Since April, NEAR Coin has reached its highest level, showing signs of revival. It was one of the altcoins that were most affected by the FTX collapse. Like Solana, the NEAR team saw excessive selling due to significant investments received from FTX. However, now that it has surpassed 2 dollars again, investors seem hopeful.

NEAR Coin Commentary

Bitcoin price at the time this article was prepared is at $43,800, with investors who were watching the levels of $25,000-$28,000 recently getting excited. The Bitcoin price rose much faster than expected over $31,800. Amidst this rise, the price of NEAR Coin is also recovering.

In October, as the major crypto surge began, NEAR Coin breached the 440-day resistance. Breakouts from long-term resistances are pregnant with parabolic rallies. Since the breakout, the upward movement has been fast, and the significant horizontal resistance zone has been reclaimed.

After creating a bullish divergence on the RSI, the price increased, and the current outlook suggests that the rally may continue. If BTC does not start a serious and sudden series of losses, new peaks are possible.

NEAR Coin Price Prediction

Similar to the weekly chart, the sentiment on the daily chart is also dominantly bullish. The RSI supports the rally, and the demand is lively. Despite the rejection on the chart, the price’s recovery from the 0.618 Fibonacci retracement resistance level on December 4th confirms the steady rise as well.

Popular cryptocurrency analyst ZaykCharts appears confident that higher levels will be tested in the future. According to him, the break seen in the descending channel clearly initiated a major uptrend.

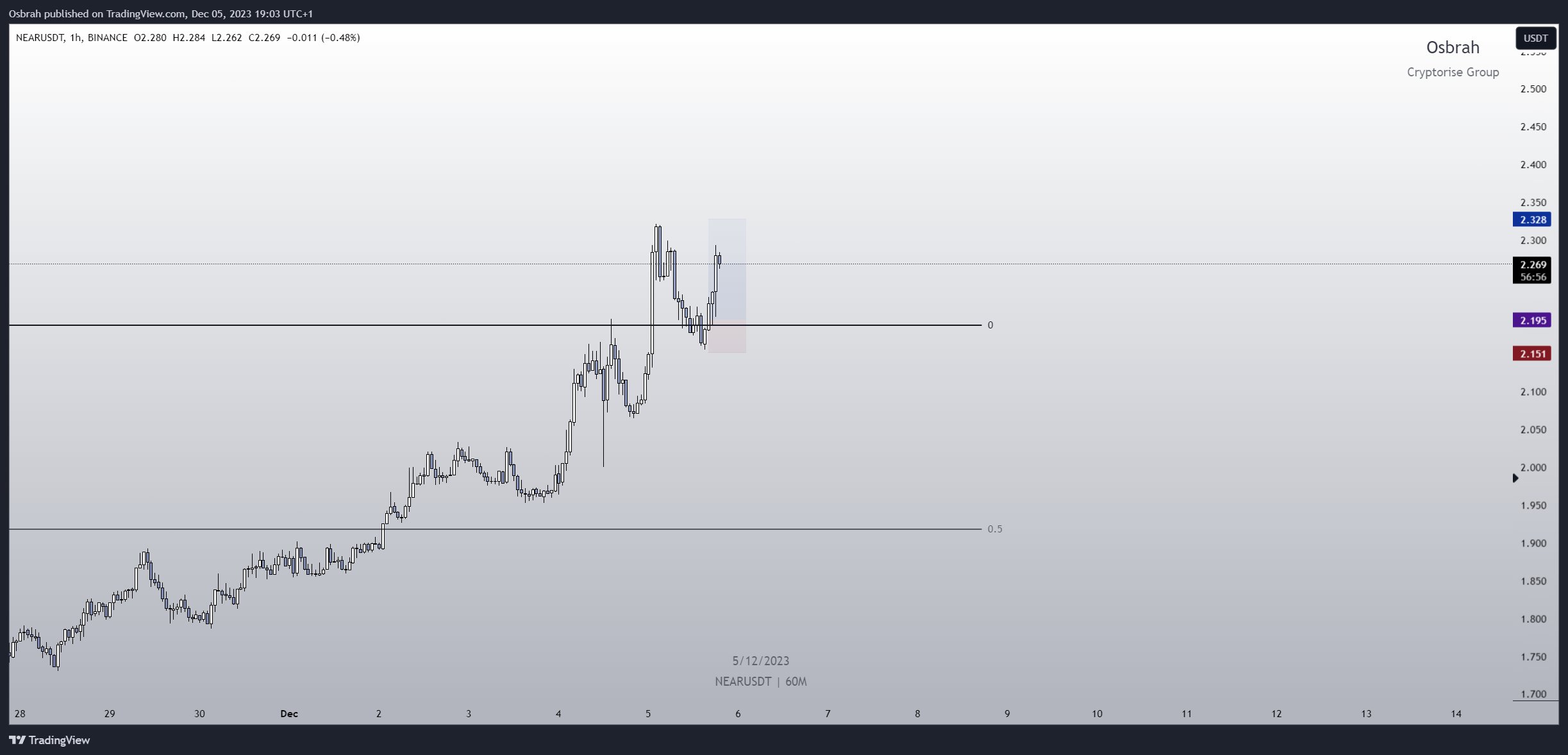

Analyst Osbrah confirms his view. Sharing a shorter-term chart, the analyst agrees on the uptrend. If NEAR continues its upward movement, the price could increase by another 15% and we could see the $2.70 horizontal resistance area being surpassed.

However, despite the strong bullish sentiment and analyst opinions, if the NEAR Coin price closes below the support level of $2.13, the trend could reverse. In this case, the targeted retracement point is $1.80.

The risk of losing support in the event of a possible BTC correction should not be overlooked. BTC has often seen corrections with double-digit losses after such rapid rises.

Türkçe

Türkçe Español

Español