Mt. Gox’s transfer of $3.1 billion worth of Bitcoin to BitGo left a balance of $3 billion in the defunct exchange. This significant reduction in Mt. Gox’s Bitcoin holdings suggests that the exchange’s long-standing supply pressure might soon end. Historically, even the potential release of Mt. Gox’s Bitcoin has been a source of concern for the market, causing uncertainty among investors.

Details of the Bitcoin Transfer

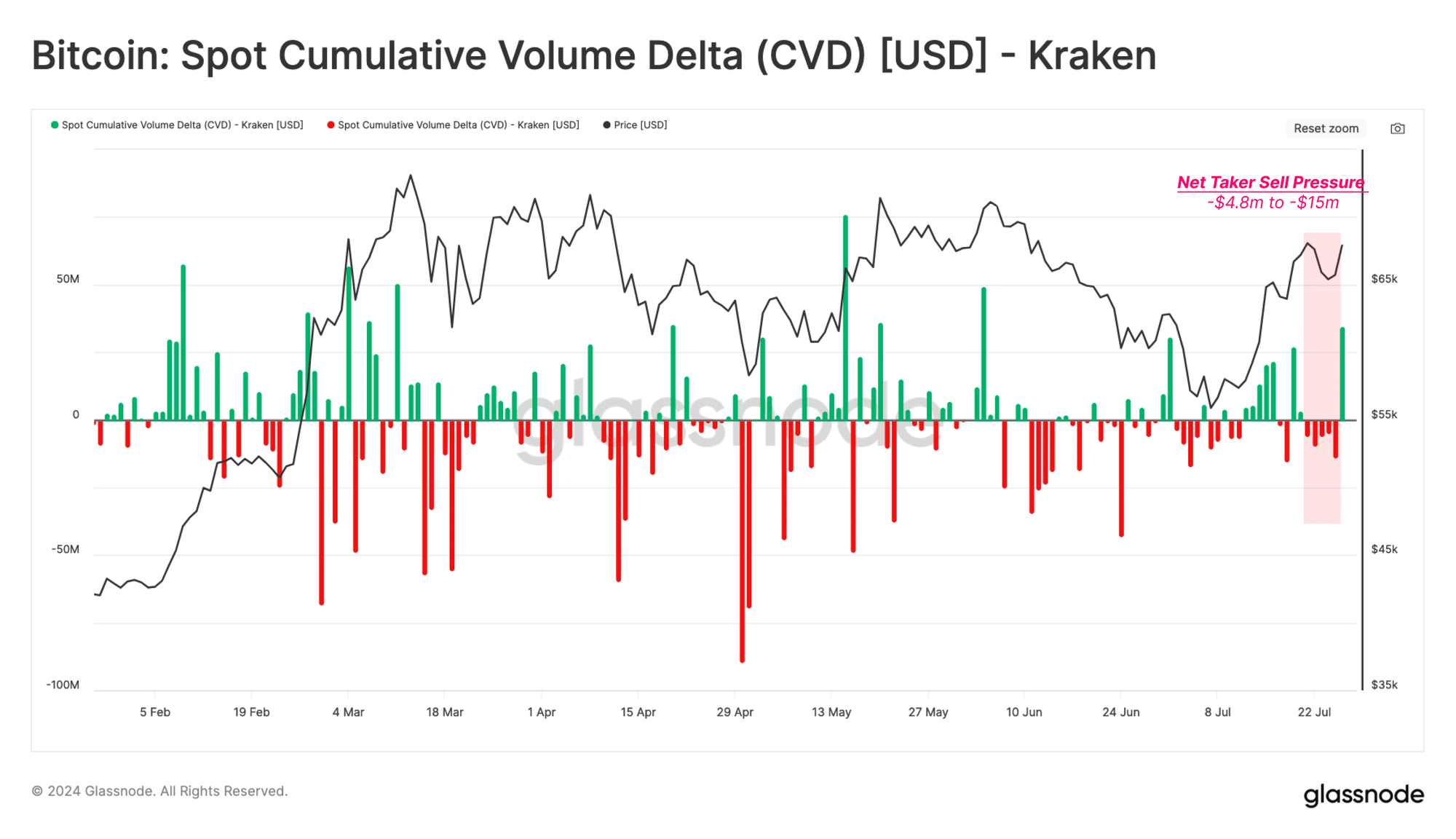

According to Arkham data, the transfer made on July 30 reduced the trustee’s balance to $3.06 billion. This was a significant move involving 33,960 BTC worth approximately $2.25 billion. Despite the scale of this transaction, it did not lead to the expected market pressure. The Spot Cumulative Volume Delta (CVD) metric on Kraken, which tracks net buying or selling volume on the exchange, showed a marginal increase, indicating no significant selling pressure.

Glassnode data supported this by showing no major impact on the sell side in major exchanges like Kraken and Bitstamp. Unlike previous Bitcoin sales by the German government, the recent repayment from Mt. Gox did not drag the market down. Consequently, it appears that the remaining $3 billion held by Mt. Gox can be moved without significantly affecting the market.

Other Market Pressures

However, the US government remains a significant factor in the market. With approximately $13 billion in Bitcoin, its movements have a profound impact. A recent $2 billion transfer by the US government caused concern in the market. Since June, fears of sales by both the German and US governments have strengthened bearish trends.

CryptoQuant analyst Axel Adler emphasizes that the selling pressure has been impressive throughout the summer. The Net Taker Volume, a metric indicating whether the market is predominantly buying or selling, has been negative, showing dominant selling pressure. Until this metric turns positive, indicating more buying volume, the market will likely remain under bearish control.

Current Market Situation

As of the latest update, Bitcoin’s price has fallen to $63,000 but faces the potential for further decline with the US employment report set to be released on August 2.

The outcome of this report will be crucial in determining whether the market can alleviate accelerating sales despite the dovish stance of the Federal Open Market Committee (FOMC).

Türkçe

Türkçe Español

Español