Many prominent crypto commentators have criticized the new crypto tax reporting rules recently put forward by President Joe Biden of the United States. The Biden administration’s proposal to introduce tax regulations for crypto mining raises concerns and experts warn that it could lead to the migration of the crypto industry out of the country.

Rules Surpassing the US

On August 25, the Internal Revenue Service (IRS) proposed new rules for brokers to comply with in order to catch tax-evading crypto users. Brokers will use a new form to facilitate tax reporting and prevent tax fraud.

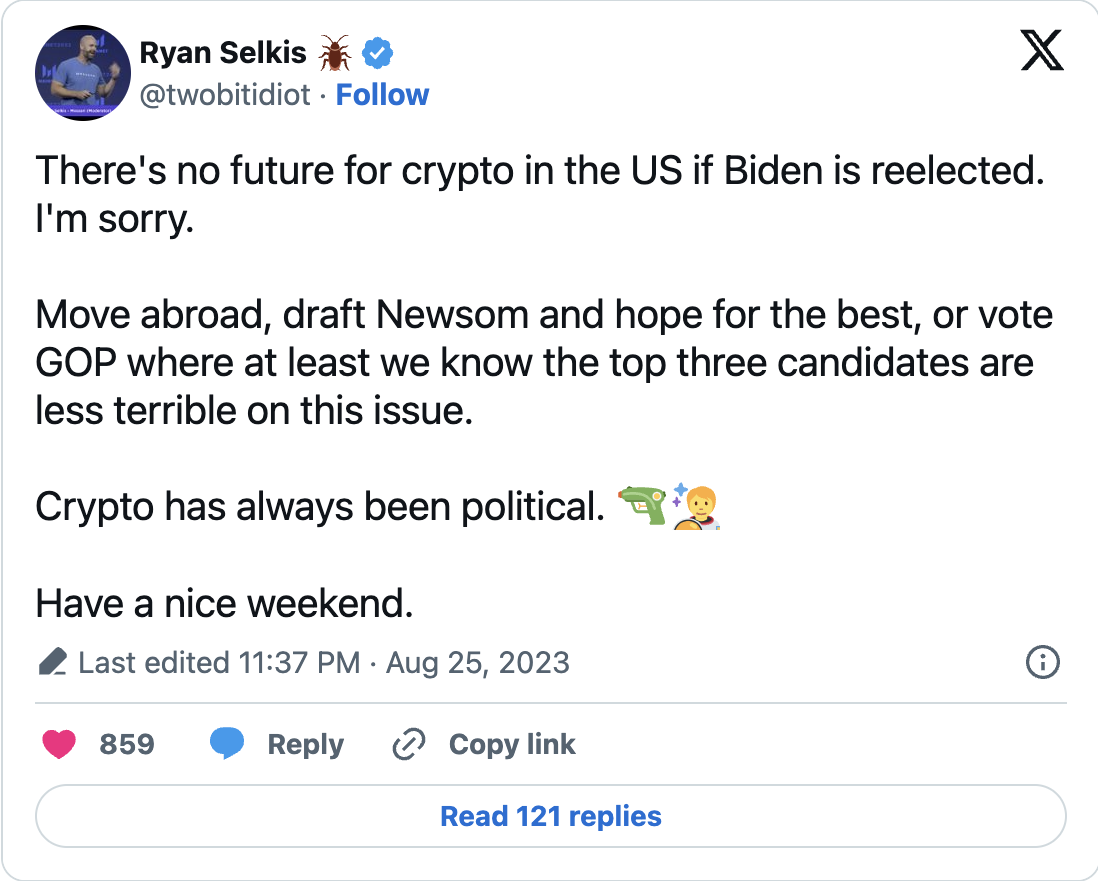

Many in the crypto community believe that strict rules will further distance the crypto industry from the US. Ryan Selkis, CEO of Messari, was among those who responded negatively to the news, believing that if Biden is reelected, the crypto industry will not flourish in the country.

Similarly, Chris Perkins, President of crypto venture firm CoinFund, argues that other countries are surpassing the US and these rules will inevitably lead to a decrease in future innovations coming to the country. He believes that simple and detailed rules are needed to support and allow secure innovation in different crypto fields.

Crypto Companies Could Leave the Country!

Other investors are skeptical that neither Democrats nor Republicans will adequately defend crypto interests in the US.

“I’m not sure both parties will be good for crypto. However, I feel definitely worse now than during the previous administration,” said one investor, pointing out the lack of privacy as another major concern.

“The commitment of the US to income tax means that they will never accept private transactions on public ledgers without tax and sanction oversight.”

This follows Biden’s proposal to impose taxes on crypto mining in order to reduce mining activities. In a budget proposal on March 9, Biden suggested a “consumption tax equal to 30% of the electricity costs used in digital asset mining.”

The crypto industry in the US has repeatedly voiced concerns about regulatory choices that affect innovation within the country. On August 13, Michael Sonnenshein, CEO of Grayscale Investments, warned that the constant imposition of sanctions by the Securities and Exchange Commission will drive crypto companies out of the country.

Sonnenshein said, “If every crypto issue has to go to court, then we’re stifling the innovation that’s happening here as a country.”

Türkçe

Türkçe Español

Español