Bitcoin (BTC) price has entered a strong consolidation phase while trading around $29,000 for some time, exhibiting extremely low price volatility. This trend in Bitcoin’s price is confusing, but several important indicators and significant formations suggest an inevitable rise in the long term.

Multiple Bitcoin Indicators Signal a Rise

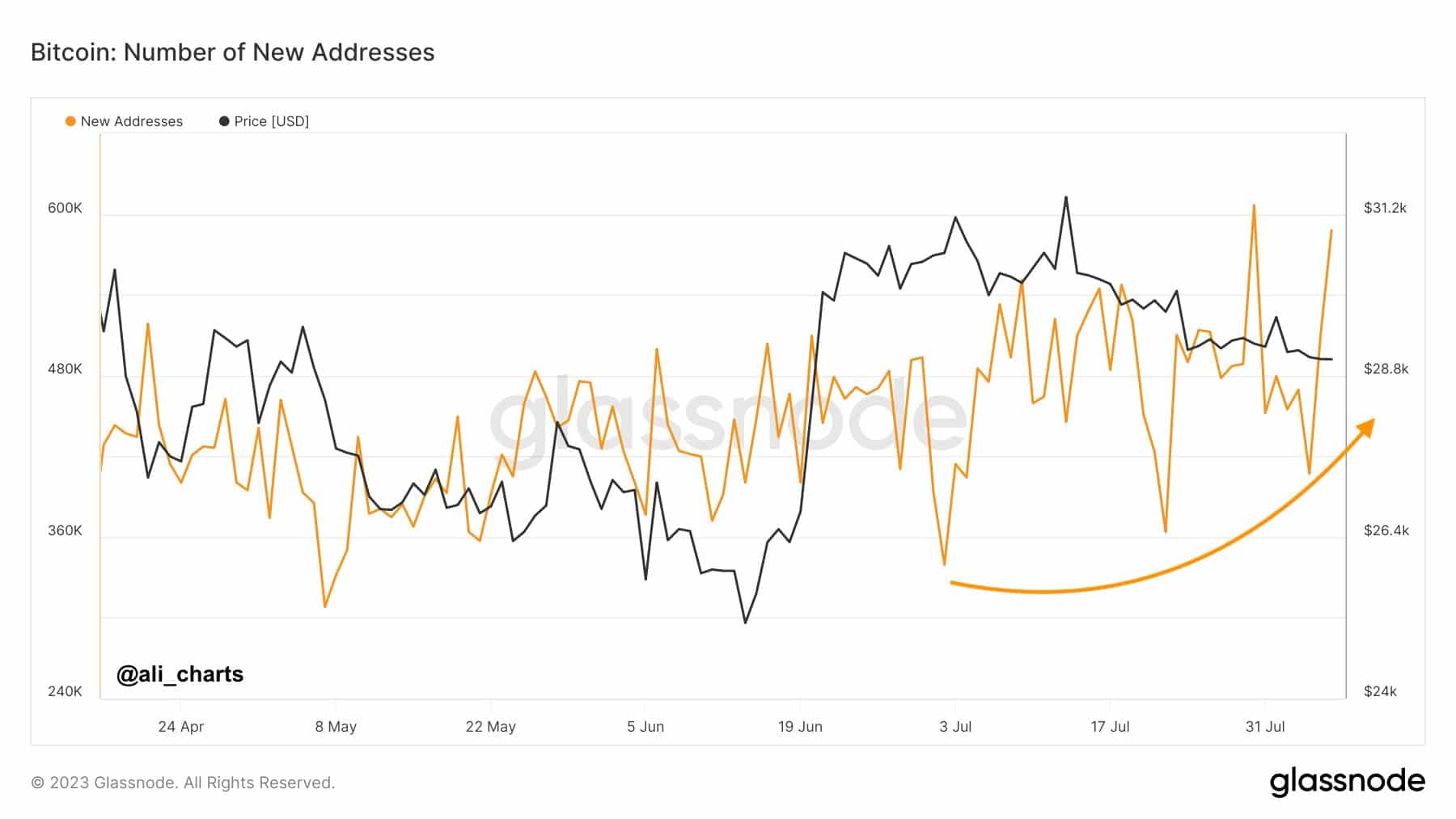

As the search for direction continues in Bitcoin, on-chain data of the largest cryptocurrency shows a general improvement in network activity. The first indication of this conclusion was the continued increase in the total number of new wallet addresses on the Bitcoin network when the price recently dropped from $32,000 to $29,000.

Prominent crypto analyst Ali Martinez stated, “This divergence between price and network growth indicates a stable long-term BTC upward trend. Buy the dip!” He claimed that price retracements should not be feared and could even be seen as buying opportunities.

Other on-chain indicators also point to a rise in Bitcoin. Martinez commented on this situation, stating, “All major BTC indicators (MVRV, aSOPR, Puell Multiple, and Reserve Risk) continue to be above the 0 level. This suggests that the ongoing decline could simply be a deviation.”

Bitcoin’s Golden Cross Formation Excitement

Meanwhile, crypto analyst TradingShot reported in an article published on TradingView on August 4th that Bitcoin has formed a golden cross formation for the third time in its history. According to the analyst, the formation may indicate the beginning stages of a rally towards new record levels for the largest cryptocurrency.

The golden cross formation occurs when a short-term moving average crosses above a long-term moving average, specifically when the 50-day moving average (MA) surpasses the 200-day MA. This indicates a positive trend for the largest cryptocurrency. Previous instances of the golden cross formation have resulted in significant price increases for Bitcoin.

Referring to previous golden cross cycles, TradingShot stated that the next upward target for Bitcoin could be its all-time high (ATH) of $69,000, which would be achieved around this time next year. They said, “It would be a fair prediction to say that Bitcoin will reach its current ATH ($69,000) next year.”