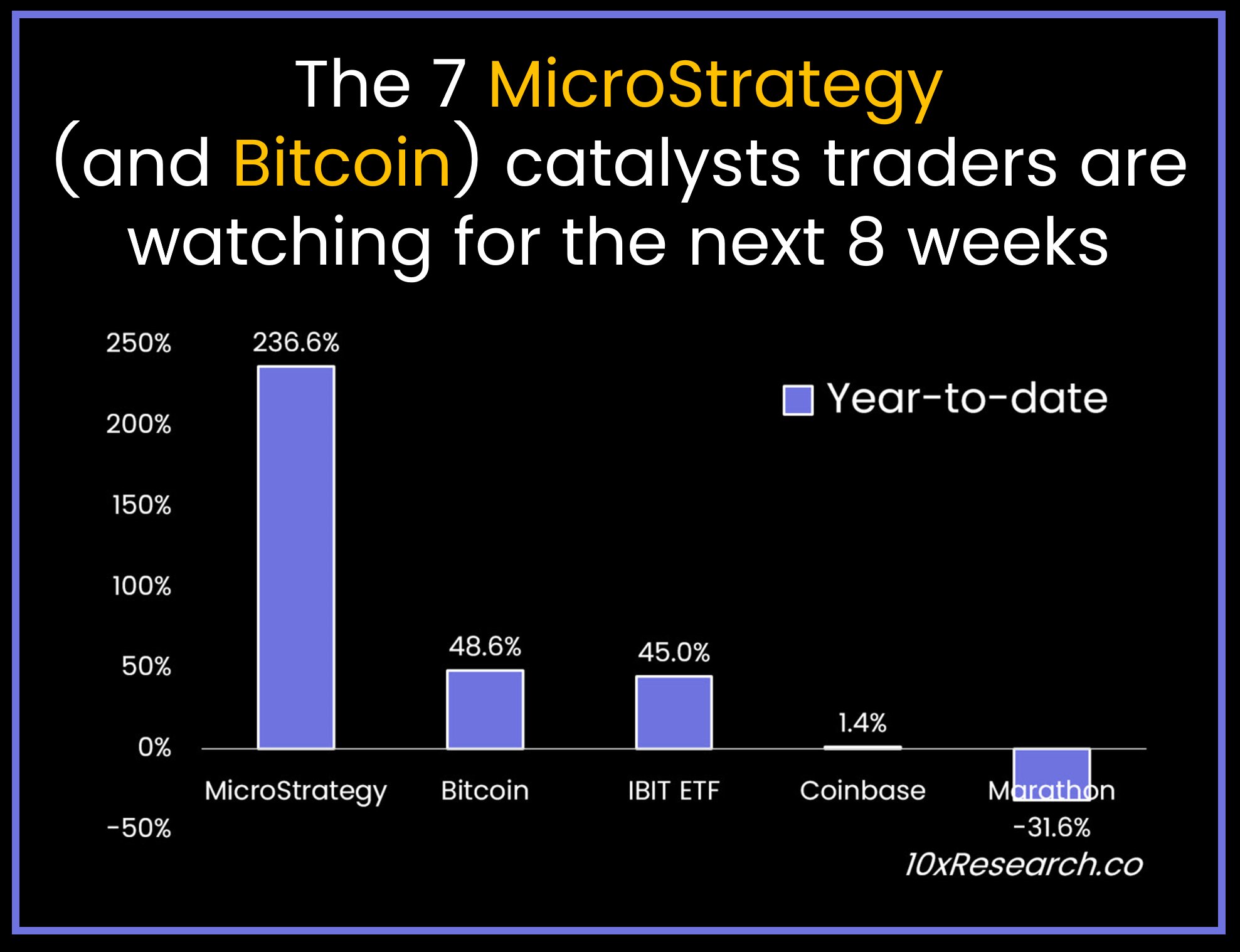

MicroStrategy’s strong stock performance may reflect positively on Bitcoin’s price. This phenomenon, known in the market as “tail wags the dog,” suggests that a rise in stock prices could also elevate Bitcoin. Investors are closely monitoring developments that could affect both MicroStrategy and Bitcoin over the next eight weeks.

According to the crypto analysis firm 10x Research, the market is at a critical turning point during this period. Year-to-date, Bitcoin has gained 48.6% in value, while MicroStrategy’s stock has surged by a remarkable 236.6%. Meanwhile, BlackRock’s spot Bitcoin ETF, IBIT ETF, has risen by 45%, while Coinbase shares have only seen a modest 1.4% increase. In contrast, Marathon Digital Holdings has dropped 31.6%, failing to meet investor expectations.

Divergence and Expectations in Crypto Mining Companies

The positive sentiment observed in the Bitcoin mining sector last year has not persisted into this year. Analysts at 10x Research indicate that the increase in mining revenues has yet to be reflected in stock prices. However, many investors anticipate a recovery in the performance of mining companies soon, believing it could present buying opportunities.

The positive market outlook for MicroStrategy enhances the likelihood of the company reaching new record levels. Investors are keenly observing the potential impact of the company’s moves to further increase its Bitcoin reserves. New investments and strategic decisions could strengthen the performance of the company’s stock even more.

If MicroStrategy maintains this momentum, significant activity in Bitcoin and the broader cryptocurrency market could be anticipated. The company’s price movements could serve as a decisive catalyst in the market dynamics for the largest cryptocurrency.

Türkçe

Türkçe Español

Español