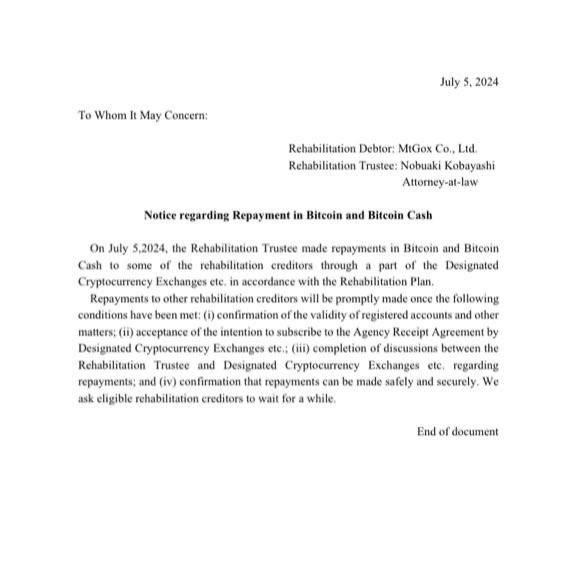

The collapsed cryptocurrency exchange Mt. Gox officially announced that it started repaying some creditors in Bitcoin (BTC) and Bitcoin Cash (BCH) through certain cryptocurrency exchanges on July 5, 2024, in accordance with the Rehabilitation Plan. This announcement indicates that the long-awaited repayment process following Mt. Gox’s 2014 bankruptcy has finally begun. The initial repayments will be made through designated cryptocurrency exchanges.

Other Creditors’ Payments to Follow Initial Repayments

After the initial repayments, other creditors’ repayments will be carried out once certain conditions are met. These conditions include verifying the validity of registered accounts and other matters, confirming the intention to accept the agreement by the designated cryptocurrency exchanges, completing discussions between the Rehabilitation Trustee and the designated cryptocurrency exchanges regarding repayments, and ensuring that repayments can be made securely and safely.

Mt. Gox stated that repayments to other creditors would be made after completing all these processes, emphasizing that this process and necessary verifications could take time. Therefore, creditors eligible for repayments were asked to be patient. The cryptocurrency exchange thanked creditors for their patience and emphasized its determination to complete the repayment process in the safest and most effective way.

The repayment process progressing gradually in this manner allows for the necessary security and accuracy checks to ensure creditors receive their deserved payments. This shows that Mt. Gox prioritizes transparency and security in the repayment process. The commencement of initial repayments is considered a promising development for all creditors.

Mt. Gox’s Activity Shakes the Cryptocurrency Market

Meanwhile, the initiation of Mt. Gox’s repayment process shook the cryptocurrency market. Bitcoin fell by over 7%, dropping to $53,400 for the first time since February. The altcoin king Ethereum (ETH) fell below the significant threshold of $3,000, down to $2,830.

The sharp decline in Bitcoin and Ethereum caused leading altcoins to drop by over 10%. Currently, many altcoins are showing a dramatic loss of over 15% in the last 7 days.