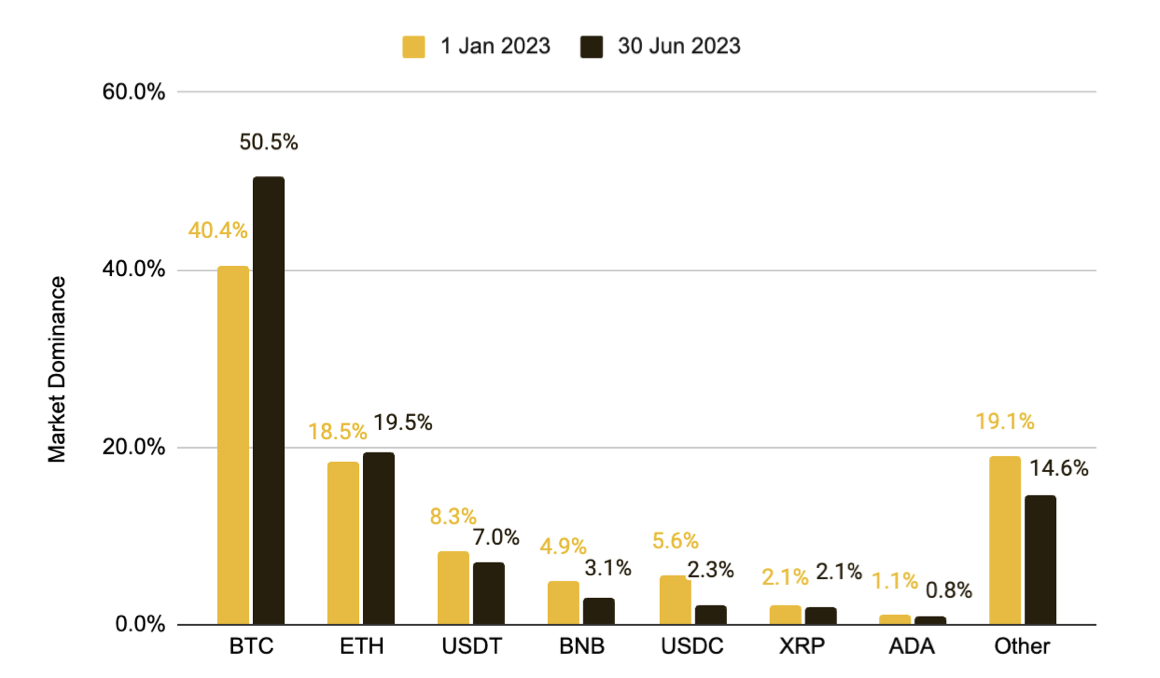

Binance, the world’s largest cryptocurrency exchange, has released its highly anticipated report shedding light on the first half of the year. The report highlights the challenges faced by the cryptocurrency market in the first half of the year, but also emphasizes positive growth in market value. It states that Bitcoin, the largest cryptocurrency, has reached its highest market dominance level since April 2021 and has outperformed traditional financial investments by a significant margin in terms of price performance.

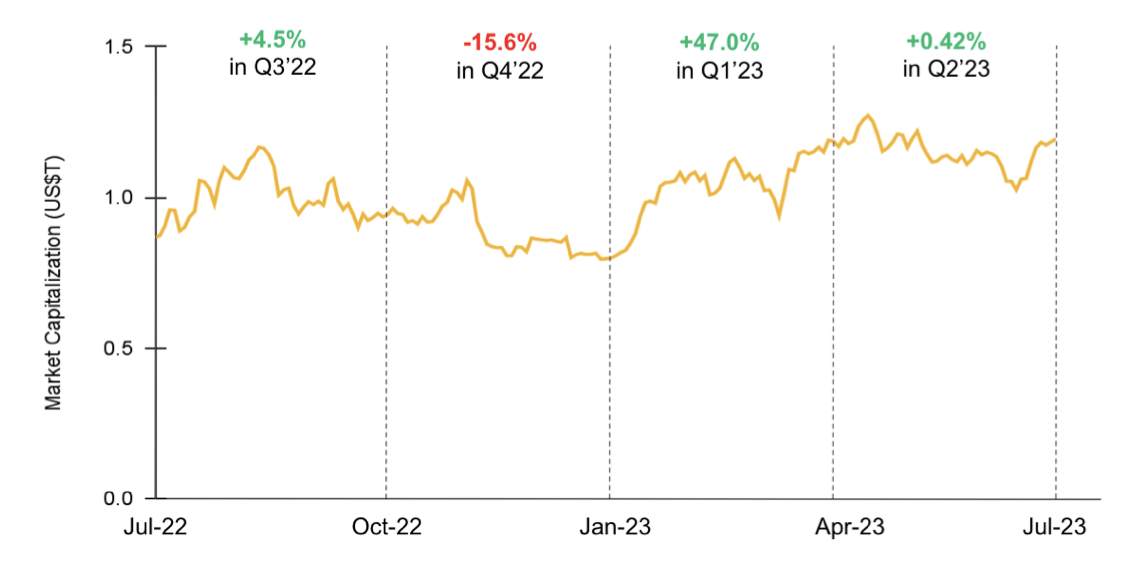

According to the report, the total market value of the cryptocurrency market has increased by 30.3% from the first day of the year until June 30th, reaching $1.17 trillion.

The report highlights the active developments in Layer 1 Blockchains, stating that the increased interest in Ethereum’s liquid staking has led to the emergence of LSTfi, while BNB Chain focuses on scalability. Solana made a strong comeback by introducing the Web3 phone, and the increase in USDT issuance on the Tron Blockchain has increased Tron USDT’s dominance.

The report also mentions significant advancements in various Blockchain networks such as Avalanche (AVAX) and Cosmos (ATOM), as well as the continued dominance of Optimistic rollups and the new heights reached by ZK technology with fully functional zkEVMs. It also adds that major Blockchain networks are approaching ideas such as L3s, Superchains, and Hyperchains.

The report includes tokens related to games, stating that there have been price increases in this token class due to market recovery, and that most games are built on the BNB Chain, Ethereum, and Polygon (MATIC) Blockchains.

Reshaping the Stablecoin Market with USDT Leading the Way

The report points out that the total value of the stablecoin market decreased by 7% in the first half of the year, while the market share of the largest stablecoin, USDT, increased significantly by 25.8% during the six-month period, indicating a redistribution of cards in the stablecoin market.

The report mentions significant developments in the DeFi sector, where liquid staking has become an important sub-sector and decentralized exchanges (DEXs) have attracted more users. Despite all the positive developments, it states that DeFi has lost some of its dominance compared to the cryptocurrency market.

The report also covers the NFT sector, noting that the market saw high transaction volume in the first half of the year, but many collections experienced significant decreases in base prices.

According to the report, the activity of deals and venture capital investments in the crypto sector has largely decreased in the first half of the year. The infrastructure sector attracted the most investment, followed by the gaming/entertainment and DeFi sectors.