The Monochrome Ethereum  $2,537 ETF (IETH) will be launched tomorrow, opening for trading. This exchange-traded fund, developed by the Australian investment company Monochrome, follows the company’s spot Bitcoin

$2,537 ETF (IETH) will be launched tomorrow, opening for trading. This exchange-traded fund, developed by the Australian investment company Monochrome, follows the company’s spot Bitcoin  $105,360 ETF released in August. Monochrome’s move towards a spot Ethereum ETF may create new opportunities for cryptocurrency traders in Australia.

$105,360 ETF released in August. Monochrome’s move towards a spot Ethereum ETF may create new opportunities for cryptocurrency traders in Australia.

Trading Options with Cash and ETH

IETH, similar to spot crypto ETFs in Hong Kong, will allow transactions in both cash and “in-kind” asset-based applications and redemptions. This feature enables investors to invest directly in the fund using ETH and withdraw in the same manner.

As of October 10, Monochrome’s spot Bitcoin ETF holds 165 BTC, with a total value slightly above $10 million. The launch of the spot Ethereum ETF is expected to provide investors with more options and invigorate the cryptocurrency market in Australia.

Growing Interest in Crypto ETFs

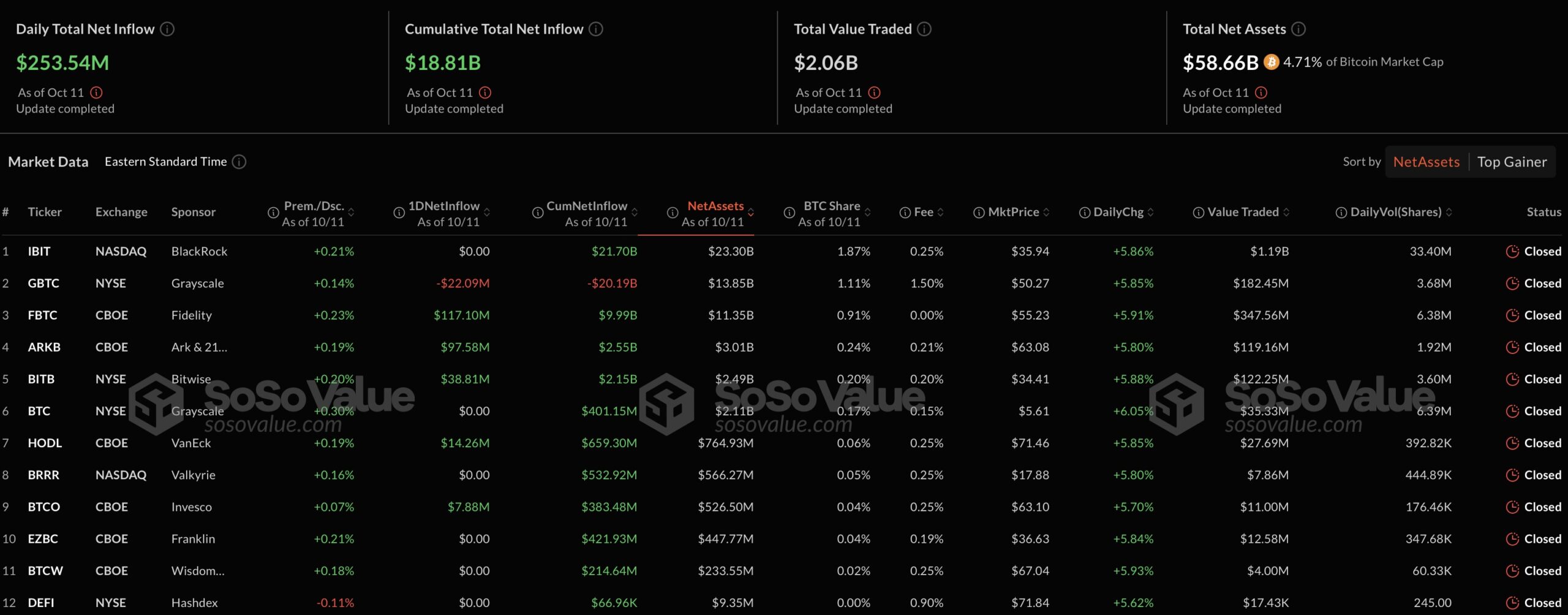

As of October 10, Hong Kong’s spot Bitcoin ETFs hold assets valued at $262.97 million, while spot Ethereum ETFs manage a net worth of $35.07 million. In contrast, cryptocurrency ETFs in the US have a significantly larger market capitalization, with spot Bitcoin ETFs managing $58.66 billion and spot Ethereum ETFs at $6.74 billion.

Crypto ETF activity is also increasing globally. Following the launch of spot crypto ETFs in the US in January, many countries have taken similar steps, although these funds remain significantly smaller than those in the US. Last week, South Korea’s Financial Services Commission announced it is considering allowing crypto ETFs.

Türkçe

Türkçe Español

Español